I WAS going to write an upbeat article.

I WAS going to write an upbeat article.

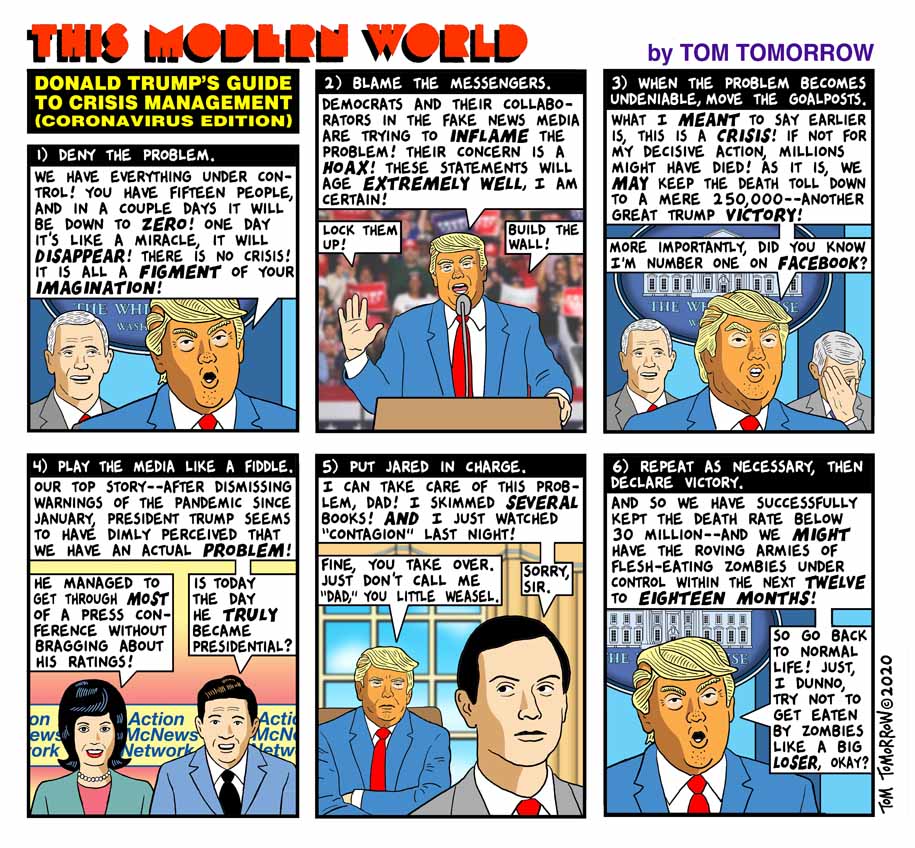

Then Trump suggested injecting disinfectants into infected people's lungs AND NO ONE CONTRADICTED HIM!!! That was yesterday's live press briefing at the White House where Trump suggested injecting poison and also using ultra-violet light inside the body – since it seems to hinder the growth of the virus in the environment.

Trump said that just seconds after those items were mentioned (not in the same way) by DHS's Bill Bryan (yet another Trump unconfirmed appointment) and it was very clear that Trump himself is only getting the information for the first time at the briefing and then he makes ridiculous and dangerous inferences from what he misunderstands and, because this is all being done on camera – no one has the guts to contradict him – no matter how insane his comments are.

“This notion of injecting or ingesting any type of cleansing product into the body is irresponsible and it’s dangerous," said Dr. Vin Gupta. "It’s a common method that people utilize when they want to kill themselves."

"As a global leader in health and hygiene products, we must be clear that under no circumstance should our disinfectant products be administered into the human body (through injection, ingestion or any other route)," said a spokesperson for Reckitt Benckiser, the United Kingdom-based owner of Lysol, in a statement to NBC News.

Yes, this is what America has come to. Lysol has to issue official statements telling people not to listen to the President and inject yourself with their product. While I certainly don't think anyone reading this is going to start shooting up Lysol just because the President said it's a promising treatment – people have died from taking hydroxyclhloroquine after the President called that a miracle cure. It turns out to be not at all effective against Covid-19 but, to be fair, we haven't tested injecting Lysol yet – BECAUSE IT'S BAT-SHIT CRAZY!!!

Not proving something doesn't work is not the same a proving it works. You don't HAVE to go walking on the surface of the sun to prove that it will kill you. There is a lot of solid scientific research that tells us how much heat a human body can tolerate and what temperature the surface of the sun is and, by knowing those two things – we are able to save you the cost of a 93M mile trip to your doom just to see if it's true.

"It ain't no joke, I'd like to buy the world a toke

And teach the world to sing in perfect harmony

And teach the world to snuff the fires and the liarsSo don't delay, act now, supplies are running out

Allow if you're still alive, six to eight years to arrive

And if you follow, there may be a tomorrow

But if the offer is shun, you might as well be walkin' on the sunAnd it ain't no joke when our mama's handkerchief is soaked

With her tears because her baby's life has been revokedSo don't sit back, kick back and watch the world get bushwhacked

News at ten, your neighborhood is under attack" – Smash Mouth

That is how science works but it doesn't work if people don't believe in FACTS and we are very much in a post-fact society at this point where the truth seems to be up for interpretation in almost any situation – mainly because people don't know the difference between facts and opinions. This is also true in the stock market as people tend to believe what they want to believe and you can go to content aggreggation sites like Yahoo, Market Watch, Seeking Alpha, etc. and find articles that agree with your viewpoint – no matter how wrong it is.

