Trillions of Dollars are being committed to "fix" the economy.

Trillions of Dollars are being committed to "fix" the economy.

So far, the stock market is not buying it as we continue to have wave after wave of selling, though we are still inside our predicted range for the S&P 500 – it just feels very frustrating as we stuggle to get back over the -15% line at 2,420. This morning the Futures are down yet again as traders are not convinced the Government is doing enough either to calm the markets or fight the virus.

Very simply: What is their plan?

If you can't answer that question – then that's the problem, isn't it. The Government has failed to articulate a clear plan to the American people in either their response to the virus or their response to the economy. Without a clear vision of what is going to happen, traders get nervous and go to cash but there aren't that many people willing to trade their cash for stocks — so the prices keep dropping until they can find a buyer. You may be willing to hold onto Disney (DIS) at $85 because you think it's underpriced (it is!), but that doesn't stop your neighbor from selling it for $75, $65, etc…

But this is not price discovery, this is panic discovery because Disney is being valued at $160Bn at $85/share yet they made $11Bn last year on $70Bn in sales and they have $5.5Bn cash in the bank. So their operating cost is about $60Bn or $5Bn per month and let's assume we are shut down for March, April, May and June and DIS can't cut costs and generates ZERO revenues – which is silly as they still have ESPN and ABC and the Disney Channel, which should do very well with 300M people staying home all day.

Even if you assume they lose the whole $20Bn, they make $10Bn a year! The parks were not destroyed by a nuclear bomb – they don't need to be rebuilt – they just need to be cleaned! The movies will still come out – even if it has to be on TV. Still, if DIS loses $20Bn (and there is no bailout), they can just borrow $20Bn and pay back $2.2Bn a year for 10 years and that would impact their forward earnings by – 20%. So DIS then makes $8Bn a year and we'll assume it stays flat and we'll multiply that by 15 assuming traders stay nervous and that's $120Bn or $80/share. THAT is the realistic discounted value of Disney so, with the stock at $85 – it's well worth taking a look:

- Sell 5 DIS 2022 $75 puts for $15 ($7,500)

- Buy 10 DIS 2022 $85 calls for $25 ($25,000)

- Sell 10 DIS 2022 $110 calls for $12 ($12,000)

That's net $5,500 on the $25,000 spread so the upside potential is $19,500 (354%) if DIS can get back over $110 20 months from now. If things turn worse and we have a recession and DIS drops to say $60 – you would be forced to buy 500 shares for $75 ($37,500) plus the $5,500 we would lose on the spread (assuming we rode it to the bitter and and never adjusted) so net $86 ($43,000), which is pretty much the current price is our worst-case scenario and we would be down $13,000 at $60.

But, if we are assigned at $60 and have 500 shares of DIS, we could sell the 2024 $75 calls for (guessing) $10 and that would drop our net to $76 and, if we were willing to own 500 more shares at $60 – we could sell those puts for $10 and drop our basis to $66 – in which case we'd get all our money back with a small ($4,500) profit at $75 but we risk being assigned 500 more and our average on 1,000 would be $66.

But, if we are assigned at $60 and have 500 shares of DIS, we could sell the 2024 $75 calls for (guessing) $10 and that would drop our net to $76 and, if we were willing to own 500 more shares at $60 – we could sell those puts for $10 and drop our basis to $66 – in which case we'd get all our money back with a small ($4,500) profit at $75 but we risk being assigned 500 more and our average on 1,000 would be $66.

So, if you don't REALLY want to own 1,000 shares of DIS at $66,000 – DO NOT sell 5 2022 $75 puts for $15. You could JUST do the bull call spread for $13 and make up to $12 with no margin requirements but really you'd be risking the same $13,000 (for 10 contracts) to make $12,000 while the spread can make $19,500 with less cash out of pocket (margin is $1,924).

