Well, you can see why we call it our "Must Hold Line."

Well, you can see why we call it our "Must Hold Line."

2,850 on the S&P 500 has been the center of all the action for the past month and that GOOD since, 1/3 into earnings season, it indicates we made the right call with our predicted ranges for the year. Of course it's also BAD – because those ranges are now a far cry from the market highs we had before… They are not coming back in the near future, so stop wishing for them (see "Portfolio Repair Workshop Part 4 – Adjusting Our Goals to Reflect Reality").

This is a huge advantage options traders have over stock traders: If you own stock in IBM, for example, at $140 and now it's at $120 – you can cross your fingers and pray it gets back to $140 (it will) or you can double down at $120 and lower your basis to $130 and hope it gets back to that and that's about all your options (other than taking the loss).

With stock options, however, I can cash out my 100 shares of IBM at $120 and IMMEDIATELY get my $20 loss back by selling the 2022 $115 put for $20. The put contract obligates me to buy IBM for $115 between now and Jan 2022 and the buyer of that contract is willing to pay me $20 to cap loss on IBM at $95 – maybe he bought it for less, maybe he also sold calls – don't know, don't care because I got my $20!

With $20 back in our pocket and $120 from the sale of the stock, we are now even (not that we would have been so foolish as to buy stock in the first place!) and our worst-case scenario is owning IBM again at $115. Still with $140 back in our pockets we can even get a bit more bullish and we can buy the IBM 2022 $110 calls for $21 and sell the 2022 $130 calls for $12 and that's net $9 on the $20 spread.

So the upside potential is $11 which is 122% on my $9 and I can only lose the $9, no matter how low IBM goes. If you bought IBM for $140, hoping it would go to $160 (+$20) and now you are down $20 at $120, imagine how better off you would be if you just bought 2 of the $110/130 bull call spreads for $18, which make $22 at just $130 (in Jan, 2022). You tie up (and risk) $122 less to make $2 more. OPTIONS!!!

That tremendous leverage and flexibility is how we are able to navigate these wild market swings but the value of the options can also swing wildly, so it's prudent to hedge. Though we think the S&P will continue to trade in a range +/- 10% around the 2,850 line on the S&P, we're more worried about being wrong on the downside and seeing it swing much lower – again. Over the long haul – our longs can take care of themselves.

We lost a fortune on our hedges over the past 10 years as the market went up and up and up but, had we not had those hedges, we would not have had the conviction to hold onto our long positions for as long as we did. It was only in September of last year, when our longs got so big that they were too expensive to keep hedging (yes, that's a thing!) that we finally cashed out and waited for the next big pullback to start seriously investing again.

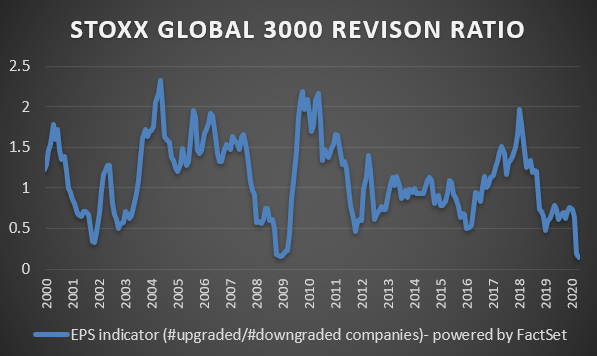

We've had a bit of it so far and HOPEFULLY that 2,500 line will continue to hold but there still aren't many stocks that we sold in September that aren't quite a bit cheaper now – so we're not missing anything by waiting for better data. Sadly, we're not getting that in Q1 earnings since they only got hit hard by the virus in the past two weeks and most companies reporting earnings have declined to forecast Q2, which means we're going to have to wait for Q2 to get some clarity.

We'll see how the states do with their vartious re-opening programs but we're already seeing spiking infection rates in places where they are attempting to re-start the economy and the CDC apparently now has a worst-case scenario (which happens to be the parth the US is on) of 200,000 DAILY infections and 3,000 DAILY deaths by June if we re-open the cities and the virus starts rapidly spreading again. As I explained in last week's Live Trading Webinar – we would be starting from a much higher base of infections than we had before.

Moving forward without fully understanding the implications of your actions is as foolish in Government as it is in the stock market. We'll be taking a very careful look at a our longs (again) and deciding which ones are really worth the risk moving forward.