The Futures are up another 3.5% this morning, pre-market as China reports NO new cases of the virus and Trump touts his "miracle cure" that people have already died from taking. Day after day, the salesman turned president has encouraged coronavirus patients to try hydroxychloroquine with all of the enthusiasm of a real estate developer. The passing reference he makes to the possible dangers is usually overwhelmed by the full-throated endorsement. “What do you have to lose?” he asked five times on Sunday.

As it turns out, the real question is "What does Donald Trump have to gain?" If hydroxychloroquine becomes an accepted treatment, several pharmaceutical companies stand to profit, including shareholders and senior executives with connections to the President. Trump himself has a small personal financial interest in Sanofi (SNY), the French drugmaker that makes Plaquenil, the brand-name version of hydroxychloroquine.

"Some associates of Mr. Trump's have financial interests in the issue. Sanofi's largest shareholders include Fisher Asset Management, the mutual fund company run by Ken Fisher, a major donor to Republicans, including Mr. Trump," said the report. "Another investor in both Sanofi and Mylan, another pharmaceutical firm, is Invesco, the fund previously run by Wilbur Ross, the commerce secretary. As of last year, Mr. Trump reported that his three family trusts each had investments in a Dodge & Cox mutual fund, whose largest holding was in Sanofi."

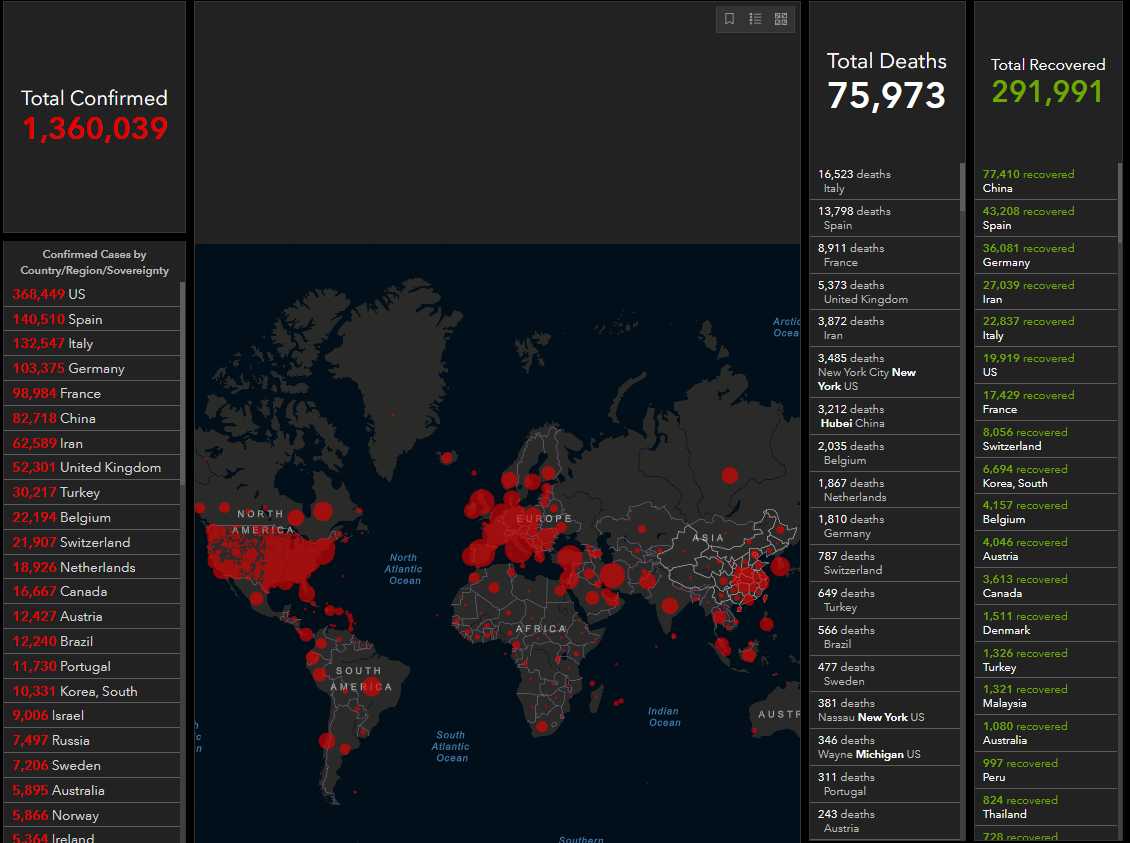

While China may have gone a day with no new cases of COVID-19, the US blasted up from 337,933 cases yesterday morning (4 times more than China, which has 5 times more people than the US does) to 368,449 (up 9%) this morning and we now have 10,943 deaths – the third highest count in the World behind Italy (16,523) and Spain (13,798), which are both openly considered disasters (and they got hit hard with infections 3 weeks before we did – so we may just be lagging on deaths as we have double their infections).