And yes, investing is like science and you SHOULD be able to predict what is going to happen next but, like the weather, there are simply too many variables for even a super-computer to take into account so we can only get "indications" of trends and make predictions based on those but always that is subject to change due to intervening events.

I was very bullish after the March crash because the Government was throwing $6 TRILLION at the economy and today they are approving another $484Bn (because $500Bn would be too much?) and of course that's going to help because 6,500 BILLION DOLLARS is an incredible amount of money – it's 1/3 of our entire GDP so, if we are having a 3-month lock-down, it should be more than adequate to support the economy.

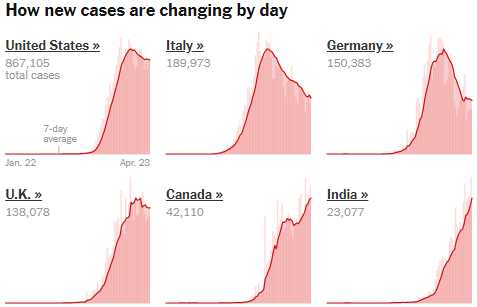

Unfortunately, 45-days into the lockdown, 95% of small businesses still haven't gotten their bailouts, 26M people are now unemployed (up from 3.5M in Jan), 50,000 people are dead and, by next week, 1M people (1/330 Americans) are sick and 10% of those people are deathly sick and not likely to live. There was an assumption that it wasn't possible to completely misspend $6Tn but, so far – Trump has done it.

Rather than do whatever it takes to make sure we are all tested and make sure we all have masks (not bandanas!) and make sure we have procedures in place to sterilize public places so it is safe to go back out there. NONE of those things are happening! That's why Trump is talking about injecting YOU with Lysol and flooding your body with UV rays – he has no solution to stop you from getting the virus in the first place, so his "fix" is based on curing you after you get it.

Am I being anti-Trump? I think I'm being anti-incompetence and Trump just happens to be sitting at the desk where the buck is supposed to stop. I can refer to him as President X if it makes you feel better but by the time he becomes an ex-President it may be far too late to avert a catastrophe. And, by catastrophe, I mean the Coronavirus, not Global Warming or the National Debt or the Infrastructure or America's Status in the World, Domestic Terrorism and Racial Tensions or the Trade War with China or the Rising Inequality, the Russian Interference into US Elections or the loss if impartiality in the Supreme Court or even Voter Suppression. Just the Coronavirus crisis for now….

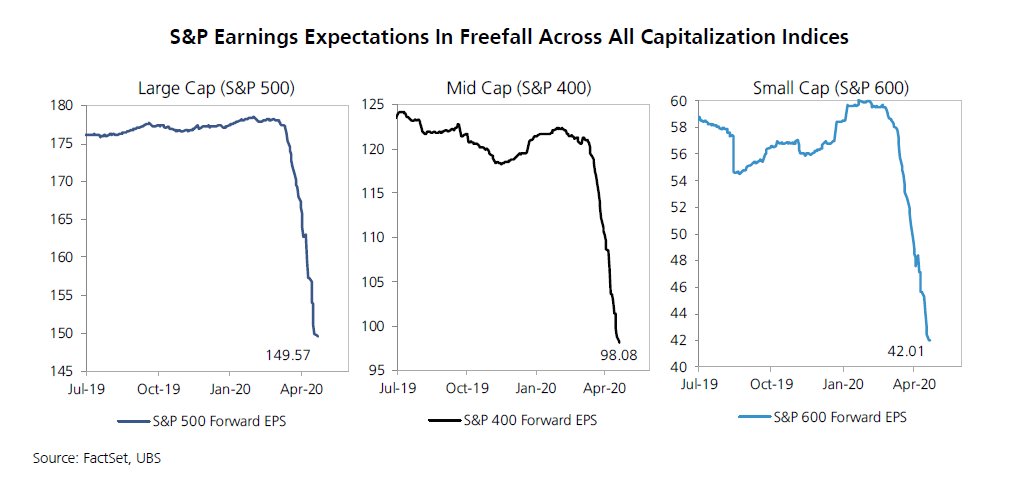

So we will have to adjust our own portfolio expectations based on the FACTS as they come in and, so far, I'm not as confident now as I was back in late March. That's why, in Wednesday's Live Trading Webinar, we decided to add another $100,000 worth of protection to our Short-Term Portfolio (where we keep our hedges) giving us $400,000 (80%) worth of protection for our $500,000 Long-Term Portfolio and I STILL am not happy being 40% invested in our LTP so we're going to have to go throuth it and cut even more positions as we approach the 1M infection mark next week.

I've lost confidence in IMAX turning around in the next 18 months, Alaska Airlines (ALK) seems too risky as it may be a long time before people want to sit in a tube with 200 other people and breath their air for 4 hours. McConnell is such a tool that I'm not sure our infrastructure ideas for FCX and VALE will play out … we'll have to review all of our positions very closely and, if we can't get over that Must Hold Line on the S&P 500 at 2,850 very soon – we might have to pull the plug on all the longs and simply wait out the virus.

We're not rushing into things if we have a positive day but next week we'll see how investors react to 1M infections and more deaths (60,000) than the 20-year Vietnam War (58,220) which, according to your Conservative buddy, was "no worse than the flu".

Have a great weekend,

– Phil