On the bright side, only 2% mortality is down from 3% but maybe that's because the rate of infection are exploding fastert than people are able to die. There were 10,000 infections on Friday and 213 deaths so 74% more infections and 71% more deaths isn't exactly what we usually call "under control" over a weekend, is it?

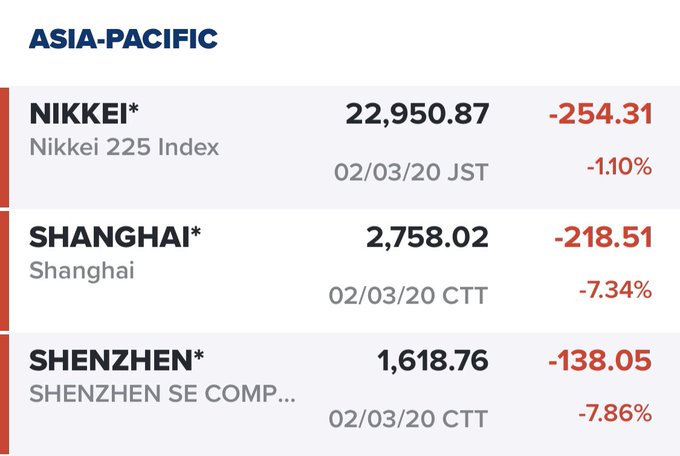

The Shanghai Stock Exchange re-opened from their New Year's holiday down 7.34% and, as I explained to our Members in Friday's Live Chat:

China rally has same low volume problem as US so they will be lucky not to fall 7.5% Monday, which is pretty much limit-down in China since they halt stocks at 10% so very hard to get the average for the index past -7.5%.

Hong Kong's Carrie Lam (pictured) is fighting her own people who want to shut down the boarder with China and she doesn't exactly inspire that "Don't Panic" vibe wearing a mask when she's interviewed, does she. Hong Kong's hospital workers voted 3,123 to 10 to shut down the boarders and they are going on strike today to attempt to foce a shutdown before they are overwhelmed by an epidemic they feel can get quickly out of hand.

My kids asked me why people in America don't seem to be worried about the virus and I told them to picture the Earth as a ball and us as ants and we hear rumors about a fire on the other side of the ball but we can't see any actual sign of it. We can panic about it or we can go about our daily lives and those are both the wrong choices because what we need to do is realize that things that happen on the other side of the ball will, ultimately, affect us and the only wise course of action is to help.

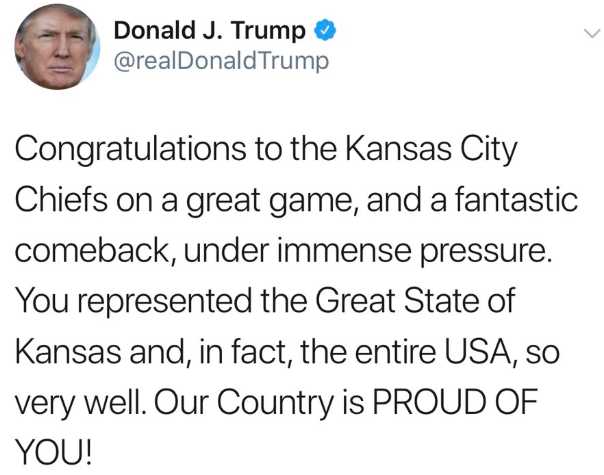

Well, you know that's not going to happen so either this problem fixes itself while we ignore it or all the panic in the World isn't going to help us by the time it finally gets close enough to our side to become "our problem". Our real problem is we have an unimpeachable, unidictable, untouchable President who doesn't even know what state the Chiefs are from, let alone where China is on a map!

Well, you know that's not going to happen so either this problem fixes itself while we ignore it or all the panic in the World isn't going to help us by the time it finally gets close enough to our side to become "our problem". Our real problem is we have an unimpeachable, unidictable, untouchable President who doesn't even know what state the Chiefs are from, let alone where China is on a map!

Gilead (GILD) is up 5% pre-market because they have been working on an anti-viral vaccine for Ebola and SARS called Remdesivir and it's being rushed into human trails in China to see if it will be effective against the Coronavirus.