Meanwhile the Futures continue to be weak and we added a hedge yesterday but there are other hedges we can add just in case the market continues to crash. The high VIX gives us great pricing on spreads and we can take advantage of that with the Nasdaq Ultra-Short (SQQQ) with the following hedge:

- Buy 20 SQQQ April $25 calls for $8.50 ($17,000)

- Sell 20 SQQQ April $40 calls for $5 ($10,000)

- Sell 10 Delta (DAL) 2022 $18 puts for $7.50 ($7,500)

This spread actually PAYS you a $500 credit and has $30,000 worth of upside protection. SQQQ is a 3x short on the Nasdaq and $40 is 60% higher than $25 so a 20% drop in the Nasdaq would pay you $30,000 per unit on the spread.

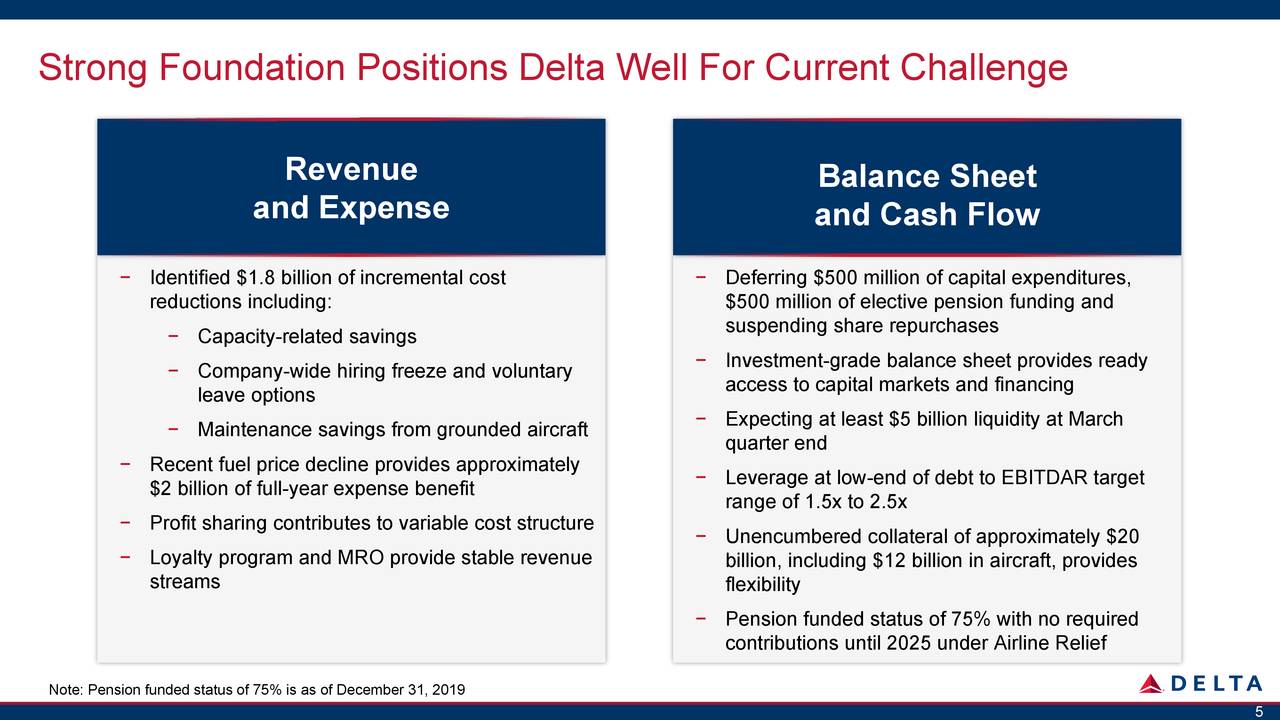

The risk is owning 1,000 shares of Delta for $18 ($18,000) but you can substitute any stock you REALLY want to own or just take the straight spread for $7,000 that pays $30,000 for a $23,000 (328%) profit if the Nasdaq drops another 20%. My logic on Delta is that they are vital and will likely be bailed out, if not by the Government then by Warren Buffett – who is one of their biggest shareholders.

