Wimps!

Wimps!

The Dow drops 700 points (1,200 off yesterday's high) and everyone is back to Doom and Gloom. We are in the MIDDLE of a Global Catastrophe that will play out over the next two to three months – it's the expectations of the participants that need adjusting – not the markets...

This is like standing in the rubble of the World Trade Center the afternoon of 9/11 and asking why the markets haven't gone back up yet – it's irrational behavior.

Yes, the Government APPROVED Trillions of Dollars in stimulus on Friday but it hasn't been deployed yet. That doesn't seem to stop a parade of idiots from going on TV to say "Well, I guess the market is telling us the stimulus wasn't enough." What morons! Even worse is the uncritical response they get from the Hosts (who are usually empty suits anyway) and the Producers whispering in their ears. Welcome to the 21st Century, where your idiotic opinion gets the same weighting as actual facts!

As our Members know, there's always a song in my head and this morning it's:

"When I'm riding in my car

And a man comes on the radio

He's tellin' me more and more

About some useless information

Supposed to fire my imagination

I can't get noSatisfaction" – Stones

Why do we listen to these people? When have they ever been right? The same thing happened in 2008 when the people who had the money (the Top 1%) got their bailouts (TARP) and then went about telling the Bottom 99% that the World was going to end and they should dump all their stocks – the same stocks the Top 1% were buying up because they knew the World was not going to end at all.

Why do we listen to these people? When have they ever been right? The same thing happened in 2008 when the people who had the money (the Top 1%) got their bailouts (TARP) and then went about telling the Bottom 99% that the World was going to end and they should dump all their stocks – the same stocks the Top 1% were buying up because they knew the World was not going to end at all.

I'm not a naysayer – I was one of the first analysts in America to tell people to hedge for a market downturn back on January 23rd, when there were 1,000 cases in China and I was worried it would be like SARS and cause a 10% drop in the market back in 2002. I was on top of it BECAUSE I'm a student of history and I look at how similar situations played out in the past to indicate what is likely to happen in the future. This time is almost never different – despite what the man on TV tells you.

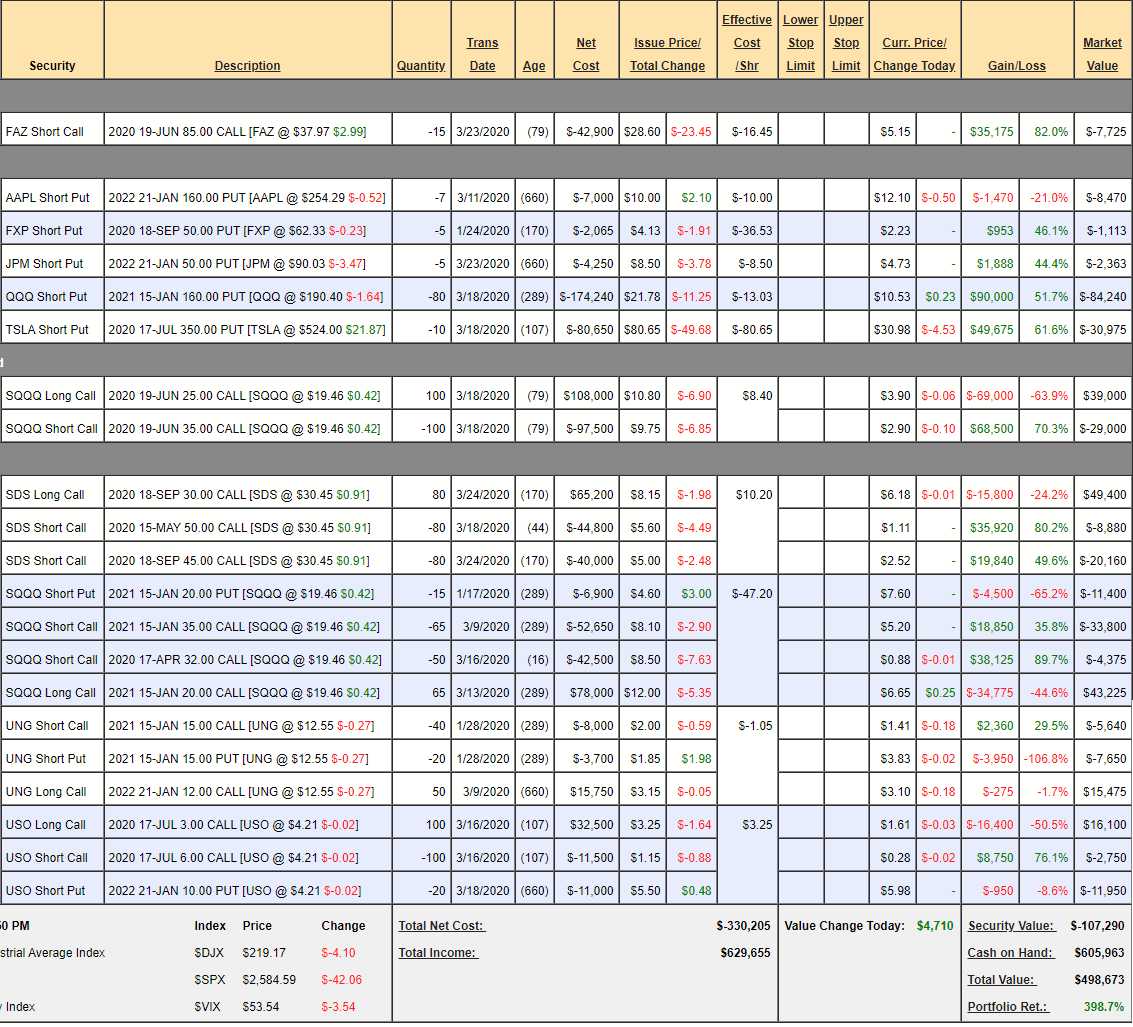

Because we hedged, our Short-Term Portfolio (STP) is up 398.7% for the year as of yesterday's close and it's important to step back and look at our hedges and determine whether or not we are adequately covered in case Team Trump continues to bungle their way into 1M deaths – which is way past my 50,000-200,000 predicted range. With 189,633 US cases as of this morning and about 3,000 deaths (they don't give US totals) and only 7,136 recoveries – things are getting worse and worse but we already expected that – so it shouldn't drastically change our market outlook – yet:

