Courtesy of Pam Martens

By Pam Martens and Russ Martens

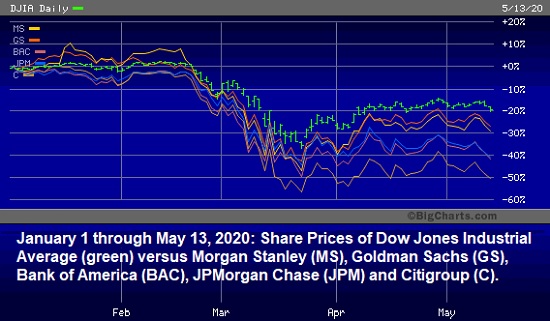

In the Federal Reserve’s most recent “Supervision and Regulation Report” on the big bank holding companies it “supervises,” the Fed continued its attempts to perpetuate the narrative that “The banking industry came into 2020 in a healthy financial position” and has simply unraveled as a result of the COVID-19 pandemic. That narrative is built on the same flimsy house of cards that the New York Times and Andrew Ross-Sorkin built the narrative that the mega banks on Wall Street were not responsible for the 2008 financial collapse.

The Fed is desperate to promote this narrative to stop a new Congress next year from holding hearings on why the Fed, for the second time in 12 years, had to engage in trillions of dollars in Wall Street bank bailouts after reassuring Congress for years that the financial system was fine as the Fed loosened or rolled back reforms like the Volcker Rule. The Fed needs this narrative to prevail in order to cover up its own negligent supervision of the behemoth banks.

Depending on the composition of Congress next year, those hearings might bring about not only a restoration of the Glass-Steagall Act (which bans trading houses on Wall Street from combining with federally-insured, deposit-taking banks) but might also put an end to the Fed’s ability to negligently supervise the big banks with one hand, while bailing them out with the other hand, using money it creates out of thin air. (The Fed will report its latest balance sheet tally today at 4:30. It is expected to be close to $7 trillion from the $6.7 trillion it reported last week – which is $2.8 trillion more than it was exactly one year ago. The growth in the Fed’s balance sheet has come as a result of efforts to prop up Wall Street banks.)

The Fed knew, or should have known (since it has hundreds of people monitoring the markets at the New York Fed) that there was a big banking crisis brewing in August of last year. Here’s the timeline:

…