Global markets are down more than 1%.

Global markets are down more than 1%.

Chinese markets are closed for the holidays or they would be down too as about 3,000 people are now infected by the coronavirus and it was 1,000 when I warned about it on Thursday so we're close to 50% daily increases in infections and we still aren't clear on the incubation period of the virus and we have no treatment for it either. That is, as we say in the medical community – NOT GOOD!

Unfortunately, the breakout is imitating the pattern of the Spanish Flu (influenza), which devastated the planet, ultimately infecting 500M people and killing 25M (5%) of them in 1918. Even with our much more modern medicines, the death rate on the coronavirus is at 3% but modern medicine comes at a price and hospitalizations quickly run into thousands of Dollars and even if 500M people can be treated for $2,000 (mostly not in hospital, of course), we're talking about $1Tn of emergency aid required (1% of Global GDP) – plus money that needs to be allocated to prevention, education and support.

Do you have an extra $1,000,000,000,000 set aside in case of emergency? We'll find out who does and who doesn't as China has already pledged $9Bn to help contain the virus and, if you do the math, that's $3,000 per infected patient in a country where health care costs are 1/4 of what we spend in the US. Let's hope the infections level off soon but there's not likely to be a quick fix to this thing and, even in the best case, China is shut down for 2 weeks and that's going to hit the GDP for about $400Bn (2.8%) – so the effect on Global Markets will be lingering.

Speaking of $400 (M in this case) – it turns out Trump DID specifically and directly tell John Bolton, way back in August, that he was withholding military aid to the Ukraine unless they agreed to investigate Joe Biden. Since Trump's own lawyers have said that the only way he should be impeached is if you could directly tie him to such a statement…. No, just kidding – he'll still be found not guilty by GOP Senators in this farce of a "trial" (and farce of Democracy).

Still, the possibility of Trump's impeachment adds to the Global uncertainty and 56M people now quarantined in China with lockdowns on travel, etc. have sent oil prices spiraling down. Quarantine laws – from the Italian “quaranta giorni,” meaning 40 days -were first developed in Venice in 1370, to keep the bubonic plague at bay by banning any ships and goods for the time it seemed to take most epidemics to burn themselves out. European nations reinforced quarantines with “cordons sanitaires” – a ring of armed guards preventing the entry or exit of anyone deemed or feared ill with an epidemic disease.

Still, the possibility of Trump's impeachment adds to the Global uncertainty and 56M people now quarantined in China with lockdowns on travel, etc. have sent oil prices spiraling down. Quarantine laws – from the Italian “quaranta giorni,” meaning 40 days -were first developed in Venice in 1370, to keep the bubonic plague at bay by banning any ships and goods for the time it seemed to take most epidemics to burn themselves out. European nations reinforced quarantines with “cordons sanitaires” – a ring of armed guards preventing the entry or exit of anyone deemed or feared ill with an epidemic disease.

I'm not looking to fear-monger here but I also don't want people to be complacent. There's not much you can do to avoid the flu (as we are all well aware from years of experience) but we can prevent our portfolios from being hospitalized by taking this outbreak seriously and making sure we are well-protected in case the situaiton worsens and drags the markets down 10% or more.

We already have SQQQ hedges in our Short-Term Portfolio, as well as our Earnings Portfolio and on Friday, in our Live Member Chat Room, someone asked what SQQQ position I would take for a new trade to cover a $100,000 portfolio and I said:

SQQQ would have been better to ask me this morning – 100 points higher on /NQ (where we shorted it, you're welcome!) but, as a new hedge, I'd go with:

- Sell 10 SQQQ 2021 $19 puts for $4 ($4,000)

- Buy 40 SQQQ June $18 calls for $3 ($12,000)

- Sell 40 SQQQ June $24 calls for $1.60 ($6,400)

That's net $1,600 on the $24,000 spread that's $5,600 in the money to start so you can only lose if the Nasdaq is higher and then your longs should make up for it. Worst case is you own 1,000 SQQQ at net $20.60, 5% over the current price and, of course rollable long-term protection but you can substitute any stock you REALLY want to own for the short puts (see yesterday's list of value stocks I like).

That /NQ (Nasdaq Futures) short, by the way, was from the PSW Morning Report on Friday morning, where we took 2 short positions at 9,271.50 and I said at the time: "I'd be more likely to add to them if they go higher than stop out ahead of the weekend with China now "locking down" 40M of their citizens (only 2.5%) with travel restrictions on 10 cities as cases have now spread to 32 of China's 34 provinces." /NQ is now at 8,978.50 and those two contracts are up $11,720 ($5,860 each) – you're welcome!

