$6,000,000,000,000!

$6,000,000,000,000!

That's right, Larry Kudlow announced this morning that the US Government's stimulus package "will come to roughly $6 Trillion." That's in the form of $2Tn of direct CASH!!! to businesses and individuals and $4Tn from the Federal Reserve or, in other words, given to the Banksters. If they just gave the $6Tn directly to our 300M US Citizens, that would be $20,000 for every man, woman and child or about $70,000 per household. I think that would do a Hell of a lot more to stimulate the economy than giving it to Goldman Sachs, don't you?

NONETHELESS, $6Tn is about 1/3 of our entire GDP – the entire output of the United States over a 4-month period and, so far, we're in week 2 of the virus shutdown and, so far, there's no evidence that economic activity is down more than 30% – or about $500Bn for the month. Granted the virus may be around for longer then 4 months but, as I pointed out yesterday – it's not likely to kill more people than cancer (6M) or even Aids (1M) and, horrible though it is – life will, eventually, go on regardless.

Another reason the Futures dropped 600 points this morning (still green though) is our beloved leader is still sticking to his idiocy of ending the quarantine by Easter (April 12th) despite every expert, including his own, saying that it's a terrible idea to set arbitrary dates this early in the process and, of course, China's quarantine lasted 50 days – how are we going to be done in less than 30 days?

Also this morning, because our President is an idiot, the World Health Organization (WHO) warned the rest of the World that the United States could become the new hub for the viral outbreak as we are THE WORST country on the planet Earth in terms of preparedness, prevention and containment. Chad looks organized compared to us – CHAD!

“This cure is worse than the problem,” Trump said. “In my opinion, more people are going to die if we allow this to continue.”

Kind of like the cure to Obamacare? Kind of like the cure to politics as usual? Kind of like the cure to high taxes? Kind of like the cure to the Washington swamp? Yes, I guess I can see the Presidents' point – some "cures" are far worse than the problems people think they are going to fix – BUT NOT THIS ONE YOU MORON!!!

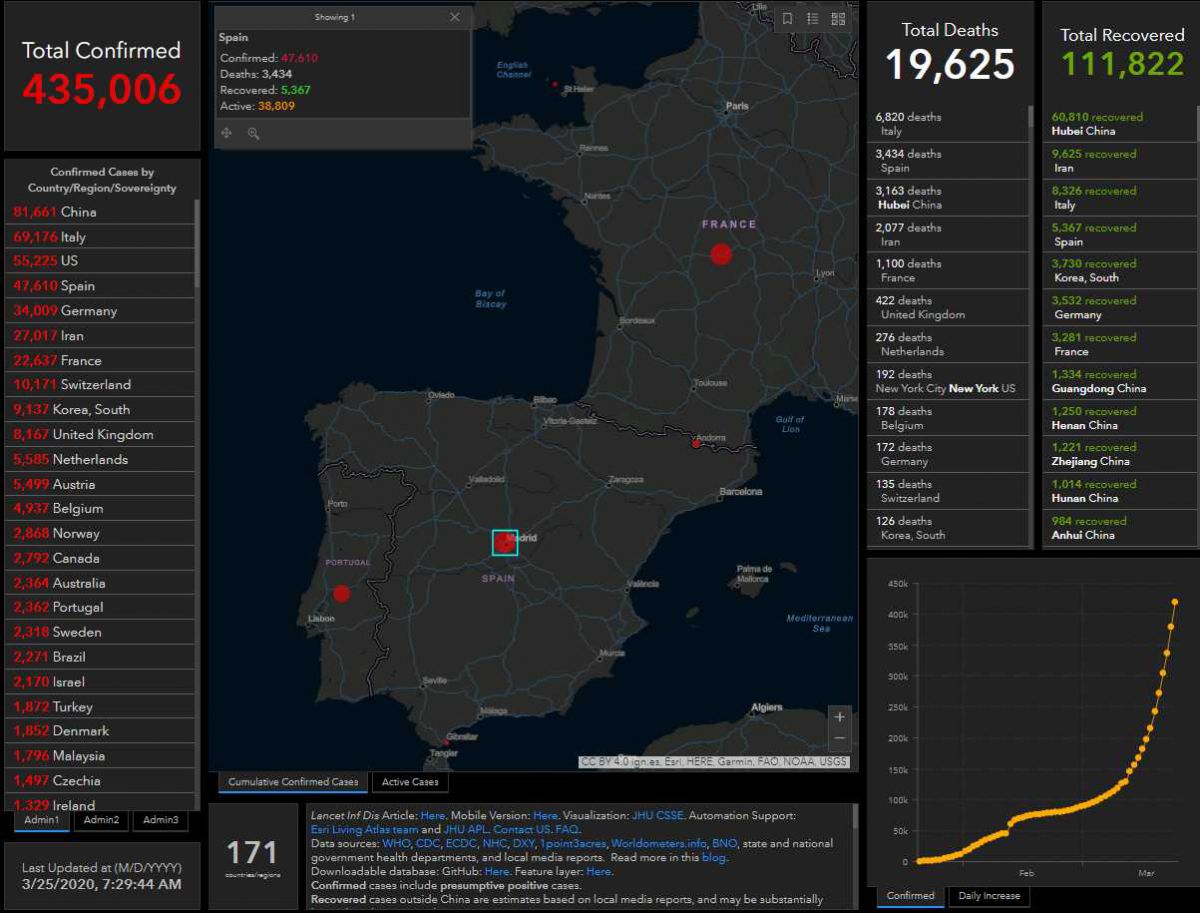

738 people died in Spain in the past 24 hours from the coronavirus. Spain now has more deaths (3,434) than China with 8,000 new cases today bringing their total infections to 47,610. Spain also has one of the highest proportion of healthcare workers affected by coronavirus, with over 5,400 confirmed cases, according to data from Tuesday. Spain has asked NATO for urgent help with material, requesting 1.5 million surgical masks, 150,000 protective suits and 450,000 ventilators. That last number is chilling as it indicates they are assuming millions of infections in Spain alone.

