My town was invaded by a parade of protestors. They had no permits, of course, you aren't even supposed to be out on the street without a face mask but apparently, waving a Trump 2020 banner in Florida is a "get out of jail free" card and men, women and their innocent children risked their lives, and the lives of others to demand that Florida be re-opened.

Many of the people in the caravans had “Trump” quotes and flags on their cars. There were also some people wearing clothes or bearing signs supportive of the fringe conspiracy theory group, “Q-Anon,” and far-right group the Proud Boys. You know, the usual right wing-nuts, egged on by the President, who tweeted out "LIBERATE VIRGINIA" and other states – as if they were oppressive regimes to be overthrown. Apparently, someone had told Trump that "Liberate Virginia" meant "Free Vagina" in French and he laughed about it all weekend – and no one in the White House dared to correct the President.

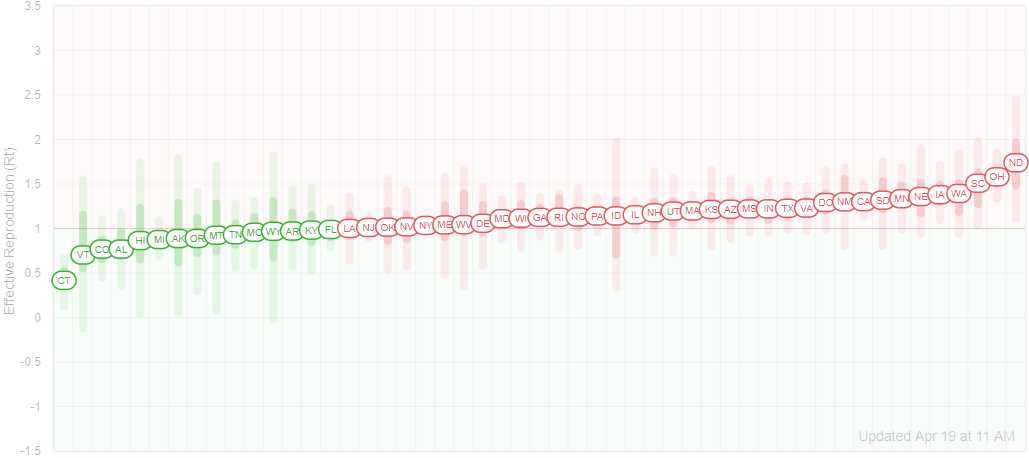

Despite Trump's 59 lies about the Coronavirus Pandemic in just the last 30 days, only 15 states (that's out of 50 – in case you are a Fox News viewer) have contained the spread of the virus (green) while 35 states (again, math done as a courtesy to Fox viewers) still have the virus spreading led by North Dakota, where each infected person is infecting 1.7 other people leading to a 170% spread of the virus every two weeks.

“We’ve avoided the cataclysmic outcomes we’ve seen in other countries and other locations,” North Dakota Gov. Doug Burgum boasted in a press conference last week, noting that hospitalizations in the state are only in the teens and deaths remain in single digits.