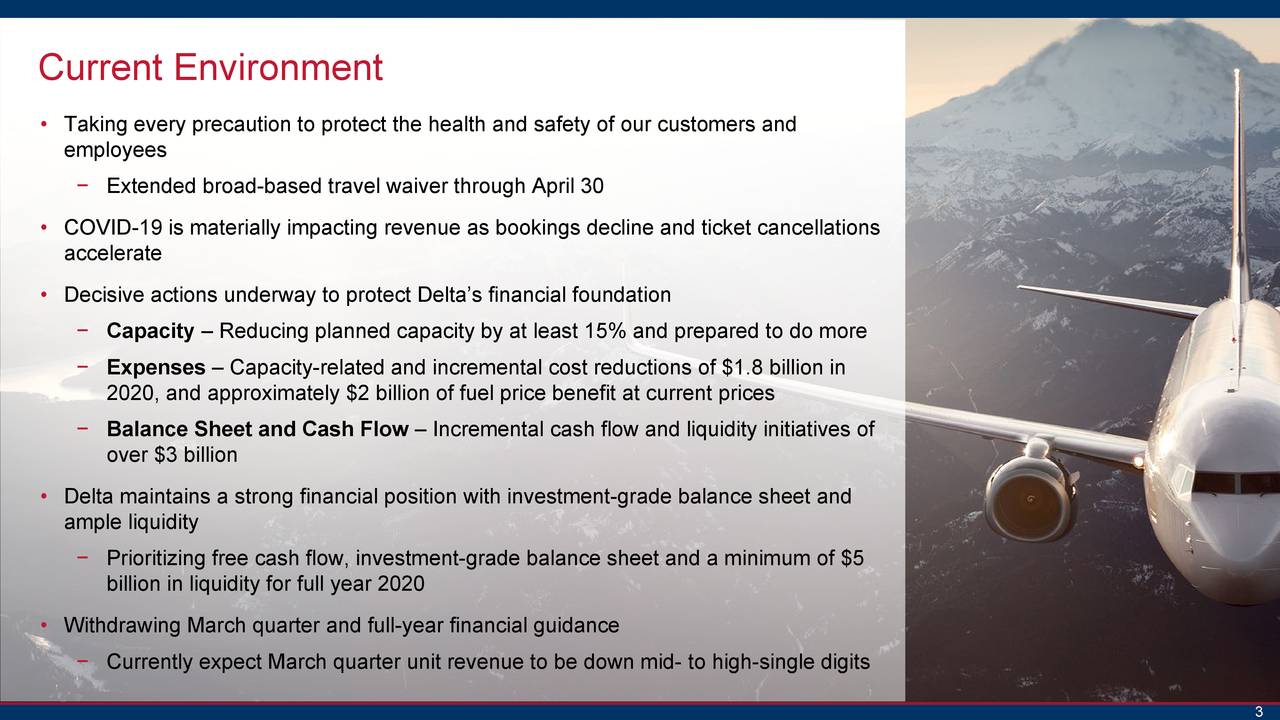

Same logic as DIS, DAL had $47Bn in revenues last year and made $4.7Bn so it costs them $42Bn to run the airline and we'll call it $3.5Bn a month of potential losses but we know fuel is 1/3 of their costs so less flying is less costs so let's say $3Bn a month is their loss so someone has to give them $9Bn and Buffett has that much under his sofa! And think of the advantage of being a fully functional airline when others are failing!

For a company that made almost $5Bn last year, you can buy the whole thing for $15Bn at $23.50.

So it's not as if there's nothing to buy and it's not as if we aren't able to hedge – there are amazing opportunities in this market – if you are brave enough to weather the uncertainty of the moment…