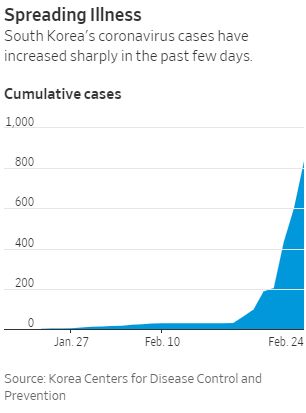

What? That's low! Well, that's just South Korea now and Italy has 215 cases, 154 in Japan and 89 in Singapore. Even the US has 35 people infected now. As I said last week, just because China seems to have things under control (though that is debateable), doesn't mean we won't get fresh global outbreaks in countries that will have a much harder time locking down their citizens to prevent the spread of the virus.

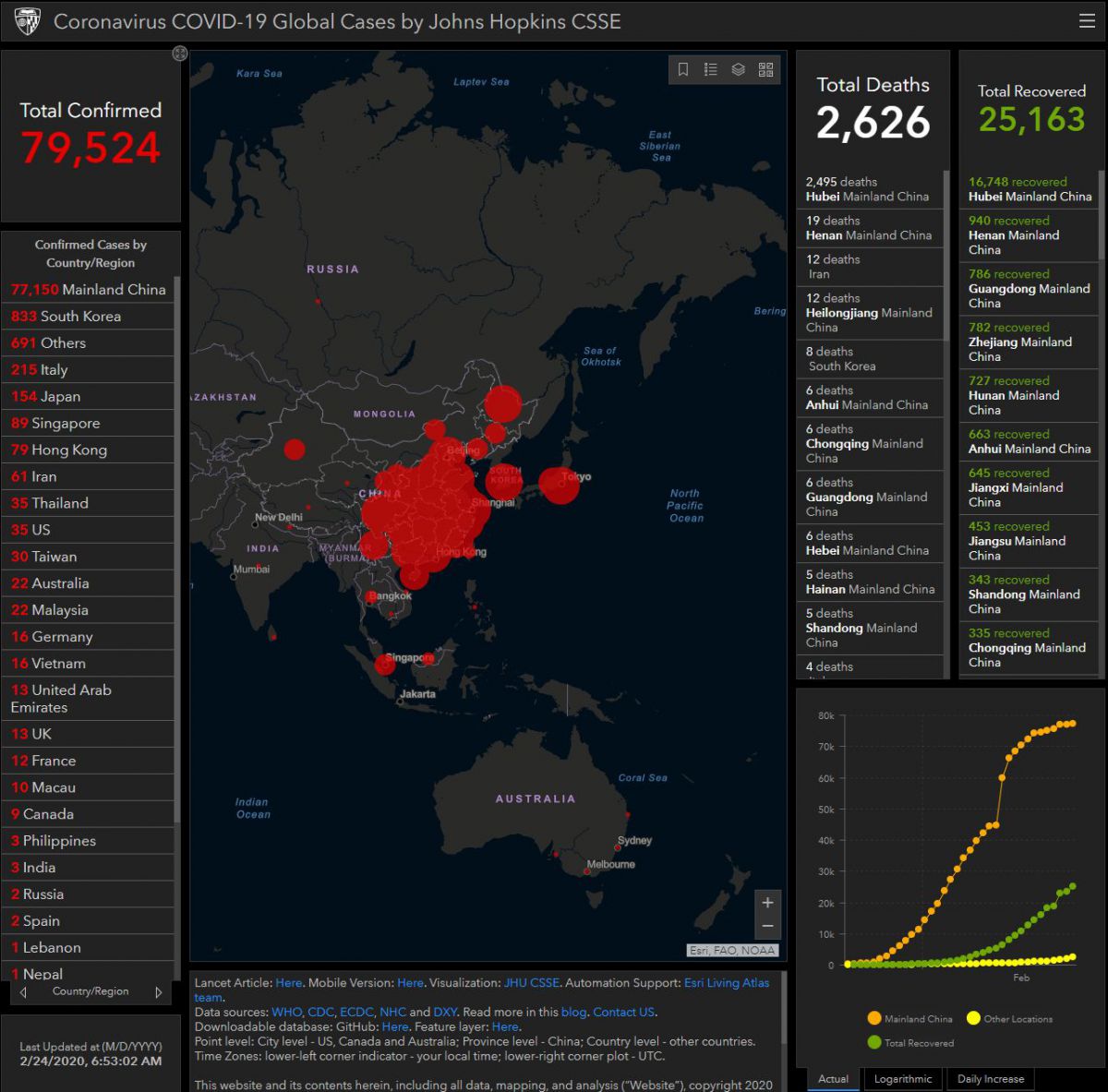

As you can see from the big chart, however, we "only" have 79,524 total cases and 25,163 have recovered so big progress in China – we just have to hope these other hot spots don't get out of hand.