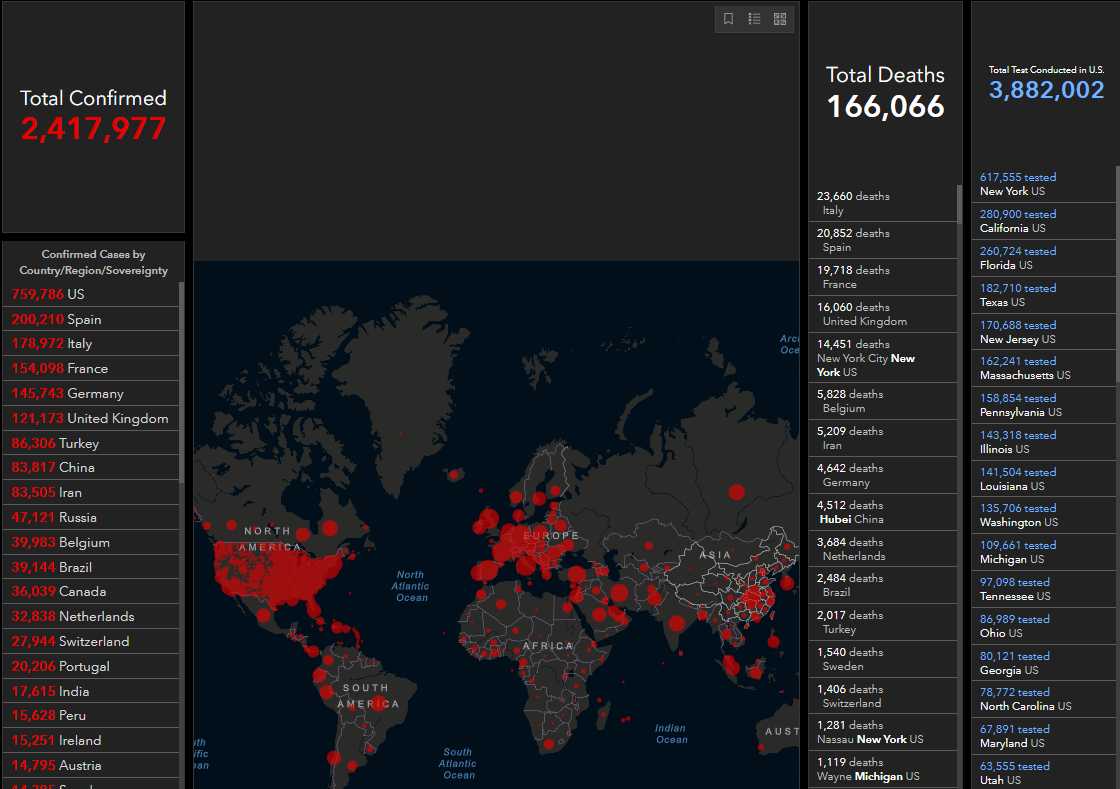

Sounds like Trump when we "only" had 15 cases in the US. Now North Dakota has 585 cases and 10 deaths while the US as a whole now has 759,786 cases (31.4% of the entire World's cases) and 40,565 deaths (24.4% of the World's total). Not bad for 4% of the World's population, right Mr. Trump?

Still, America can do greater and we WILL do greater under the leadership of President Trump, who is inciting protests to re-open the states MUCH earlier than any actual scientists or other World Leaders or the WHO (Boo!) are recommending despite the fact that, last Monday, we had 557,663 cases in the US so that's 36.2% more cases in a week vs Spain who had 169,496 (18.1% more this week), Italy who had 156,363 (14.5% more this week), France who had 133,672 (15.3% more this week) or Germany who had 127,854 (17.9% more this week)…

You get the idea, some countries have the virus under control and some do not. The US clearly does not so removing the restrictions this early in the came is almost certain to lead us to disaster – perhaps one the country will not be able to recover from yet we are simply sitting back and letting Donald Trump literally gamble with all of our lives?

You get the idea, some countries have the virus under control and some do not. The US clearly does not so removing the restrictions this early in the came is almost certain to lead us to disaster – perhaps one the country will not be able to recover from yet we are simply sitting back and letting Donald Trump literally gamble with all of our lives?

You know Donald Trump is a gambler, he's gambled and lost and bankrupted companies he's run 5 times and now he's putting the entire United States on the line and spinning the wheel as if it doesn't matter if he loses once again. It's kind of scary.

So far, in the US, for 36% of the people who have had an outcome from being infected with the virus, the outcome has been death. Only 15% of the people who have been infected in the US have had outcomes so far (recovered or dead) so 85% of the cases (again, math for Fox viewers) are still active. We don't really know how many people are infected as we've only tested 3,861,596 people so far and that's just over 1% of the population.

Without testing and without PLENTIFUL supplies of PPE (personal protective equipment), NO ONE should be running around potentially infecting other people – that is simply MADNESS. Yes, it is bad for the economy to be closed for 3 months while the virus runs its course and the state have time to gather supplies and roll out mass testing programs to make sure we track down every infected person to protect the rest of us BUT that takes time.

Not doing that, as I said last Monday (before the President joined team virus), the US is now past 1/500 infected and, at the current rate, 0.5% (1/250) will be infected by the first week of May and, by the end of May, 1/100 Americans will be infected and if we don't have their spread ratio down well below 1 by then – in two weeks more it would be 1/50 and, by the end of June, 1/25 would be infected – 82.5M Americans. THAT is the cost of ignoring the science and opening up too soon!

Are you willing to bet your country on it?

If not, tell that to your Congressmen – especially your GOP Senators and Governors.