I don't want to be that guy.

I don't want to be that guy.

I don't want to be the guy who yells at the cheering crowds who swarm back onto the beach and into the water that the shark is still out there but, the shark is still out there! WTF is wrong with you people? There are now 1.2 MILLION infections in the US as of May 4th and on April 4th it was 308,000 so that's 892,000 new cases in the last 30 days – an increase of 290% in 30 days. Even the Mayor of Amity Island would have kept the beaches closed if 3 deaths had turned into 9 deaths during the month. There were no more deaths – so he thought it would be safe but why were there no more shark attacks? BECAUSE PEOPLE DIDN'T GO IN THE WATER!!!

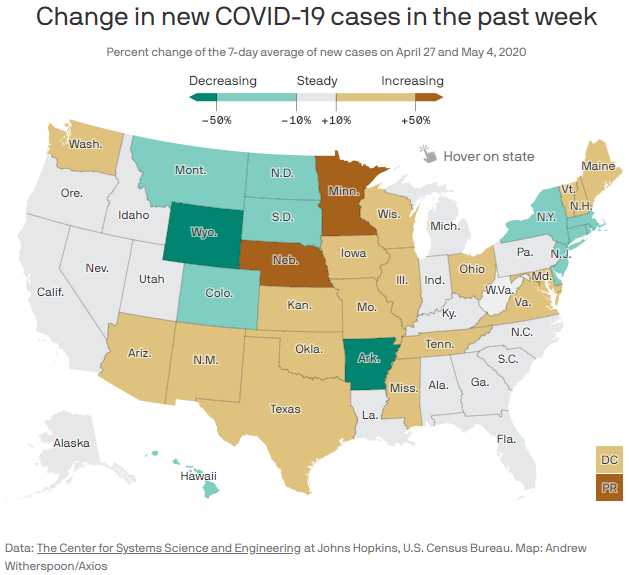

What happened when they re-opened the beaches? Chaos! Some states do have strict lock-downs in place and have stopped the increase in the rate of the growth of the virus and some have even decreased rate of the spread of the virus BUT IT'S STILL SPREADING IN EVERY SINGLE STATE. Re-opening the states now when we haven't contained it in ANY state is MADNESS!!!

Only 180,000 people out of 1.2M infected have recovered from the coronavirus so far in the US. 70,500 Americans are dead – more than we lost in the 20-year Vietnam War but Donald Trump is drafting all of you into the war against Corporate Losses. The entire planet has 257,906 deaths and 27% of those are US deaths – despite the US being only 3% of the World's population and again, that's SO FAR, as IM infected people are still waiting for their outcome from the disease and who knows how many millions will be infected if we re-open too soon.

WHY TAKE CHANCES? Why gamble with American lives. Trump is very quick to blame China for not warning us sooner but who didn't know about the virus heading into New Year's in China? That was back in early January, when Trump said the US had 5 cases that would "magically" go away. The magic didn't happen and then we had 25 cases on Feb 29th and we certainly didn't need China to warn us then, did we?

By March 15th, 29 cases had turned into 2,900 cases in the US and finally we began a lockdown but it was far too late and far too poorly enforced and we had far too little equipment and, two weeks later, on March 31st, there were 188,000 cases in the US – almost half of those people are now dead. By April 15th, 630,000 cases and that has now doubled and, seriously, the decision is that we can open back up – NOT because the lockdown was a success but because Predident Trump has decided to sacrifice hundreds of thousands of American lives in order to get Corporate Profits back on track.

By March 15th, 29 cases had turned into 2,900 cases in the US and finally we began a lockdown but it was far too late and far too poorly enforced and we had far too little equipment and, two weeks later, on March 31st, there were 188,000 cases in the US – almost half of those people are now dead. By April 15th, 630,000 cases and that has now doubled and, seriously, the decision is that we can open back up – NOT because the lockdown was a success but because Predident Trump has decided to sacrifice hundreds of thousands of American lives in order to get Corporate Profits back on track.

Why is this happening? Once again we fall victim to having a Nation full of people who don't understand the concept of math so they accept a lot of bullshit because they don't understand the numbers.

The US GDP is $18.5 Trillion per year so, in any given quarter, there is $4.6Tn of economic activity. While the lockdown is devastating for the economy, it doesn't kill all of it. We are still eating and we are still washing our clothes and using electricity and watching Netflix, etc. In fact, the US GDP was only down 4.8% in Q1 but that only represented 2 weeks of lockdown so let's say it's 2.4% per week of damage so, in a full, 13-week Quarter, we could lose 31.2% of our GDP – that just so happens to be very much in-line with what was experienced in Asia and parts of Europe that have been shut down the longest.