The U.S. is showing a large acceleration in the number of infections and has the potential to become a new epicenter of the outbreak, said Margaret Harris, a spokeswoman for the Geneva-based WHO. Over the 24 hours through 10 a.m. Geneva time Monday, 40% of new cases were in the U.S., more than any other country. “This is a time for scientific, evidence-based decision making,” Nancy Pelosi said in an MSNBC interview Monday, adding that the cost to the economy of more deaths would be greater than the economic consequences of social isolation.

Economically, China’s government is facing the worst fiscal situation since the global financial crisis more than a decade ago, with revenue falling after the government shut down economic activity in February to curb the spread of the coronavirus. The income of central and local governments contracted 9.9% in the first two months of the year compared to a year ago. That was the deepest fall since February 2009. Tax revenue declined more than 11%, with drops in value-added taxes, corporate income taxes and car purchase taxes undercutting the government’s coffers just as it needs to find extra money to stimulate the economy. Spending also dropped, but a surge in outlays on health-care and social security kept the decline to 2.9% from a year ago. The tight fiscal conditions add to the urgency for the government to raise money from bond sales and allow a higher deficit in 2020.

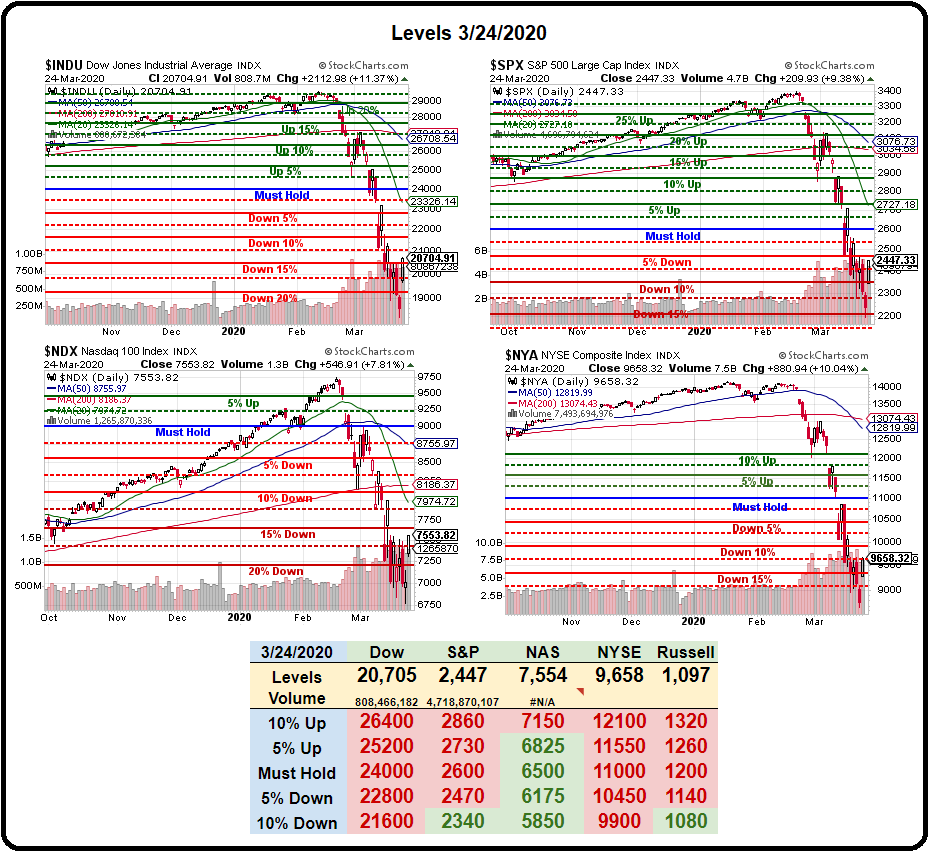

Still, 9.9% contraction is not 50% contraction or even 30% contraction – that's what's being priced into the US economy and China REALLY shut down their country and enforced it harshly. As I said yesterday – you can't simply stomp out economic activity if you don't kill the humans – they will find a way to generate GDP and that is why we flipped bullish last week – 40% down is too low and we are able to sell puts that put us into positions 20-40% lower than that!

In fact, we just got our Durable Goods Report for February and it was UP 1.2% vs -0.7% expected and Uber Eats (UBER) just repored a 10% increease in sales last week and a 30% increase in driver sign-ups. Boeing is a big part of Durable Goods and they, along with the airlines, are getting a $50Bn relief package as part of our $6Tn giveaway. Target (TGT) says comp store sales are up 20% from last year this month and Nike (NKE) just announced great earnings and are up about 10% pre-market.

We get Investor Confidence readings at 10am and a Business Confidence Survey at 11am but these are the readings from a lot of scared, irrational people who are suffering from a lack of leadership and a shortage of clear facts – so take it with a grain of salt.