How does America have 4 times more virus cases than China (1.44Bn people) and India (1.4Bn people) combined with 1/10th the combined population? According to Donald Trump, it is Obama's fault. Italy and Spain say it's Obama's fault too and Putin is blaming Obama as well since it seems to work for the Republicans – so why not?

While I don't trust SNY and it's already popped a lot, 3M (MMM) is interesting as it's still around $140 and they have just agreed to sell 165M masks to the US right away and the company expects to double their capacity to 2Bn masks/year by the end of 2020, producing 100M masks a month (world-wide) right away with 50M masks a month earmarked for the US, 40% more than they currently produce.

The masks are only $1 each and MMM is an $80Bn company with $32Bn in revenues and $5Bn in income so it's not actually very cheap at $140 but it is great publicity for them and they will be getting their foot in the door with pretty much every Government on the planet – so perhaps they will be able to sell some Scotch Tape and Post-It notes as well?

| Year End 31st Dec | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020E | 2021E | CAGR / Avg |

|---|---|---|---|---|---|---|---|---|---|

|

$m

|

31,821 | 30,274 | 30,109 | 31,657 | 32,765 | 32,136 | 32,199 | 33,322 | 0.197% |

|

$m

|

7,135 | 6,946 | 7,027 | 7,788 | 7,207 | 6,102 | -3.08% | ||

|

$m

|

4,956 | 4,833 | 5,050 | 4,858 | 5,349 | 4,570 | 5,042 | 5,437 | -1.61% |

|

$

|

7.49 | 7.58 | 8.16 | 9.17 | 9.18 | 7.81 | 0.852% | ||

|

$

|

7.49 | 7.71 | 8.03 | 8.34 | 8.46 | 9.38 | 8.71 | 9.45 | 4.60% |

|

%

|

+11.5 | +3.01 | +4.17 | +3.84 | +1.40 | +10.8 | -7.11 | +8.46 | |

|

x

|

15.0 | 16.2 | 14.9 | ||||||

|

|

1.91 | 2.69 | |||||||

We can collect $12 for promising to buy 500 shares of MMM for $100 by selling 5 2022 $100 puts for $12 ($6,000) and that would net us in for $88 ($44,000) if assigned and that would use up $22,000 worth of ordinary margin so make sure you REALLY want to own MMM before selling puts but we have room in our Long-Term Portfolio so let's add that play as we also know that we can roll the short puts or, if assigned, we can sell 2022 calls (the $140s are $22) to further lower the basis so we're very confident we could end up with MMM below net $70 – a 50% discount to the current price.