31.2% of $4.6Tn is $1.435Tn and Congress has already authorized $2.7Tn to offset the economic damage caused by the virus. That alone is enough to keep the country locked down for 6 months if we have to. The Federal Reserve has access to another $4Tn that they can disburse if necessary so we have MUCH MORE THAN ENOUGH money to get us through an extended lockdown.

US wages are $6Tn a year and the average Dollar earned gets spent 3 times in the economy – hence the $18Tn GDP. But again, any 3 months of labor is 1/4 of $6Tn and that's only $1.5Tn so the Government again has/had enough money to simply pay everyone's salary for 6 months – taking the burden off employers and giving the people all the money they usually spend, which would then trickle back up to the employers.

US wages are $6Tn a year and the average Dollar earned gets spent 3 times in the economy – hence the $18Tn GDP. But again, any 3 months of labor is 1/4 of $6Tn and that's only $1.5Tn so the Government again has/had enough money to simply pay everyone's salary for 6 months – taking the burden off employers and giving the people all the money they usually spend, which would then trickle back up to the employers.

It would have been the simplest thing in the World to send eveyone in America 1/3 of their 2019 declared Income as a stimulus check to cover 100% of a 3-month closure. Of course there would be some cases where people and businesses would still need special bailouts but 167M working, tax-paying Americans would have been taken care of right away.

Why did this not happen and why the rush to re-open America? Well, do you remember the $500Bn that Trump carved out of the first $2.2Tn bailout that he was able to disburse at will and then he fired the guy who was supposed to provide Congress with oversight? That's called a "Slush Fund" and the faster Trump ends the lockdown, the more of that money he gets to keep, presumably to attempt to buy the next election.

Who is "overseeing" that $500Bn fund now, why it's Brian Miller, Trump's White House Counsel who defended him in the impeachment trial. Trump has already issued a statement that assertings his right, not only to withhold information from Congress about the coronavirus bailout payments, but to deny Congress even the right to know what information is being withheld, or that a cover-up is under way.

Even at 2%, the interest on $500Bn is $10Bn – almost $1Bn per month that Trump can skim off the top by simply delaying aid payments but the complete lack of oversight and reporting to Congress means the President can do whatever he wants with $500Bn – including giving it to his friends and family or to countries that won't allow him to be extradited once he's on the run.

Trump has already declared victory and is winding down the Coronavirus Task Force but the virus itself shows no sign of winding down. Winding down the task force allows Trump to stop spending his $500Bn, leaving him with a massive election war chest he can distribute (or pilfer) at will. Should this "Mission Accomplished" moment be as ridiculous as Bush's – don't think for a second Trump will be shy about asking for another $500Bn – even while telling us that he refuses to account for the first $500Bn – that's just the kind of guy he is, and you know that's true.

Trump has already declared victory and is winding down the Coronavirus Task Force but the virus itself shows no sign of winding down. Winding down the task force allows Trump to stop spending his $500Bn, leaving him with a massive election war chest he can distribute (or pilfer) at will. Should this "Mission Accomplished" moment be as ridiculous as Bush's – don't think for a second Trump will be shy about asking for another $500Bn – even while telling us that he refuses to account for the first $500Bn – that's just the kind of guy he is, and you know that's true.

So, while I was ENcouraged by the approval of the stimulus 6 weeks ago, I am now DIScouraged by the very uneven and even capricious way it has been doled out. Notice how few earnings reports have companies saying they got aid from the Government. Where did the money go? How many small business owners do you know who got the loans they were promised?

We get the Non-Farm Payroll Report on Friday and it will show MILLIONS of people lost their jobs in April, most likely we are past 22M unemployed and almost no way to stop the number from hitting 30M – 20% of the US work-force out of a job. States are running out of Unemployment Funds and GOP Governors don't want to use that money for the same reason Trump wants to keep his – so they are all doing what they can to push their citizens back to work and, if hundreds of thousands of them die – let them eat cake!

We've already had more American deaths from the virus than the entire Vietnam War, we lost 405,000 Americans in World War II and 620,000 in the Civil War and, sadly, neither of those "goals" are out of Trump's reach. MAYBE things will go well and not that many people will die and Trump will get to say "I told you so".

Maybe it won't and maybe you'll die or I'll die or our children will die – none of that seems very real with "just" 70,500 people dead out of 330M but "only" 1.2M of us have been infected so far and, of that group, we've only seen 250,000 outcomes, 25% of which were death so pretty good odds you will live – at the moment.

But those odds are a lot worse than they were a month ago, when 1/4 as many people were infected.

Be careful out there!