Holy cow, what a week!

Though the Futures are down a bit this morning, we're back to our late January highs, before the Coronavirus was a known threat and before Donald Trump began to publically compile an enemies list and promise retribution in 2020. None of that seems to matter as Central Banksters around the World promise financial retribution in the form of MORE FREE MONEY – because money fixes everything, doesn't it?

The virus is proving hard to "fix" as a cruise ship in Japan now has 61 cases of the virus, more than any other country outside of China and there are 3,700 very scared people on that ship with 41 new cases since yesterday and they caught it from a man who got off the ship on Jan 25th, causing the ship to be quarantined on Feb 3rd (Monday), when one case was known to be on the ship. 8 people on another ship are now infected in Hong Kong, that ship has been quarantined since Wednesday with 3,600 people on board. 5,000 additional passengers on 3 cruises may have crossed with the other infected passengers – not to mention all the ports they docked at.

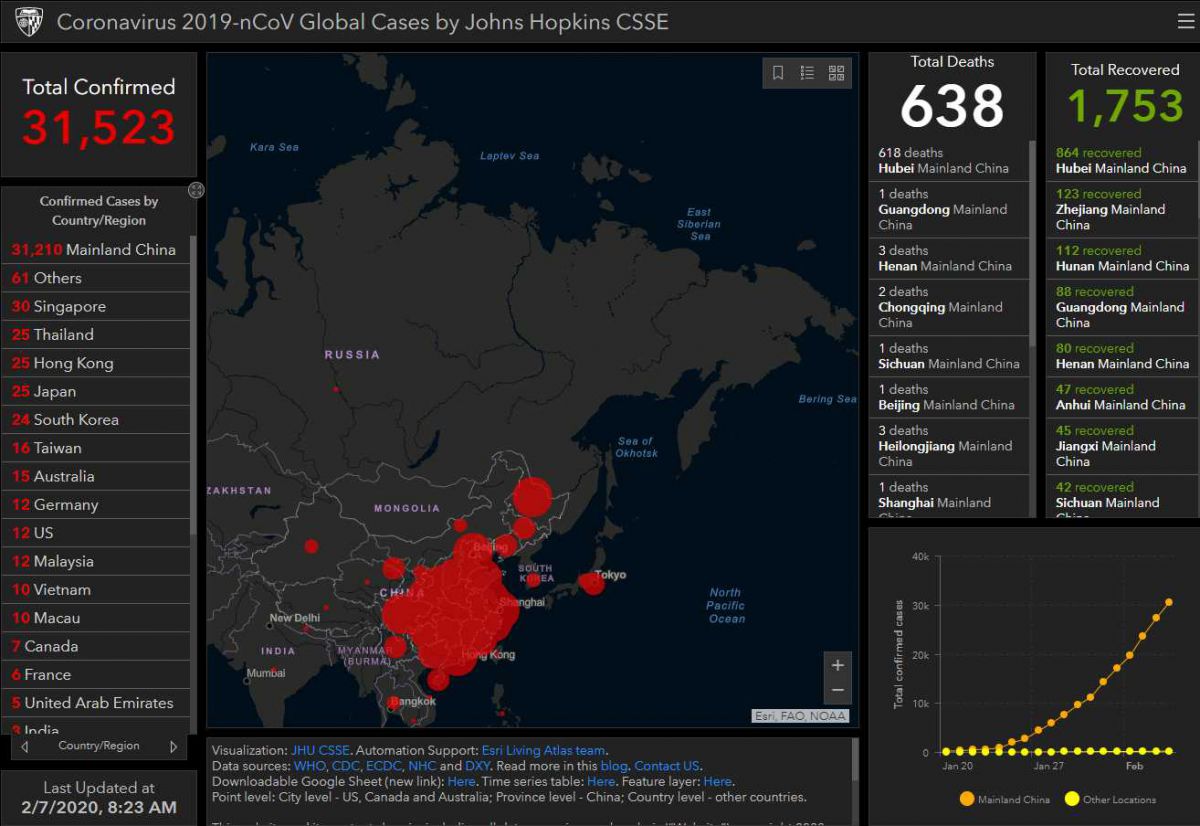

So this virus definitely is not over until it's over. There are now 31,523 confirmed cases and that's up 3,179 (11.2%) from yesterday and 638 deaths is up 73 (13%) and both of those numbers are continuing to slow but 305 cases outside of China is up 46 (18%) and, as we see from the cruise ships – it only takes one person with the virus to not be contained and you suddenly have a new epidemic so – not safe yet.

So this virus definitely is not over until it's over. There are now 31,523 confirmed cases and that's up 3,179 (11.2%) from yesterday and 638 deaths is up 73 (13%) and both of those numbers are continuing to slow but 305 cases outside of China is up 46 (18%) and, as we see from the cruise ships – it only takes one person with the virus to not be contained and you suddenly have a new epidemic so – not safe yet.

Non-Farm Payrolls were just announced and they are a strong 225,000 jobs gained in January but keep in mind we added 2.4M people since last year so we need 200,000 jobs a month just to stay even – that's often forgotten when we are "amazed" by the job growth and last year we averaged 175,000/month – not really enough for all the new citizens.

Non-Farm Payrolls were just announced and they are a strong 225,000 jobs gained in January but keep in mind we added 2.4M people since last year so we need 200,000 jobs a month just to stay even – that's often forgotten when we are "amazed" by the job growth and last year we averaged 175,000/month – not really enough for all the new citizens.

As I noted yesterday, we are still running headlong into a major poppulation crisis (as are most countries) as the number of people between 35 and 50 (30M in prime earning years) is being dwarfed by the number of people who are 55 and older (40M) so of course our forward-paying Social Security System can't possibly not fail 10 years down the road – there simply won't be enough working people to support the retired people.

That's happening NOW, climate change is also happening NOW and our Infrastructure is a disaster that needs to be fixed NOW! None of these things are currently concerning the markets as we're way too focused on distractions, like who's going to be elected to go down on this sinking ship in November. I don't like to be doom and gloomy but it is my job to point out risks and these are all big ones that the market is simply not pricing in.

Climate change is the premise for buying Tesla (TSLA) and alt-energy companies and battery companies, even nuclear companies but, for other investors, it's still a hoax while "clean" coal is not. You can say "that's what makes a market" but it's a lot like betting whether you'll die of smoke inhalation or be burned to death while a fire is raging around you – it might not matter – there will be no winners.

It is true that, a lot of times, if we just ignore something it will go away. Look how Iran went away – that was less than a month ago and we all forgot that we bombed them, and they bombed us and they shot down a plane – so last month! We're ignorning the virus and that will hopefully go away and we ignore the divisive political nature of impeachment and that seems to have gone away (but not the divisions) – can we really ignore everything until it goes away?

It is true that, a lot of times, if we just ignore something it will go away. Look how Iran went away – that was less than a month ago and we all forgot that we bombed them, and they bombed us and they shot down a plane – so last month! We're ignorning the virus and that will hopefully go away and we ignore the divisive political nature of impeachment and that seems to have gone away (but not the divisions) – can we really ignore everything until it goes away?

If so, I don't want to kill the buzz so let's just not worry about it and enjoy our weekend. We shorted the S&P Futures (/ES) yesterday at 3,350 and that's a good hedge into the weekend and those are 3,333 this morning but the Nasdaq (/NQ) is still over 9,400 and we'll short them below that line – just in case people forget to ignore things between now and Monday.

Otherwise, have a great weekend,

– Phil