Trump is officially out of control.

Trump is officially out of control.

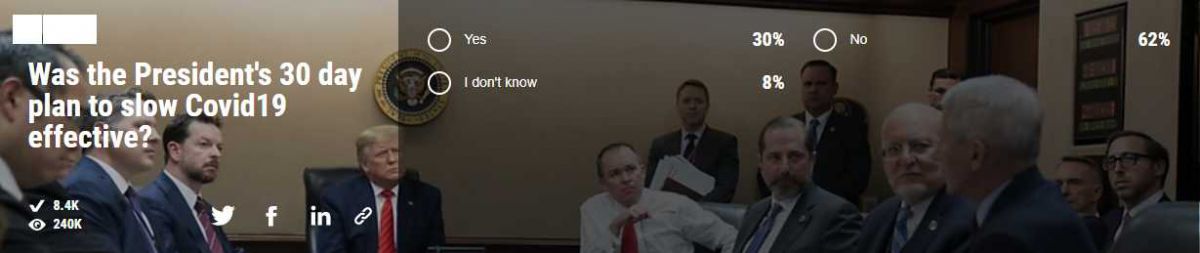

It's May 1st and the Federal Government just ordered 100,000 more body bags on top of the 60,000+ (more than the 20-year Vietnam War) citizens we've already buried. It was literally just a month ago that Trump told Hannity (3/26) that he didn't think the medical equipment the Governors were asking for was needed – so he didn't send any of that. Now he is ready to send 100,000 body bags instead – those only cost $5M – much cheaper than actually helping.

This isn't about that, if you don't realize Donald J Trump has completely and totally bungled the job of fighting the Coronavirus – then there's no facts that will ever convince you otherwise – they are all out there already. This is about the new disaster Trump is causing by seeking to distract people from his inept response to the virus and the deaths of 100,000 voters, who knew 1M other voters at least and, by election day, it could be 10M voters.

"In a transparent attempt to distract from his continuing failure to lead an effective response to a disastrous public health crisis, the great showrunner in the White House is in the process of introducing a new story arc: an epic battle with an evil China.

"It involves blaming China for a virus that was most likely uncontainable, making all sorts of dark insinuations and demanding that his intelligence services find grist for anti-Chinese conspiracy theories, and threatening massive economic retaliation, apparently even to the point of defaulting on U.S. debt." – Salon

Trump is threatening more tariffs, Trump likes tariffs, his base likes tariffs – China is fun to hate. As Orwell predicted about Trump in 1984:

"The German Nazis and the Russian Communists came very close to us in their methods, but they never had the courage to recognize their own motives. They pretended, perhaps they even believed, that they had seized power unwillingly and for a limited time, and that just around the corner there lay a paradise where human beings would be free and equal. We are not like that. We know that no one ever seizes power with the intention of relinquishing it. Power is not a means; it is an end."

"For if leisure and security were enjoyed by all alike, the great mass of human beings who are normally stupefied by poverty would become literate and would learn to think for themselves; and when once they had done this, they would sooner or later realize that the privileged minority had no function, and they would sweep it away. In the long run, a hierarchical society was only possible on a basis of poverty and ignorance.”

There's another reason Trump needs you to hate China now – China is returning to normal, their massive response to the virus has actually contained it there and the country is opening back up. The response of the Chinese Government to the pandemic and their success at eraticating it with 1/10th the number of cases the US already has DESPITE having 2 months more advanced warning than China about the virus – makes the President look bad by comparison.

There's another reason Trump needs you to hate China now – China is returning to normal, their massive response to the virus has actually contained it there and the country is opening back up. The response of the Chinese Government to the pandemic and their success at eraticating it with 1/10th the number of cases the US already has DESPITE having 2 months more advanced warning than China about the virus – makes the President look bad by comparison.