Financial 3x Bear ETF (FAZ) – We played this one as a technical trade when the VIX was high and FAZ was spiking – we just couldn't resist the ridiculous price they were offering for the June $85 calls but now we can play FAZ as a hedge – just in case the bailouts really aren't enough so we're going to buy back the June $85 calls and pocket a $35,175 profit and add the following hedge:

- Sell 5 FAZ Jan $25 puts for $5 ($2,500)

- Buy 15 June $45 calls for $10 ($15,000)

- Sell 15 June $65 calls for $7 ($10,500)

That's net $2,000 on the $30,000 spread so it's a nice hedge if the banks fall apart and not too risky as we can only be assigned 500 shares at $25 ($12,500) which we would then use to hedge the addition of cheap Financials stocks in our Long-Term Portfolio. JPM is cheap at $85, C at $40, BAC at $20 – we could even begin selling puts on those to raise some cash but I'd like to see some earnings first. JPM reports on the 13th, BAC the 14th and C reports on the 15th.

Short puts – These are offset hedges to other positions and we're not worried about the net entries but our 80 QQQ puts have a nice profit so we can take those off the table as it flips us more bearish and drops cash into our portfolioo. Also, the TSLA puts make me nervous – so let's take that money and run run too.

Nasdaq 3x Ultra-Short (SQQQ) – I cannot believe you can still get this spread for $1! Let's add 100 more for $10,000 and pay for it by selling 15 Jan $20 puts for $7 ($10,500).

S&P 500 2x Ultra Short (SDS) – This hedge gives us $120,000 worth of protection and is currently net $20,360 so pretty cheap insurance. We sold short May $50s so we hope the S&P doesn't fall too far but it's only a 2x ETF so it would take a 30% drop in the S&P for SDS to get to $50 (60% up from $30) and I think we'll have time to add more hedges between here and there.

SQQQ – This is our older hedge (we always have hedges!) and we cashed out the winning position but now we're too bullish so we'll buy back the short April calls for a nce $38,125 profit (89.7%) in two weeks and we'll see what kind of pop we get before we decide to re-sell. That leaves us with a pretty striaghtforward $97,500 spread that's currently a net $1,975 credit so we have $99,475 worth of protection on this spread.

Natural Gas ETF (UNG) – I THINK, with all the oil wells shutting down, that Natural Gas will become a bit more scarce and we only need to get to $15 so let's give it a month and see how it's looking. This is not a hedge, just a bet but it's kind of a hedge on the hedges as an improving economy would tank the main hedges while this trade makes $15,000.

Oil ETF (USO) – The non-stop wail of the pundits is deafening here. Not one of them predicted a drop at all but now that oil is at $20 – they are predicting $10, $0 and even, somehow, they will PAY YOU to take the oil (negative prices). How long will that last as a business model? It can happen – it happened with Nat Gas in Europe a few years ago when supplies were swelling the pipes and they paid commercial customers to move the gas into their private storage but then the market rebalanced.

We've been playing the Oil Futures (/CL) long off the $20 line with tight stops below and, at the moment, there are 4 open contracts that are up slightly. I should have taken them off the table at $20.50 this morning but I was writing this article and missed it! Inventories are 10:30 and super-risky as we'll likey have a big build and there's no sign Russia and OPEC are cooperating at all so oil COULD go lower but all that is expected so I think maybe a bit of relief from lack of shock. BUT (and I like Big Buts) I will be shocked if we're not at $30 by July – and that would be up $10,000 per contract from here.

That's what our July USO spread is about too – we expect Oil to go up 50% from $20 to $30 by July and so USO should go up 50% from $4 to $6 by July and that would put our spread $30,000 in the money and it's currently net $1,400 so there's a $28,600 (2,042%) profit potential and the worst case is we get assigned 2,000 shares of USO at net $10.70 ($21,400) from the 20 short puts – and that's still not terrible as a long-term play.

So our new FAZ hedge offers us $28,000 of hedging potential, 200 of the SQQQ June $25/35 spreads at net $10,000 pays +$190,000 if the Nasdaq fails, SDS has $100,000(ish) upside potential, SQQQ Jan $20/35 spread also is a $100,000 hedge and USO, UNG and the short puts balance losses on the hedges….

That's another $418,000 worth of downside protection for our long portfolios and the LTP started with $500,000 and is down 20% at $400,000 but, with the $500,000 we have in the STP – we're up a combined 50% for the year, despite the downturn. In fact, with hedges like these, we almost prefer the market head lower before it goes back up but, with hedges like these, we feel free to do a bit more bottom-fishing – as we are very well protected.

The best thing you can do in uncertain markets like these is to be well-balanced. If you are balanced, you can go with the flow and make adjustments. If you are not balanced – you get tossed about in the market turmoil and have to hang on just to survive.

That's no fun!