I want free money NOW!!!

I want free money NOW!!!

That's the word from Wall Street, which is in no mood to give Congress a couple of days to decide how to dole out $1.5Tn(ish) in stimulus spending for the first round of the bailout that has, so far, been bothering Americans for a month. Imagine how things will be in month 3! We left off Friday Morning with 246,275 global infections, 9,115 deaths and 84,506 recoverd and Italy was the rising star of the virus World with 35,713 infections and 2,978 deaths and the US had 14,250 infections.

This morning there are 349,211 Global Infections (42% more), 15,308 Deaths (68% more) and 100,165 Recoveries (18.5% more). So STOP listening to the news and their "expert" opinion makers and for God's sake stop listening to the Government and think for yourself. These are statistics – hard facts. If there is a 3 times faster rate of people being infected than are recovering – that's not good, if there is a 4x faster rate of people dying than recovering – that's not good either so, in general, your take on this weekend is "Not Good" and don't let people tell you otherwise.

Now, there are mitigating factors like more testing leads to more cases and sure, that's true but more testing doesn't lead to more deaths (hopefully) so that's a hard fact we need to pay attention to and lack of recoveries is a big concern and makes it seem kind of like BS when people try to assure you that most people get mild cases. If that's true, why have 233,738 people who have been infected stil not recovered?

No one is being honest with us – that's the main problem. One true thing we can isolate is 712 people on the Diamond Princess Cruise Ship got infected one month ago and, as of today, 567 recovered and 8 have died. It was a Princess Cruise Ship, so we can assume they were generally upscale passengers and generally older and it was early on – so they got the best possible care before hospitals began crowding up yet, one month later, 137 passengers (19%) have still not recovered (or died).

THAT is an indication of the burden this virus is placing on the medical system, keeping people in the hospital for 30 days is VERY expensive – especially if they are in intesnive care and/or isolation. Even if there's only a 1% chance of nurses or doctors catching the virus, over 30 days they are exposed to it 100 time – that's not very good either.

THAT is an indication of the burden this virus is placing on the medical system, keeping people in the hospital for 30 days is VERY expensive – especially if they are in intesnive care and/or isolation. Even if there's only a 1% chance of nurses or doctors catching the virus, over 30 days they are exposed to it 100 time – that's not very good either.

I'm not saying all this to freak you out. What I'm saying is we KNOW this because we can do the math and, regardless of what BS you hear out of the White House – they know it too. Well, maybe not Trump as he doesn't seem to know anything but Fauci knows and Congress knows (that's why they knew to dump their stocks 2 months ago). Knowing what's really happening allows us to assess the situation without fear and uncertainty and react appropriately.

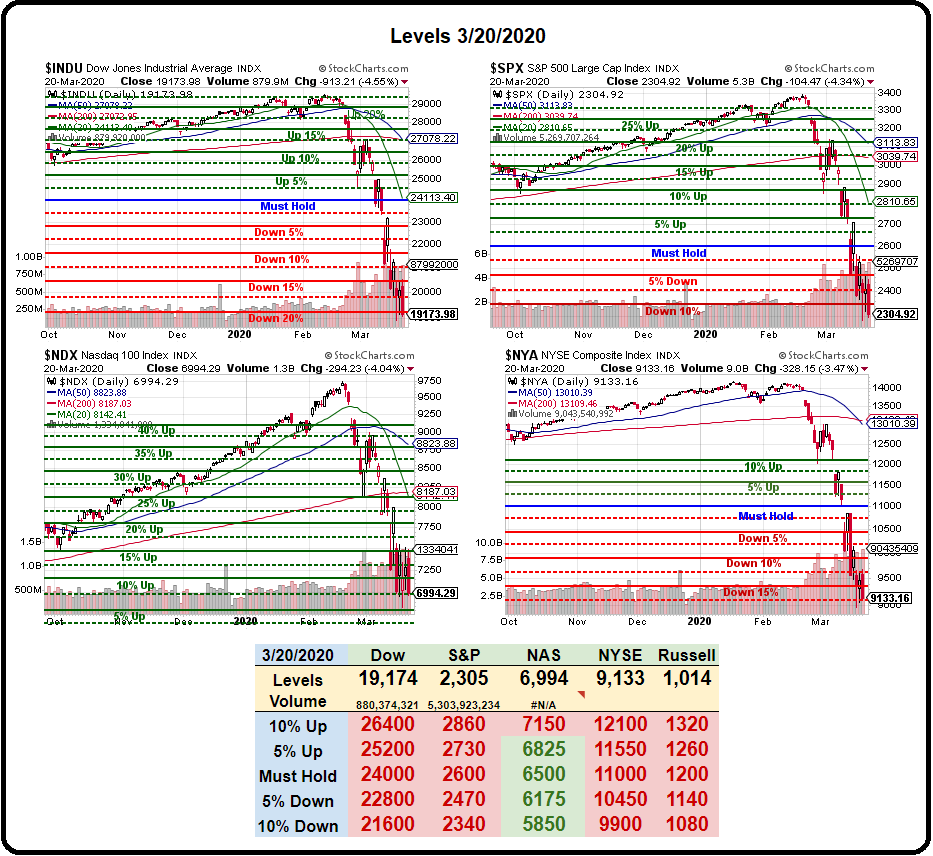

We have turned fairly bullish in expectations of Congressional Support and the Futures were sharply lower last night (again) as Congress failed to pass a support bill but it's not because they aren't willing to provide support – it's the form of support they are arguing about. Support will come – maybe just not today…