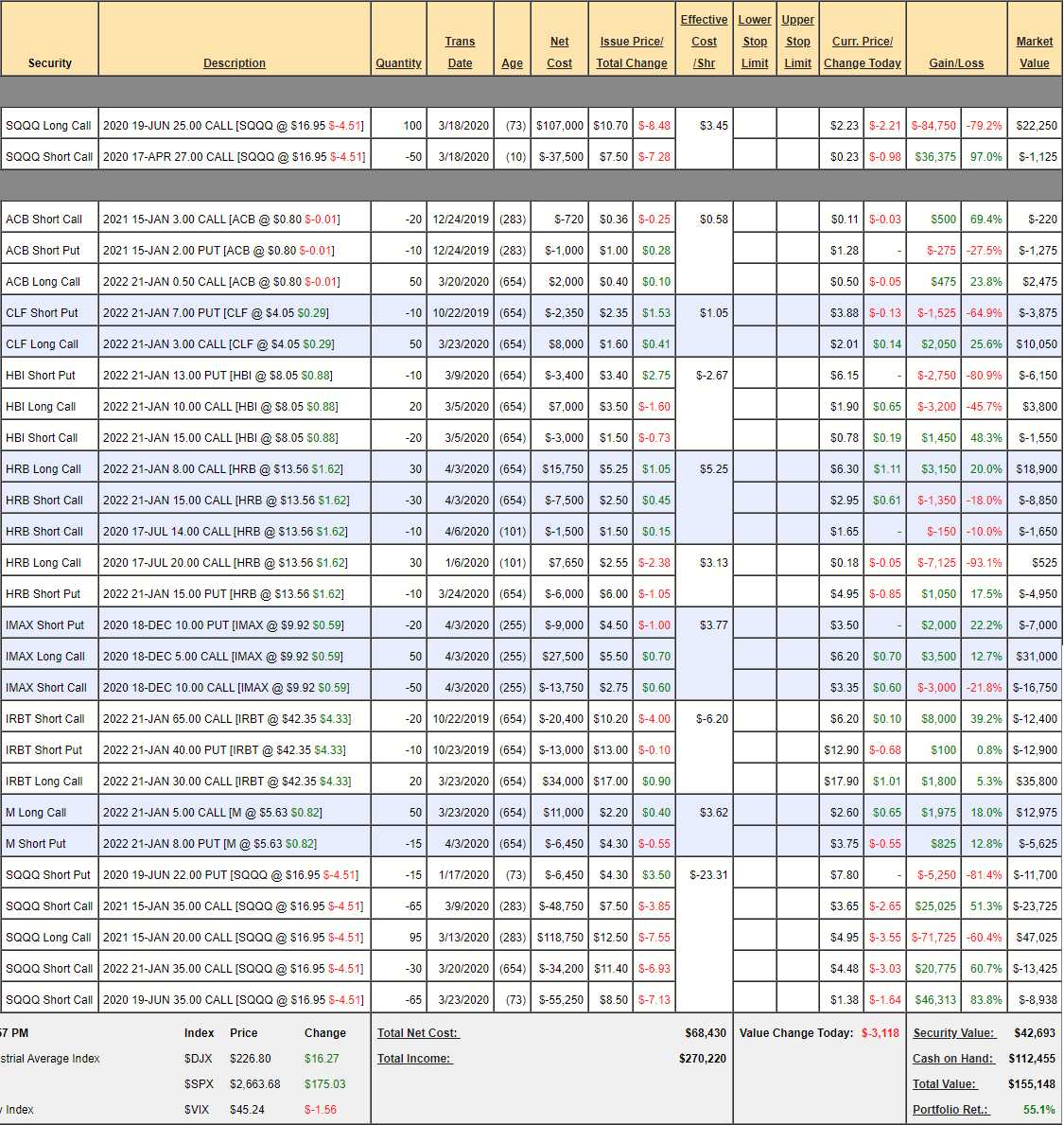

Looking at this morning's action – I think traders are getting ahead of themselves as the only reason the virus is under control in China is because they were locked down for 2 months and this has been only two weeks in the US and Earnings Reports come out next week and those will be ugly. On Friday we made bullish adjustments to our Income Portfolio and that's gone from $132,078 on Friday morning to $155,148 at yesterday's close – up $23,070 (17.5%) in just two sessions and it should be up further this morning but that means it's time to lock in some of our gains – just in case we pull back again.

