35M people have lost their jobs in 60 days.

35M people have lost their jobs in 60 days.

The way stores and restaurants are opening, with limited customers allowed in and limited seating – getting back to normal isn't normal at all. “We have a situation where people and families in every part of the country are facing this unprecedented crisis, and they are looking for relief,” said Congresswoman Pramila Jayapal yesterday, where she co-sponsored a bill with Josh Hawley (R-MO) to guarantee incomes during this pandemic. “This is a proposal with broad support that should be taken seriously,” she added. “What are we waiting for? Are we waiting for unemployment to reach 50 percent?”

The only reason we're not seeing people marching and protesting like they did in the Great Depression demainding Government Support is because they can't leave their homes. 35M people is 10% of our country but it's 20% of our work-force and we didn't start from zero unemployment – this is a dire situation and things are starting to unravel and, once again, we are being met with a big ball of dysfunctional incompetence from the Administration.

See, I didn't say TRUMP Administration so you can pretend any Administration could have F'd America over this badly. The Hoover Administration was about as incompetent as the Trump Administration. In fact, with promises of high tariffs and low taxes – you can see that Trump pretty much just copied Hoover's playbook – including kicking off the country's second Great Depression:

Losing the jobs couldn't be helped, they are a result of the Lockdown Policy which was a rational response to the virus but the WAY we are losing the jobs should have been helped. Wages in the US are $6Tn per year or $500Bn per month and you can see what kind of money the Government is throwing around so the question is – why couldn't they simply throw some at the workers? Just give the workers $1Tn while they take two months off and there is ZERO damage to Consumer Spending Power which, in turn, drives the economy.

Of course there would be some things consumers wouldn't spend on, like Retail, Restaurants, Travel and Live Entertainment but then we could have compensated JUST those industries and it would have cost half as much as we have spent on this ineffective mess of a bailaout already.

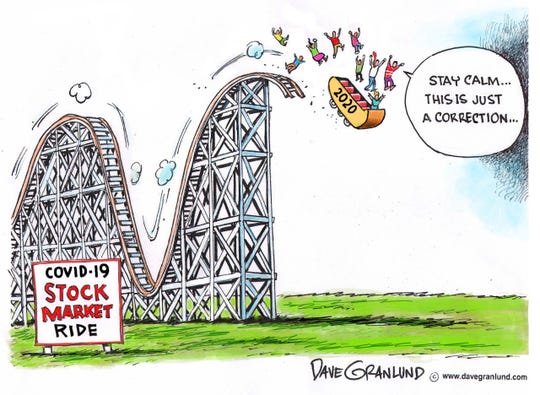

Throwing money at the Stock Market BECAUSE you didn't deal with the virus that is causing the problem in the first place is pointless. Unfortunately, we know Trump gauges his success based on the Dow's performance and we know he doesn't think 100,000 or 200,000 deaths by incompetence are a big deal – not when he has donors and their portfolios to worry about.

Throwing money at the Stock Market BECAUSE you didn't deal with the virus that is causing the problem in the first place is pointless. Unfortunately, we know Trump gauges his success based on the Dow's performance and we know he doesn't think 100,000 or 200,000 deaths by incompetence are a big deal – not when he has donors and their portfolios to worry about.

We don't have to CURE the virus, we just have to give people the confidence that the situation is in hand but, by giving people confidence, I don't mean lie to them until they think things are fine when they are not – that's only a short-term fix – the Administration needs to do what other countries have done to get on top of the virus and that's:

- Extensive Testing

- Extensive Sanitization

- Enough PPE for EVERYONE

- Extensive Tracking.

Yes, we don't want to lock up 80% of the population to protect the 20% who are severely at risk, but if we let the 80% out and they get each other infected – how are the 20% going to remain unaffected – even if they stay locked up? The simple, logical solution is to only let the unaffected out so that the people who are out can't infect the people who have to stay in and vice, versa. Why are we not doing that?

Meanwhile, Mr. Hawley, the Missouri Republican, has introduced a proposal that would cover 80 percent of employers’ payroll costs up to the median wage, about $49,000 a year. A companion bill that Mr. Hawley introduced goes further, providing families and single parents making less than $100,000 with a monthly check for the duration of the crisis.

“Let’s not overthink this,” Mr. Hawley said in unveiling his bill. “These families need relief — now — to pay bills that are coming due, make those emergency grocery runs and get ready for potential medical bills. Let’s get it to them.”

He's a Republican and he's trying to help – we'll see if anyone lets him.