$4.5 TRILLION!

$4.5 TRILLION!

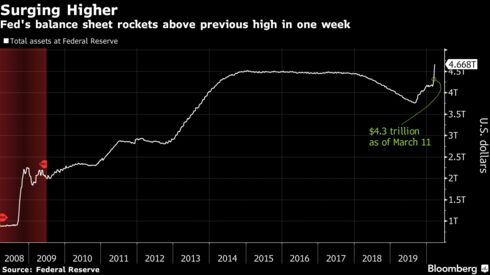

That's how much more lending power the Fed just opened up. That's on top of the $4.66Tn they arlready doled out – $1Tn of it in the past month alone… The Fed spent $4Tn buying the first recovery so what's another $4.5Tn to buy the next one? That was a trick question as the answer is "A good start!"

Pat Toomey (R) of Pennsylvania told Bloomberg yesterday that ANOTHER $4.5Tn is waiting in the wings. Who knew we had this much money sitting around? Certainly not the 700,000 Americans Trump pulled off Food Stamps because he said we couldn't afford $4.2Bn to feed starving children. Yet if one Octogenarian in the Senate gets a virus – suddenly $4,500Bn is available to ease the pain.

"Burn in Hell" is not something you usually hear in a Financial Newsletter but sometimes it's hard to find nicer ways to express yourself….

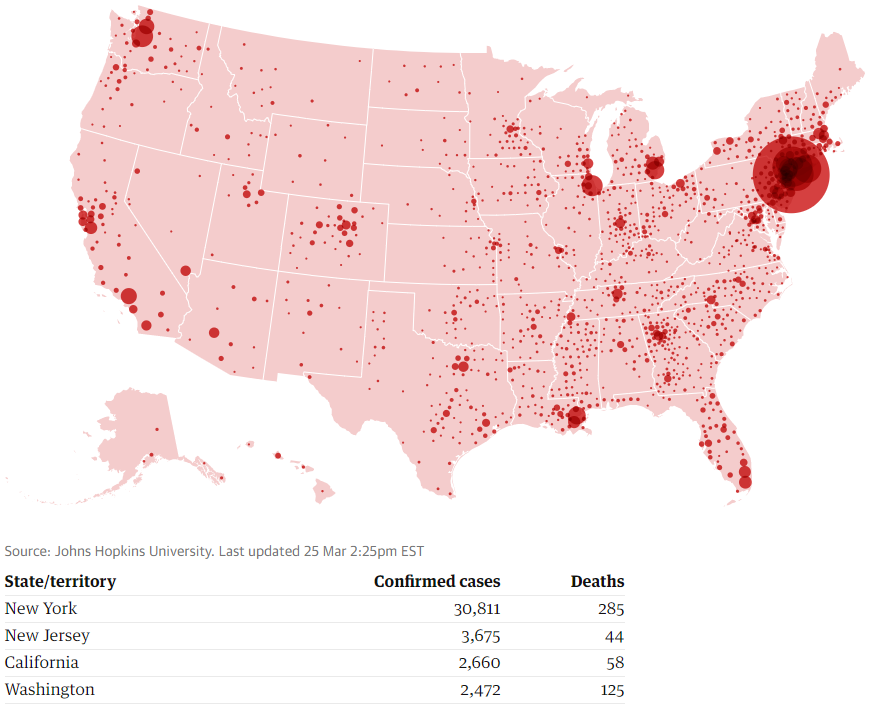

We still need the House to confirm the bill but let's keep in mind this is only our FIRST bailout package. If things drag on, there will cerainly be others and the way our Government is responding, things are certainly going to drag on. If you wonder what FEMA is doing during this emergency, New York, Hawaii and North Carolina have issued an urgent request to FEMA for emergency mortuary assistance as deaths mount across the states.

We still need the House to confirm the bill but let's keep in mind this is only our FIRST bailout package. If things drag on, there will cerainly be others and the way our Government is responding, things are certainly going to drag on. If you wonder what FEMA is doing during this emergency, New York, Hawaii and North Carolina have issued an urgent request to FEMA for emergency mortuary assistance as deaths mount across the states.

New York City has 17,856 cases of the virus (worst city on Earth) and over 200 people have died in the past week, which has overwhelmed the city's morges and they are currently keeping the dead outside in makeshift tents. As usual, states turn to FEMA to clean up the mess and soon we'll be hearing all the stories of families screaming about misplaced bodies, etc. This is, of course, not uprecedented:

What, too soon?

CBS (VIAC) will be putting Stephen Colbert back on the air on Monday, apparently from his house but they plan on doing a full show with interviews (from their homes) and even the production team is working remotely (though someone had to come over and set up the cameras, I imagine). Jimmy Fallon already started doing his show (sort of) and Jimmy Kimmel and Seth Meyers have been podcasting. The Daily Show, Full Frontal, Conan, John Oliver and Bill Maher are also going to start doing home shows.

As I said to our Members, after a few weeks, people get bored with any crisis and start going back to "normal" as much as possible. That's why we don't buy into these end-of the-World GDP forecasts. In fact, Singapore's GDP was down 10.6% in Q1 – about the same as China's and both countries are looking at 2-4% contractions for the year. This is not a good reason for stocks to be off 40%, is it?

Will the virus be worse in the US? Well, Donald Trump is the President – so draw your own party-line conclusions as to how well he will handle the virust compared to other World Leaders – many of whome didn't have 3 months' notice to prepare when the breakout started in Asia in December.

This is why, in our Webinar yesterday, we stressed taking up positions in BLUE CHIP STOCKS that are on sale – we gave you 20 of them in the past two weeks and our Member Portfolios have been adjusted to take full advantage of the next market correction – the one that corrects for the irrational panic that is driving it now.

Wednesday March 11th: Money Talk Portfolio Update (7 trade ideas)

Thursday March 12th: Thursday Failure – Trump Shuts Travel, Provides No Solutions, No Stimulus – Market Tanks (again) (10 trade ideas)

Tuesday March 17th: 2,400 Tuesday – S&P Tests the Bottom of our Target Range (10 trade ideas)

PhilStockWorld March Portfolio Review (100 trade ideas)

There's over 100 trade ideas in those 4 posts and we are still looking to sell puts that are 20-40% below the current price and/or use bull call spreads that are 30-50% in the money and pay at least 100% at levels that are less than halfway back to the highs. In other words:

If you missed the bottom on BA, you have to take advantage of what you've got so we have a big pop yesterday that inflated the options premiums, raising the internal volatility of the BA contracts and we take advantage of that by selling as much premium as possible:

- Sell 10 BA June 2022 $175 calls for $55 ($55,000)

- Buy 10 BA June 2022 $110 calls for $85 ($85,000)

- Sell 5 BA June 2022 $85 puts for $20 ($10,000)

Here we're paying net $25,000 for a $65,000 spread that's $50,000 in the money so it's not a very ambitious target and we're promising to buy 500 shares of BA for $85 – about 1/2 the current price. Like the virus, BA's troubles are now more irrational panic than a realistic assessment of the long-term damage done to the company and what do you think the airlines are going to do with $50Bn in bailout money? Airlines have 3 major expenses, fuels, staff and new planes. They aren't flying and they laid off their staff – what's left to do?

I'd like to say this is the opportunitiy of a lifetime but it's really the opportunity of the decade – as this sort of thing happens all too often, unfortunately.

Still – don't miss out!