The market crashed hard on the news as the Futures came back on from the weekend break last night – dropping 2.5% across the board in the US but we chose to go long on the Dow (/YM) Futures as they tested 28,200 in our Live Member Chat Room this morning – as that's the 2.5% line and should be bouncy by at least 0.5% or about 150 Dow points which would be good for morning gains of about $750 per contract if all goes well.

Anything less than that is a weak bounce and, if so, it will be a strong indicator that the market wants to head 2.5% lower by Wednesday. All in all though, it's just a minor correction in a massive rally that's been going on since early last year. We've been very cautious with our entries so far and this is a nice sale the market is throwing so we can go out and do a bit of bargain shopping – if the virus issue isn't getting worse.

Of course, Corporate Profits will be worse in Q1 and some countries may spiral into a Recession – because not every country gets to print money the way the G7 can. China's President Xi warned yesterday that the virus epidemic is “still grim and complex,” calling for more efforts to stop the outbreak, revive industry and prevent the disease from disrupting spring planting of crops which, as I mentioned last week – is our next looming disaster (a year of hunger from missed farm production).

Invoking the martial theme the ruling party has given the anti-disease campaign, Xi called on them to “deploy medical forces” to “cut off the source of infection,” especially in the capital, Beijing. At the same time, he said they must help factories and other companies reopen and make sure low-income workers are employed. The president said “low-risk areas” in China should adjust disease-control measures to “fully restore production” while higher-risk areas keep their focus on epidemic prevention.

Invoking the martial theme the ruling party has given the anti-disease campaign, Xi called on them to “deploy medical forces” to “cut off the source of infection,” especially in the capital, Beijing. At the same time, he said they must help factories and other companies reopen and make sure low-income workers are employed. The president said “low-risk areas” in China should adjust disease-control measures to “fully restore production” while higher-risk areas keep their focus on epidemic prevention.

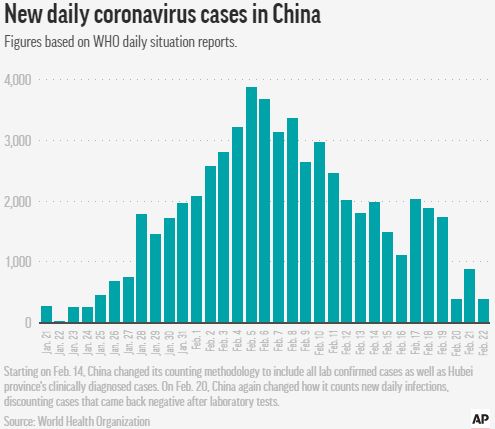

Infections in China are down but not out and putting people back to work in crowded factories may not be the greatest idea at the moment but, like many countries, China has to try to balance a potential Health Catastrophe with a certain Economic Catastrophe if they don't get those factories open and especially if they don't get those crops planted.

8:30 Update: Oops, worse than I thought, there are now 833 cases in South Korea, that's up 602 since yesterday. Sorry to keep circling back to this but this is pretty out of control and the Futures have already stopped out our longs and it looks like we're on the way to a 5% correction (3,230 on /ES, where we can play long for the next bounce but tight stops below) as the markets finally begin to digest the severity of the virus and its potential impact on the Global Economy. If that fails to hold, this could be the first leg of a 10% correction.

8:30 Update: Oops, worse than I thought, there are now 833 cases in South Korea, that's up 602 since yesterday. Sorry to keep circling back to this but this is pretty out of control and the Futures have already stopped out our longs and it looks like we're on the way to a 5% correction (3,230 on /ES, where we can play long for the next bounce but tight stops below) as the markets finally begin to digest the severity of the virus and its potential impact on the Global Economy. If that fails to hold, this could be the first leg of a 10% correction.

That's because a new report from a WHO infectious disease modeling team based at Imperial College London is estimating about two-thirds of Covid-19 cases worldwide have gone undetected. The analysis suggests the global spread of the novel coronavirus is significantly greater than the current volume of confirmed cases.

“We are starting to see more cases reported from countries and regions outside mainland China with no known travel history or link to Wuhan City,” explains Natsuko Imai, one of the authors on the new report. This new report set out to explore how accurate current country-based surveillance of the disease may be, in relation to the average volume of travelers flying out of the epidemic epicenter in Wuhan, China.

“We compared the average monthly number of passengers traveling from Wuhan to major international destinations with the number of COVID-19 cases that have been detected overseas,” says another author on the new report, Sangeeta Bhatia. “Based on these data, we then estimate the number of cases that are undetected globally and find that approximately two thirds of the cases might be undetected at this point. Our findings confirm similar analyses carried out by other groups.

The report concludes it is very likely a number of undetected chains of transmission have begun in many countries across the globe. Director-General of the World Health Organization Tedros Adhanom Ghebreyesus affirmed this growing concern during a recent WHO briefing. Although the Director-General did state the “window of opportunity for containing this coronavirus is narrowing”, the WHO has not yet classified this outbreak as a pandemic. Less than 2,000 cases have been currently confirmed outside of China, however, as this new report indicates, the viral spread may be broader than the official numbers suggest.

So, obviously, be careful out there!