Smart Portfolio Management is all about BALANCE and we need to be aware of when we are making too much money as acutely as when we are losing too much money. We did not expect a V-shaped recovery but we're getting the start of one with the S&P 500 back over 2,700 already this morning. We are generally expecting 2,850 to be the top of our range so we need to now look at each of our positions and make sure we are comfortable and for sure we will be adjusting our SQQQ hedges to lock in these gains.

- Aurora Cannabis (ACB) – Nothing to worry about here – stilll dead!

- Cleavland Cliffs (CLF) – Nice pop and we are naked long, which we hate to be as that makes us the sucker paying the premiums. The 2022 $7 calls are 0.80 and I think we should ask for $1 as that would put $5,000 back in our pocket and take all of our cash for this trade off the table so we end up with a free $25,000 spread we can ignore for 2 years. That's the kind of position I love to have in our portfolios!

- Hanesbrands (HBI) – Already a spread we have a lot of confidence in.

- H&R Block (HRB) – We added a new spread so clearly we're confident in the 2022 outlook but it would be a miracle if your July $20 calls get back in the money but simply not worth cashing in this low either.

IMax (IMAX) – Once China starts going to the movies again, this stock will pop. It's already a spread and already almost 100% in the money so I guess we were too conservative in our adjustment but it will pay $25,000 if IMAX is over $10 in December and we bought this spread for net $4,750 so we stand to make $22,250 (468%) by December and the net is currently $7,250 so up $2,500 (52.6%) in two days is a good start but still good for a new trade with all this upside remaining.

As you can see, you don't have to swing for the fences to make great money trading option spreads. It's not at all complicated (see Friday's post for long explanations of the strategies) and all we have to do is simply look for stocks that are clearly undervalued and put ourselves into reasonable positions we feel strongly will work out over time. That's all we have to do!

- IRobot (IRBT) – Another spread we left alone as we were confident with our targets.

- Macy's (M) – This one we got more aggressive with, doubling down on the long 2022 $5 calls and now we're back over $5 but I think this one has a lot of room to run, so we're not going to cover until maybe $10 – at which point our long calls will be $25,000 in the money and we only spent net $4,550 on the adjusted spread.

- Nasdaq 3x Ultra-Short (SQQQ) Part 1 – Up at the top we have 100 June $25 calls and 50 short April $27 calls. The April calls are toast and we took a big hit on the June $25s but it's insurance, not a bet – it's there to protect our long positions. Fortunately, the positions we want to roll to have also gotten cheaper so we'll leave the short calls to expire worthless and roll our long calls at $22,250 to 40 of the Jan 2021 $15 calls at $6 ($24,000) so we're paying a very small amount of money ($1,750) to buy $20,000 worth of position and keep 1/2 our insurance for the whole year.

- Nasdaq 3x Ultra-Short (SQQQ) Part 2 – We're going to roll the 95 Jan 2021 $20 calls at $4.95 down to the Jan 2021 $15 calls at $6 spending $1.05 ($9,975) to pick up $47,500 in position (and additional protection). The 15 short June $22 puts at $7.80 ($11,700) can be rolled to 20 of the Jan $17 puts at $6 ($12,000) and we will put a stop on 35 of the short June $35 calls at $2 and 30 more (the rest) at $3 – just in case things dive again.

Note that we've spent $11,425 and now we have 135 Jan $15 calls with SQQQ at $17 so a 20% drop in the Nasdaq would pop SQQQ 60%, back to $27, which would make the $15s worth $12 or $114,000. That's our protection on a 20% drop. Since we know our positions will make $153,600 if all goes well (less the $23.070 they made this week, of course) we're not worried about losing the net $21,787 we have tied up in our hedges.

We still have over $100,000 worth of cash to deploy but just making sure we stay on track will make us well over 50% per year so we're in no hurry to add positions here – just keeping this portfolio in balance is a worthwhile endeavor – especially if we can ride out choppy markets like this this one while maintaining nice gains!