I like GILD down here at $65.50 (where it should open) as it's "just" an $80Bn valuation and GILD is good for about $8Bn in profits, though not last Q when they lost $1.2Bn on write-offs and such. Overall, they are a great company with a respectable pipeline and I think this is a great entry so we're going to add them to our Long-Term Portfolio as follws:

- Sell 5 GILD 2022 $62.50 puts for $8 ($4,000)

- Buy 15 GILD 2022 $55 calls for $13 ($19,500)

- Sell 15 GILD 2022 $65 calls for $8.50 ($12,750)

That's net $2,750 on the $22,500 spread so $19,750 of upside potential if GILD can simply hold $55 through Jan, 2022. Ordinary margin on the short puts is $2,400 so it's a very efficient way to make $19,750 over 2 years.

While we can look for potential brights spots, like GILD, the bottom-line is that the entire first Quarter for China is now shot to Hell and that's a $13Tn economy so $3Tn+ potentially hit and I'd say that's at least a $1Tn hit to the Global GDP (1%), which has a good chance of pushing many countries into recession – and that's WITHOUT the virus spreading.

So, as tempting as it may be – I wouldn't be jumping in and buying the dips just yet as we only have about the same number of recoveries as deaths, which makes this virus 42.6% fatal as it runs its course, possibly. While the Global Media is downplaying the virus, you might want to check out some of the stuff that's being posted on Social Media from the battle zone. Here's a woman being dragged from her home for not reporting to a quarantine center:

Come on lady, let's go

It's just the flu#coronavirus pic.twitter.com/CTJH3fCrl7

— Harry Chen PhD (@IsChinar) February 3, 2020

Yep, things are getting crazy! Keep in mind you are being told not to worry by the Media that is owned by the same Billionaires that want you to go out and buy their products as well as the products of their sponsors. If the empty streets of China begin to spread around the World – it's a lot more than 1% of the Global GDP that's going to fall off a cliff. We have lots and lots of earnings reports this month and we'll see how many of them are concerned about the Virus:

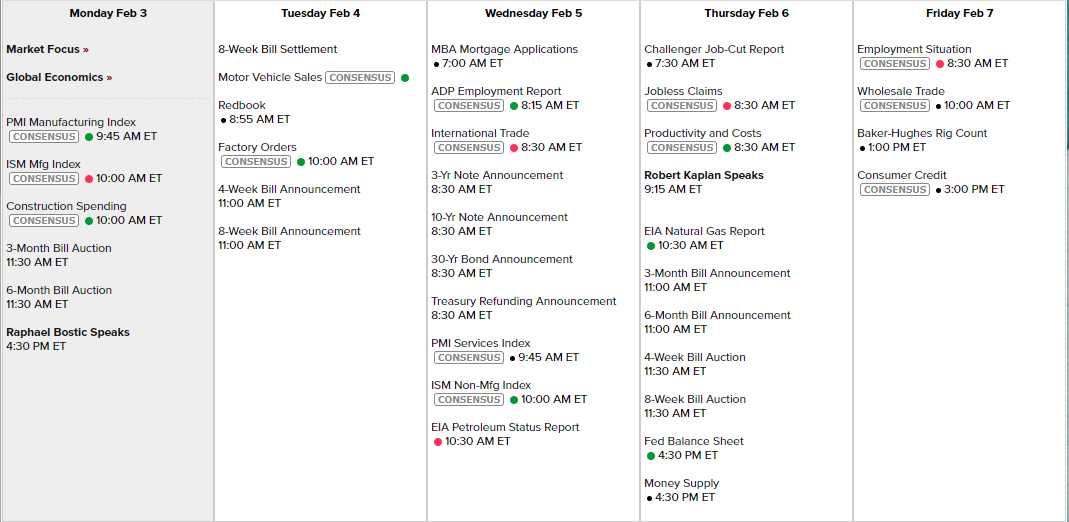

There's very little Fed Speak this week – Just Bostic and Kaplan but a good amount of data ahead but we'll be more conerned with Global Data to see who's numbers are being affected by the virus already: