Courtesy of Pam Martens

By Pam Martens and Russ Martens

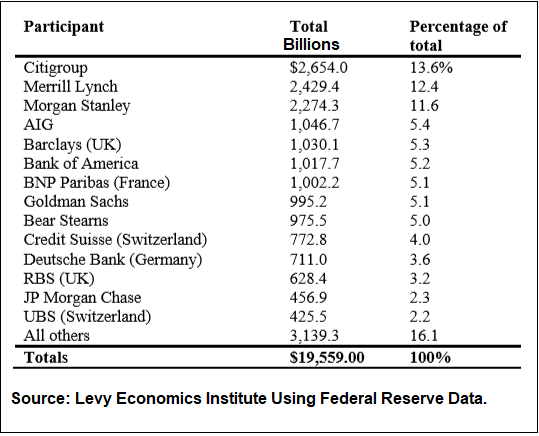

From December 2007 to November 10, 2011, the Federal Reserve, secretly and without the awareness of Congress, funneled $19.6 trillion in cumulative loans to bail out the trading houses on Wall Street. Just 14 global financial institutions received 83.9 percent of those loans or $16.41 trillion. (See chart above.) A number of those banks were insolvent at the time and did not, under the law, qualify for these Fed loans. Significant amounts of these loans were collateralized with junk bonds and stocks, at a time when both markets were in freefall. Under the law, the Fed is only allowed to make loans against “good” collateral.

Six of the institutions receiving massive loans from the Fed were not even U.S. banks but global foreign banks that had to be saved because they were heavily interconnected to the Wall Street banks through unregulated derivatives. If one financial institution in this daisy chain of derivatives failed, it would set off a domino effect.

Another $10 trillion was spent by the Fed providing dollar swaps to foreign central banks, bringing the final tally of the bailout to $29 trillion. The Levy Economics Institute used the data that the Federal Reserve was forced to release through an amendment attached to the Dodd-Frank financial reform legislation in 2010 to compile the $29 trillion tab. Its figures are in line with the audit done by the Government Accountability Office (GAO), also mandated by the same amendment. The GAO audit included most, but not all, of the Fed programs, so its figures fall short of the comprehensive job done by the Levy Economics Institute.

…