When will things get back to normal?

When will things get back to normal?

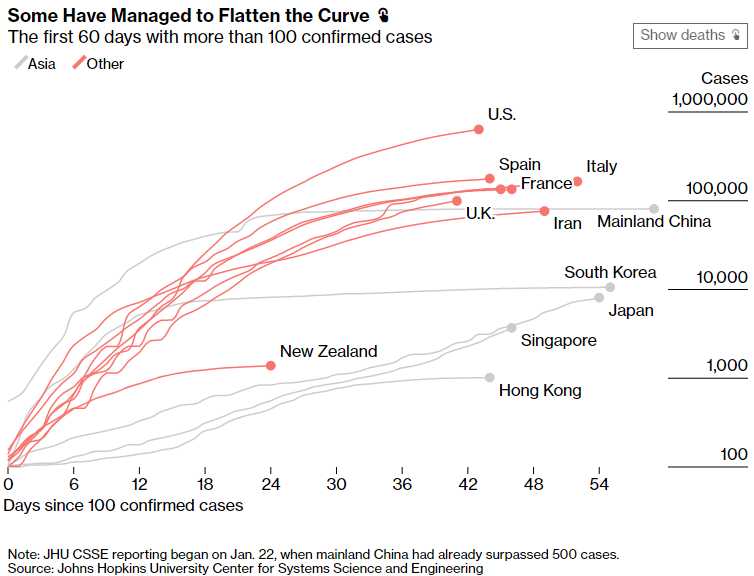

That's the question on everyone's mind these days and it's very hard to get a clear answer. As you can see from the chart on the right, the global lockdown does seem to be flattening the curve and China has been getting back to work without too many new cases popping up but it's still 45 new cases today – certainly what a Capitalist is going to call "acceptable losses" in the context or restarting the economy.

China's lockdown began 45 days ago and our lockdown began 30 days ago while South Korea (52M people) never had a lockdown but instead went with testing at a very early stage (they had their first case the same day the US did). Testing and early detection have given South Korea the lowest death rate from the viurs in the World, with just 169 deaths out of 10,000 cases discovered. Rather than rely on people with symptoms volunteering to be tested, SoKo authorities took a proactive approach which helped identify cases without symptoms which may have otherwise gone on to spread the virus further.

Using technology developed during the MERS outbreak, authorities were able to track cases using credit card records, GPS and security camera footage to find who those individuals came into contact with and ensure they were tested too. The government sent texts out to residents informing them when a case was discovered nearby and allowed access to its tracking data. Many chose to self-quarantine, and using the tracking data, they could also see which public spaces were high-risk areas for infection and should therefore be avoided.

Now, unlike many other ghost towns across the world, South Korea’s cities are full of people going about their usual business. Crucially, many are practicing social distancing and almost everyone is wearing face masks. To counter the risk of travelers from abroad spreading the virus, authorities announced on Wednesday strict rules for anyone arriving from abroad, including a mandatory two-week quarantine.

Now, unlike many other ghost towns across the world, South Korea’s cities are full of people going about their usual business. Crucially, many are practicing social distancing and almost everyone is wearing face masks. To counter the risk of travelers from abroad spreading the virus, authorities announced on Wednesday strict rules for anyone arriving from abroad, including a mandatory two-week quarantine.

Like many Asian countries, South Korea also has extensive spraying campaigns to sterilize all public areas to prevent the virus from lingering and accumulating day by day. To me, this is encouraging because the virus CAN be controlled – the only problem is we have an inept Government that is doing NONE of these things with a President who is so eager to declare "Mission Accomplished" that he doesn't care how many lives he puts at risk by sending Americans back to work without any of these proven protections in place.

During a series of phone calls with the President yesterday, Banking and financial services executives told Trump that his Administration needed to dramatically increase the availability of coronavirus testing before the public would be confident enough to return to work, eat at restaurants or shop in retail establishments.

