Courtesy of Pam Martens

Bloomberg News has an article up today with the headline: “The Fed Loves Main Street as much as Wall Street This Time.” The article is accompanied with a graphic of Fed Chair Jerome Powell shooting equal amounts of money at Main Street and Wall Street. Nothing could be further from the truth. Despite the headline, the article by Peter Coy offers not a scintilla of evidence to support the premise that Main Street is getting a fair shake from the Fed. What the article does do is adopt the talking points the Fed has used in every press release it has issued on a new funding facility rollout – that the money will (through some magical and invisible and unexplained hand of the market Gods) make its way to American workers and households.

Bloomberg News has an article up today with the headline: “The Fed Loves Main Street as much as Wall Street This Time.” The article is accompanied with a graphic of Fed Chair Jerome Powell shooting equal amounts of money at Main Street and Wall Street. Nothing could be further from the truth. Despite the headline, the article by Peter Coy offers not a scintilla of evidence to support the premise that Main Street is getting a fair shake from the Fed. What the article does do is adopt the talking points the Fed has used in every press release it has issued on a new funding facility rollout – that the money will (through some magical and invisible and unexplained hand of the market Gods) make its way to American workers and households.

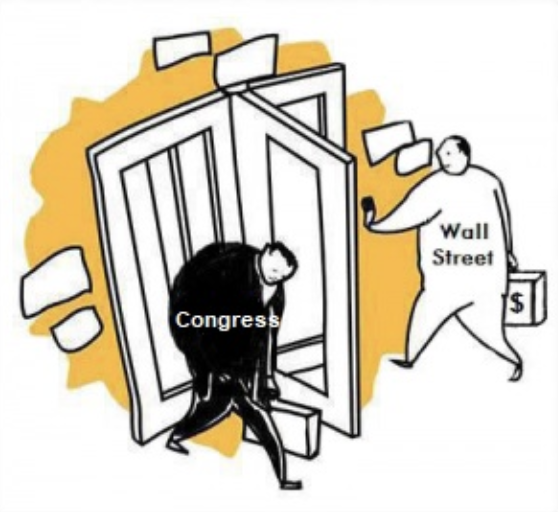

It’s all bunk. Here’s what is actually happening. The stimulus bill (CARES Act) stipulates that the U.S. Treasury will provide $454 billion of the $2.2 trillion total to the Federal Reserve. That $454 billion will be the loss absorbing capital to leverage the Fed’s purchases of toxic debt from Wall Street to a maximum of 10 times or $4.54 trillion. So, already Main Street is behind. Main Street is getting $2.2 trillion minus $454 billion for Wall Street and $46 billion for airlines and “national security” businesses, likely meaning Boeing. That leaves $1.7 trillion versus the $4.54 trillion that will be offered to Wall Street, or $2.84 trillion more heading to bail out Wall Street.

But the Fed had already created another Wall Street bailout program last year that is not included in that $4.54 trillion. The Fed’s repo loan program has already funneled more than $9 trillion to Wall Street in revolving loans since September 17, 2019. So that makes it $13.54 trillion for Wall Street versus possibly $1.7 trillion for Main Street, if it’s not siphoned off by loopholes in the new law. (Those repo loans, as of yesterday, were being made at the preposterous interest rate of 1/10th of one percent to Wall Street firms; firms that couldn’t even borrow at 10 percent in September.)

It has been clearly stated by Fed Chairman Powell that the U.S. taxpayer that is putting up this loss absorbing capital will eat any losses from the Fed’s funding facilities for Wall Street.

The Federal Reserve is, in turn, handing almost all of this money over to the New York Fed, which is privately owned by some of the largest Wall Street banks: JPMorgan Chase, Citigroup, Goldman Sachs and Morgan Stanley, for example. (One funding facility, the Money Market Mutual Fund Liquidity Facility, will be run by the Boston Fed.)

The New York Fed, in turn, is signing contracts faster than you can say “ripoff” with Wall Street firms that will actually be the managers of this money and decide what to pay for the toxic debt they are buying from their Wall Street pals. Another group of Wall Street firms will actually get to hold the securities that are purchased as the “custodians.” JPMorgan Chase has been the custodian of the Fed’s Mortgage-Backed Securities (MBS) purchases since the last financial crisis, despite pleading guilty to three criminal felony counts. JPMorgan Chase currently holds $1.46 trillion of the Fed’s MBS assets. (They don’t call it a captured regulator for nothing.)

…