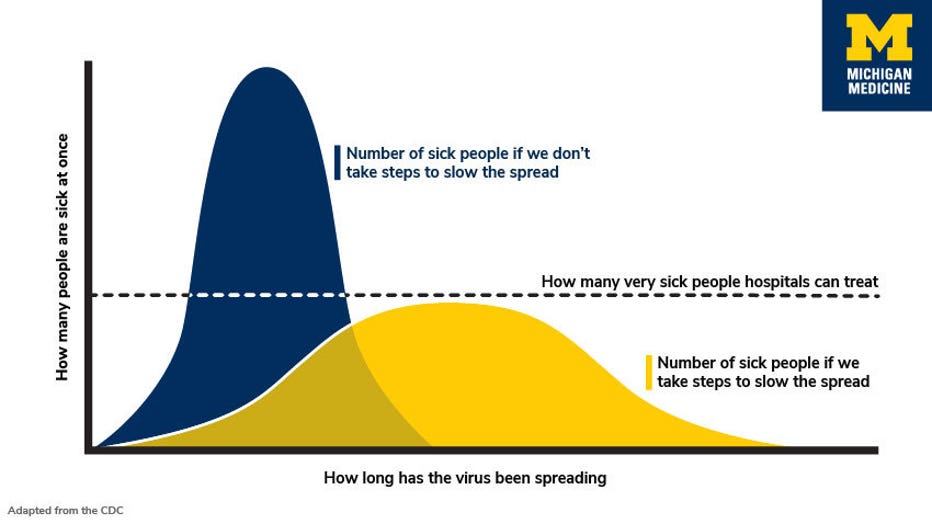

Meanwhile, we have a "worst-case scenario" from the CDC but it's not going to make you feel better. 50 teams of experts ran the numbers and they concluded that 2.4-21M Americans would require hospitalization if we do nothing. For reference, the US has 925,000 hospital beds and, as we just noted, people are in the hospital for weeks to months. So doing nothing – NOT AN OPTION!!!

Italy is a test case for having a slow response and a shortage of hospital beds – 59,138 people have been infected – almost all in the past 30 days, and 5,476 of them are already dead with 7,024 recovered so 46,638 outcomes still to be determined but 10,925 (23%) of those people got sick since Friday!

Italy is a test case for having a slow response and a shortage of hospital beds – 59,138 people have been infected – almost all in the past 30 days, and 5,476 of them are already dead with 7,024 recovered so 46,638 outcomes still to be determined but 10,925 (23%) of those people got sick since Friday!

Realistically, one thing that stops the spread of a virus is stopping the spread of people and "Social Distancing" is one thing if you must go out but staying home and only infecting your family is the other. In 1918 the US got the Spanish Flu (which did not come from Spain but we didn't like Spain, so…) and, in Philadelphia, they did not stay home and thosands of people died but in St Louis, the mayor quickly took that advice, closing for several weeks “theaters, moving picture shows, schools, pool and billiard halls, Sunday schools, cabarets, lodges, societies, public funerals, open air meetings, dance halls and conventions until further notice.”

In 1918 they didn't have our tools to slow the spread of a virus or to treat people but simply shutting things down for 30 days saved thousands of lives in St. Louis and it's happening in many countries around the World now so I lean towards the lower worst-cases, where we don't end up too much worse than China, despite Team Trump's total bungling of the response so far.

So let's assume that other states follow the lead of NY and California and essentially shut down business for a month. That won't "cure" the virus – it will simply slow the spread drastically and, like St Louis, drag it out over time so it's easier to deal with on a monthly basis. We'll end up like China, taking people's temperature before they can enter any public places and we'll clean things more than usual but, other than that – we can kind of get back to normal by June, which is still Q2.

We're not going to lose all of Q2 and our GDP is $1.5Tn per month so if we lose 50% of our GDP (doubtful) for 2 months, $1.5Tn would make up for it – as long as it was appropriately distributed. THAT is what Congress is arguing about – not IF we need the stimulus but HOW the stimulus will be distributed – and that's a very silly reason to panic out of stocks today.

We're not going to lose all of Q2 and our GDP is $1.5Tn per month so if we lose 50% of our GDP (doubtful) for 2 months, $1.5Tn would make up for it – as long as it was appropriately distributed. THAT is what Congress is arguing about – not IF we need the stimulus but HOW the stimulus will be distributed – and that's a very silly reason to panic out of stocks today.

Also, if there is an end to the virus – then what's the reason to sell Marriott (MAR) at $75 and (VAC) at $48. $75 is $24Bn for the World's biggest hotel chain and they made $1.3Bn last year and $1.9Bn the year before. Are you never going to stay in a hotel again? It MAR going bankrupt? Maybe the lose $2Bn and get bailed out for $1Bn and they pay that over 10 years and it hits their earnigns fro $100Bn a year – THAT is the damage done – it doesn't wipe out the whole company!

Marriott Vacation Club (VAC) is even stupider at $48 because that's $2Bn and VAC earned $142M last year but people don't realize VAC is like a time-share property, they only manage the properties and the people who stay there pay the upkeep and taxes – whether they use it or not! It's not very likely they are hard-hit by the virus so I love them down here:

For our Long-Term Portfolio:

- Sell 5 VAC October $30 puts for $8 ($4,000)

- Buy 10 VAC Nov $40 calls for $18 ($18,000)

- Sell 10 VAC Nov $75 calls for $8 ($8,000)

That's net $6,000 on the $35,000 spread that's $8,000 in the money to start so the upside potential at $75 is $29,000 (483%) and your worst case is being assigned 500 shares of VAC at $30 ($15,000) plus the $6,000 spent on the spread would be $21,000 or $42 per share – still 15% below the current price. That's your WORST CASE!

We have a lot of companies like that in our portfolio and we're taking advantage by adjusting our positions more aggressively at what we think is a nice bottom but, of course, we also have our hedges. At this point though, we stand to make so much money if the market turns around that we do hope our hedges get wiped out!

It's going to be a very interesting week – trade carefully!