Courtesy of Pam Martens

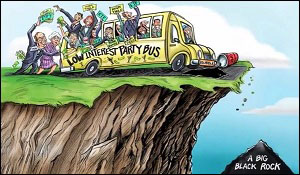

In 2015, the legendary Wall Street investor, Carl Icahn, called BlackRock “an extremely dangerous company.” (See video clip below.) Icahn was specifically talking about BlackRock’s packaging of junk bonds into Exchange Traded Funds (ETFs) and calling them “High Yield,” which the average American doesn’t understand is a junk-rated bond. The ETFs trade during market hours on the New York Stock Exchange, giving them the aura of liquidity when one needs it. Icahn said: “I used to laugh with some of these guys…I used to say, you know, the mafia has a better code of ethics than you guys. You know you’re selling this crap.” Icahn warned that “if and when there’s a real problem in the economy, there’s going to be a rush for the exits like in a movie theatre, and people want to sell those bonds, and think they can sell them, there is no market for them.”

BlackRock not only sells junk-rated bond ETFs under the brand name iShares, but it has some of the largest investment grade corporate bond ETFs, including one that trades under the stock symbol LQD, which was experiencing serious losses and seeing major outflows of money until the Federal Reserve announced recently that it was creating three facilities to buy investment grade corporate debt from the primary and secondary markets, as well as investment grade corporate bond ETFs, along with agency commercial mortgage-backed securities.

And just who is going to be running these facilities for the Federal Reserve? None other than BlackRock – posing an enormous conflict of interest which was readily observable in the market as BlackRock’s investment grade ETFs rallied dramatically on the news.

According to the “Terms of Assignment” the New York Fed released, BlackRock will be allowed to buy up its own corporate bond ETFs as well as those of its competitors. The only caveat in the contract is this concerning the Fed’s Secondary Market Corporate Credit Facility (SMCCF):

“BlackRock will treat BlackRock-sponsored ETFs on the same neutral footing as third-party ETFs. All ETF transactions will be effected through intermediaries at market prices on a best execution basis, whether in the secondary market or via primary creations and redemptions. If the share of the SMCCF’s holding of BlackRock-sponsored ETFs exceeds or is expected to exceed the then-current market share of BlackRock-sponsored ETFs in the corporate bond ETF market on average over a given calendar month, BlackRock will notify the New York Fed for review and consultation. The New York Fed may direct portfolio adjustments at any time.”

…