When Donald Trump looks bad by comparison to others what does he do? He villifies them. Soon China will have a derisive nickname and Fox will be running non-stop stories about how horrible they are and maybe we'll even begin having military skirmishes with them over petty things – ANYTHING to distract you from the fact that China is getting back to normal by doing things the Trump Administration still isn't close to accomplishing. As noted by CityAm's Shuyu Gao:

I was aware when I booked the trip to China that there would be a quarantine period to follow on arrival. This required 14 days and nights in a hotel designated by the government, to be paid for out of my own pocket.

Upon arrival at my quarantine hotel, I was tested for Covid-19. Thereafter, my temperature was tested twice a day for two weeks. I also had to register on a Tencent mini app, which gave me a QR status code red.

After 14 days, and having cleared a second test for the virus, I was free to check out, at which point the medical staff updated my QR code on the app, which turned to green (shown below).

I was later granted another green QR code for the city of Nanjing; after my mum got a call form the local Nanjing government to check on the arrival time of my train.

These QR codes were checked on entry to “check-in” at places such as visiting the bank or a supermarket. My temperature was often taken, and this was common in both Guangzhou and Nanjing.

There is another QR code which I had to scan at certain places; it tracks people’s movements, which proves highly effective when carrying out contact tracing in order to protect the public.

In Guangzhou, everyone is required to wear a mask in public. For a brief moment I was not wearing my mask in the lift and on the metro. In both instances I was detected by cameras and asked to put one on.

There is much focus on mitigating the risk of a second wave of outbreaks in China, now that the country has largely re-opened after the lifting of lockdowns. My experience suggests that this is a risk the authorities are taking very seriously.

Before leaving Guangzhou, I took the opportunity to look around a few shopping centres and restaurants. There were many people going about their daily lives, but social distancing measures were evident in most restaurants, and the shops were relatively quiet, albeit a Friday afternoon.

That's WITH the lockdown! I wonder what will happen when we lift it?

Whatever it is – it certainly won't be Donald Trump's fault, right?

1,069,880 divided by 30 is 35,662. That's how many times the infections have increased in two months. To get to that level, you have to add 18.7% more infections per day for 61 days – that's a factor the scientists (BOO!!!) would say is R0 factor of 1.187, indicating that 1 person infects 1.87 other poeople. So what happens if you remove the restrictions and, instead of starting with 30 cases, we start with 1,069,880 cases? Well, in just 30 days, 183M people would be infected.

BUT, "only" 27,327 new people were infected today from 1,042,553 yesterday so that's only 2.6% per day under lockdown. So lifting lockdown will put us higher than 2..6% (which, by the way means, if you are one of 100 people in a restaurant of a movie theater, by the end of your meal or the film, 2 or 3 of you will have contracted the virus) but lower than 18.7% so let's say it's just 5% (5 people per restaurant or screening per day) that get infected each day.

Unfortunately, compounding 1,069,880 by 5% over just 31 days still gets you to 4.85M infections by the end of the month (right around when they are likely to realize lifting restrictions was a huge mistake – if it is) and, by the end of June, we'd be looking at 21M infected. Those are the dice Trump is rolling!

Unfortunately, compounding 1,069,880 by 5% over just 31 days still gets you to 4.85M infections by the end of the month (right around when they are likely to realize lifting restrictions was a huge mistake – if it is) and, by the end of June, we'd be looking at 21M infected. Those are the dice Trump is rolling!

The market is down today on Trade War talk and also on disappointments from Apple (AAPL) and Amazon (AMZN) that weren't disappointing at all from a Fundamental standpoint. There is still $2.7Tn of stimulus from the Government and $4Tn of liquidity from the Fed and another $2Tn soon to come out of Congress and that, my friends, is already $8.7Tn, which is 45% of our ENTIRE GDP, which was down 4.2% annualized percentage points as of yesterday morning (Q1 reading).

While Q2 is obviously going to be much worse, 4.5% of a quarterly $5Tn is down $225Bn, not $8.7Tn and losing ALL of Q2 would be another $5Tn for $5.225Tn total – still NOT $8.7Tn. The reason this money doesn't seem like enough is that Trump and Co. are funneling a large portion of it off to their friends and family and, if you don't think that's happening – then the President must be doing a really great job.

Have a great weekend,

– Phil