That /NQ (Nasdaq Futures) short, by the way, was from the PSW Morning Report on Friday morning, where we took 2 short positions at 9,271.50 and I said at the time: "I'd be more likely to add to them if they go higher than stop out ahead of the weekend with China now "locking down" 40M of their citizens (only 2.5%) with travel restrictions on 10 cities as cases have now spread to 32 of China's 34 provinces." /NQ is now at 8,978.50 and those two contracts are up $11,720 ($5,860 each) – you're welcome!

Remember, I can only tell you what is likely to happen in the markets and how to profit from it – the rest is up to you!

Consider 9,000 the stop line to lock in those gains or, if you went with our Dow Index (/YM) shorts (from our live Chat Room) at 29,215, the stop there should be 28,500 to lock in gains of $3,575 per contract on those. Remember, we use the Futures to supplement or even sometimes to counter our primary index hedges overnight, when the market is closed but we feel the situation is changing or intraday – when we want to react to news but feel the situation may change too quickly to bother setting up an options spread. Once the markets actually open, the hedges can protect us adequately and it's good to cash in our Futures plays – since they can quickly be put back on if needed.

Meanwhile, $52.50 is the magic line for Oil Futures (/CL) as it's a bit of an over-reaction and you know OPEC isn't going to put up with sub-$60 oil for very long so /CL can be played long here with tight stops under the line and, if oil is still low at the open, we can set up a nice Oil ETF (USO) play for our Short-Term Portfolio (STP) using the July contracts, something like this:

- Sell 10 USO July $11 puts for $1 ($1,000)

- Buy 30 USO July $10 calls for $1.40 ($4,200)

- Sell 30 USO July $12 call for 0.60 ($1,800)

That's net $1,400 on the $6,000 spread so the upside, at $12 or better in July, will be $4,600 (328%), which should help pay for those higher gas prices by then. Speaking of gasoline, /RB hit $1.44 and that's a tempting long as well but I think Oil is the easier play at the moment and we're already long on Natural Gas (/NG), which is now back at about $1.96 despite the drop in oil.

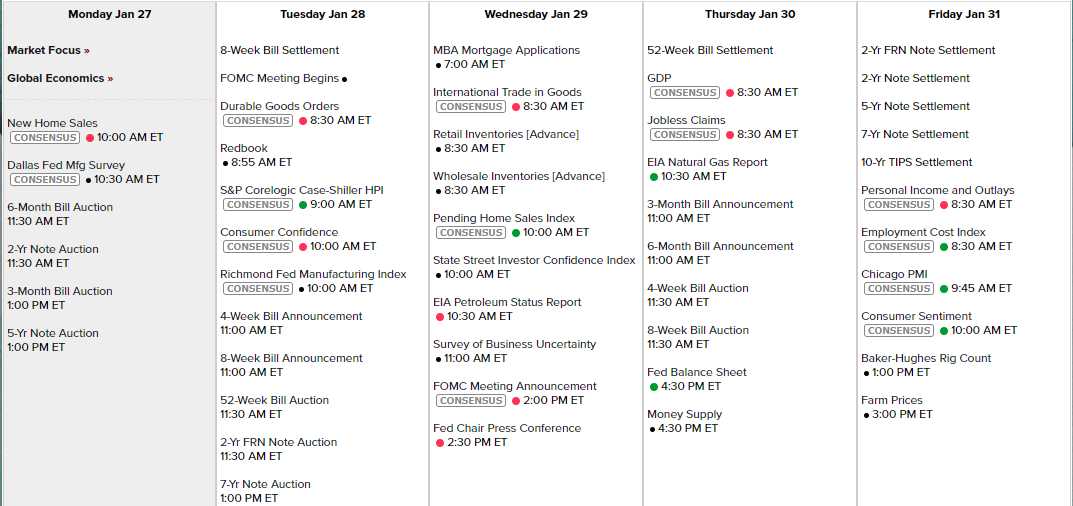

There's a lot of data this week and a Fed Meeting on Wednesday, so no Fed speakers other than Powell at 2:30 on Wednesday. Before that we have New Home Sales and the Dallas Fed this morning, Durable Goods, Redbook, Case-Shiller, Consumer Confidence and the Richmond Fed tomorrow followed by Inventories, Mortgage Applications, Investor and Business Confidence on Wednesday. After the Fed it's GDP Thursday and Friday is still busy with Personal Income and Outlays, Chicago PMI and Consumer Sentiment:

It's also the peak of earnings season, with over 200 (40%) companies in the S&P 500 reporting, including:

Meanwhile, there may or may not be a Boeing plane crash in Afghanistan this morning – news reports are conflicting but BA stock is down 2% at about $315 – might be a good chance to sell puts as the $300 line has held tough!

BA 2022 $270 puts can be sold for $30 and that nets you in for $240, which is 20% below BA's current price – it's a reasonable entry point and you collect $3,000 per contract against $1,800 in margin – so it's efficient as well.