Courtesy of Pam Martens

When the history books of this era are finally written, this will go down as a time when regulators allowed a no-law zone to be drawn around Wall Street. As the Federal Reserve Bank of New York is using taxpayer money to buy up junk bonds to shore up the sagging balance sheets of the behemoth banks on Wall Street and making ¼ of one percent interest loans to those banks against tanking stocks as collateral, those same Wall Street banks are trading their own bank’s stock in their own thinly-regulated internal stock exchanges known as Dark Pools.

When the history books of this era are finally written, this will go down as a time when regulators allowed a no-law zone to be drawn around Wall Street. As the Federal Reserve Bank of New York is using taxpayer money to buy up junk bonds to shore up the sagging balance sheets of the behemoth banks on Wall Street and making ¼ of one percent interest loans to those banks against tanking stocks as collateral, those same Wall Street banks are trading their own bank’s stock in their own thinly-regulated internal stock exchanges known as Dark Pools.

It simply can’t get any crazier than this — and yet somehow it always does in this unprecedented era.

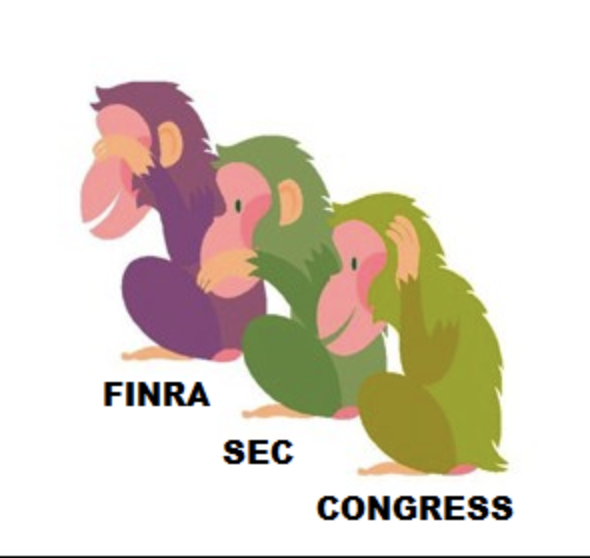

On June 2, 2014, to stem public outrage over claims of rigged markets, FINRA, the self-regulator and good buddy of Wall Street that conducts Wall Street’s private justice system, began to report publicly the three-week old trading data from the Dark Pools. But instead of providing daily reports with execution times for stock trades included, the data is lumped together for the entire week. That’s makes it a lot harder, if not impossible, to see if there is collusion happening by a banking cartel.

The week of March 16, 2020 was a brutal week for the stock market. The Dow Jones Industrial Average lost a total of 4,011.65 points in that 5-day trading period and a stunning 3,000 of those points came on Monday of that week.

We thought it would be informative to see what the Wall Street banks did in their Dark Pools that week when it came to the plunging price of JPMorgan Chase, which lost 19.6 percent of its stock value that week. Would JPMorgan Chase’s stock value have dropped by even more, had it not been for all those shares bought up by its Wall Street bank pals that week? You decide – because the Securities and Exchange Commission isn’t a bit interested. (See related articles below.)

As a benchmark, we looked at the trading of JPMorgan Chase in Dark Pools for an up-trending week, the week of February 3, 2020. For that week, Dark Pools traded 5,457,956 shares of JPMorgan Chase in a total of 32,581 trades. That compared to 16,086,587 shares traded by Dark Pools during the crash week of March 16, an increase of almost three times as many shares. The number of trades that occurred in the Dark Pools in JPMorgan Chase’s shares more than tripled to 113,019. (See charts below.)

…