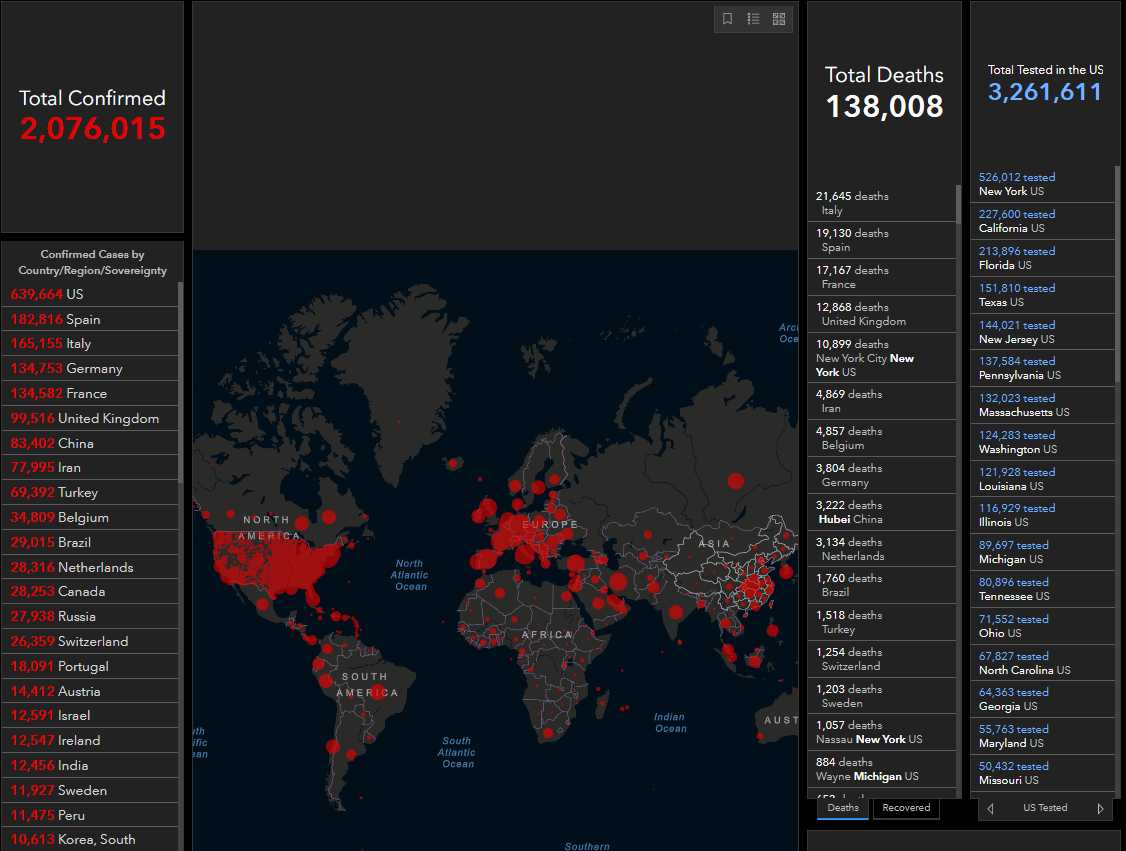

While Trump summarized things by saying at yesterday's briefing that "The data suggests that nationwide we have passed the peak on new cases" the reality is that the US had a record loss of 2,569 lives yesterday, bringing out total over 28,000 with a 10% gain on the day and, as of this morning, we have 640,000 infections – 30% of the World's total 2,076,415 – even though we have just 4% of the World's population so, very simply, 8 times the average infection rate of the rest of the planet – despite us inflating the whole planet's curve by 30%!

While Trump summarized things by saying at yesterday's briefing that "The data suggests that nationwide we have passed the peak on new cases" the reality is that the US had a record loss of 2,569 lives yesterday, bringing out total over 28,000 with a 10% gain on the day and, as of this morning, we have 640,000 infections – 30% of the World's total 2,076,415 – even though we have just 4% of the World's population so, very simply, 8 times the average infection rate of the rest of the planet – despite us inflating the whole planet's curve by 30%!

Things can't get back to "normal" until either Trump recognizes the failure of his current policy and starts doing what the rest of the World is doing or until we, the people, recognize the President's failure and do something about that – and this can't wait until November! If Trump refuses to take this crisis seriously and continues to sacrifice American lives on the alter of his ego, then it's up to State Governors to take matters into their own hands and override the President's GUIDELINES (because he's not actually in charge).

There's also talk of invoking the 25th amendment and removing Trump from office due to incompetence but you need 2/3 of both houses and that would mean 21 of 53 Republican Senators would have to agree with that plan, so it's more likely going to be up to the Governors and their State Legislators to show some backbone – otherwise we could be suffering through this crisis for the rest of the year if we try to re-open too early without taking sensible precautions.

We are only about 2 weeks away from Trump's incompetence leading to 60,000 deaths – that's more than the 58,220 lives that were lost in the 23-year Vietnam War! I apologize if I am offending Trump fans and maybe it makes you feel better to blame China or blame the World Health Organization or blame whoever Trump/Fox is blaming today but the FACT is the whole World has the same World Health Organization but it's the US (and the EU) that has 8 times more infections and on track for a similar surplus of deaths.

We are only about 2 weeks away from Trump's incompetence leading to 60,000 deaths – that's more than the 58,220 lives that were lost in the 23-year Vietnam War! I apologize if I am offending Trump fans and maybe it makes you feel better to blame China or blame the World Health Organization or blame whoever Trump/Fox is blaming today but the FACT is the whole World has the same World Health Organization but it's the US (and the EU) that has 8 times more infections and on track for a similar surplus of deaths.

Are you just going to sit there and cower in your home or are you going to do something about that?

Spain (46M), Italy (60M), Germany (83M), France (66MM) and the UK (66M) have essentially the same population as the US and have 716,822 infections between them with Germany bringing down that curve and we'll keep an eye on what they do in the next few weeks. Germany has a ban on large public events, from soccer matches to concerts, that will be extended until Aug. 31, and restaurants and bars would remain closed as well but small stores will be allowed to re-open on May 4th, providing they follow health and safety guidelines.

“We must not be hasty,” Ms. Merkel said. “We must learn to live with the virus as long as there is no therapy and no vaccine. This is about the lives of people.”

European Union officials earlier Wednesday set guidelines for ending national lockdowns and urged the bloc’s 27 member governments to coordinate their moves. If it works and we can all begin getting back to work over the next 60 days – our GDP is $1.5Tn per month and it's 30% down for the first month (March 15th-April 15th) so that's $500Bn and let's say were 30% down for Month 2 ($500Bn) but only 15% down in Month 3 ($225Bn) and 10% down for the rest of the year ($900Bn) – that would be a $1.625Tn hit to the economy and the Government already put aside $2.2Tn, so we can get through this crisis – we just have to start doing the right things!