No major incidents.

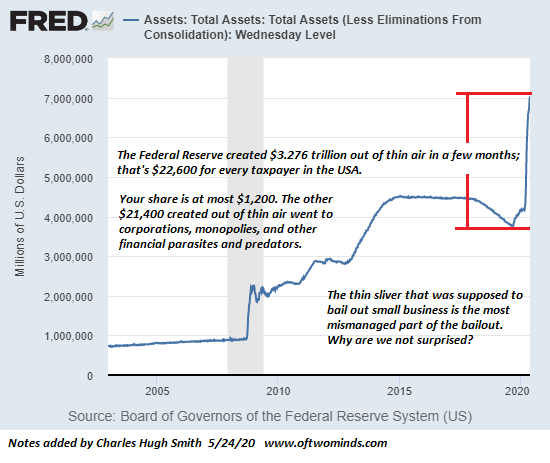

We had a lovely holiday weekend here in the US and nothing terrible happened as much of America re-opened for business so, without any obvious blood in the water – the markets are in celebration mode. We won't know there's a problem with re-opening for another week as people don't tend to show Covid symptoms right away so, for now, we can act as if everything is fine – and maybe it is and, if it is, then $6.7Tn was certainly enough money to get us through a 2-month lockdown.

If, on the other hand, these isolated spikes in new cases begins to spread, then the people getting all bullish now are idiots and betting into another disaster. Of course, Corporate Profits have sucked so it's kind of hard to justify a trip back to the all-time, pre-virus highs but traders gotta trade and there's not really anyting else to put your money into in this zero-rate World other than good old US Equities.

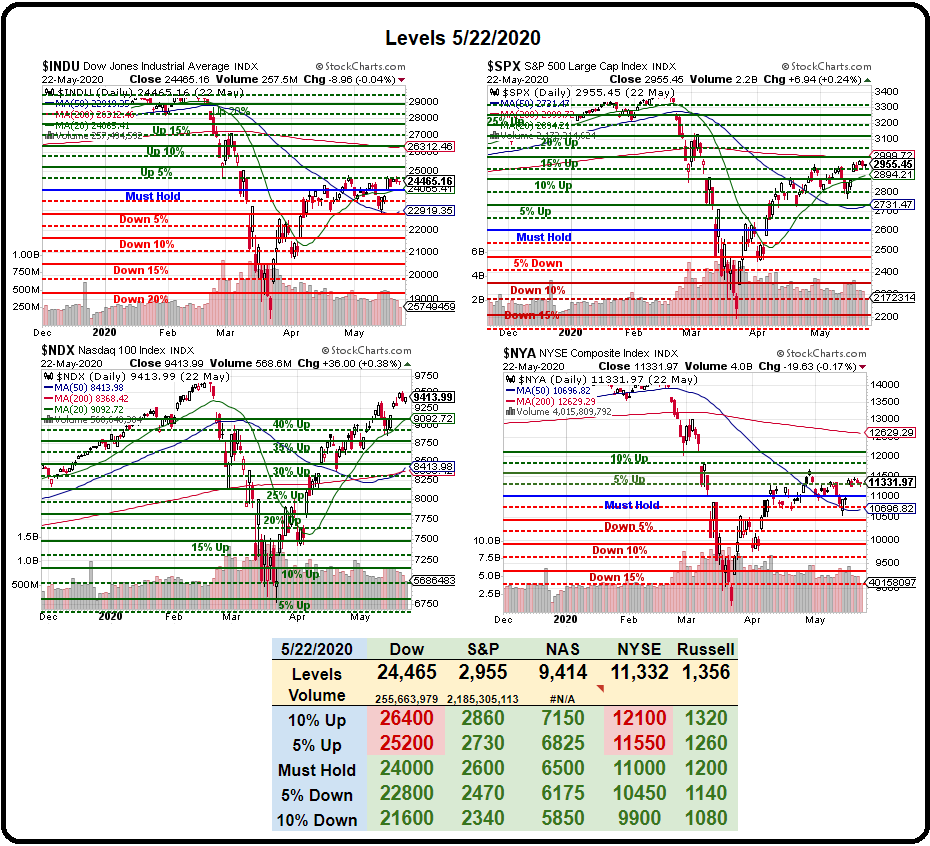

That's fine with us as we have PLENTY of long positions. In fact, we added more hedges to protect our Long-Term Positions, which already made a ridiculous amount of money on the re-rally and this morning the Futures are up another 2%, right at the 3,010 line on the S&P 500 (/ES), in fact.

In order to push the facts even further out into the Future, the Trump Administration released their testing strategy to Congress on Sunday and it was, of course, no strategy – instead pushing the responsibility of testing out to the individual states so they should have 50 different methods and 50 different ways of counting and 50 different panels wasting money on 50 redundant studies rather than have a Federally coordinated effort organized by the nation's top experts. MAGA Baby!

The proposal also says existing testing capacity, if properly targeted, is sufficient to contain the outbreak. But epidemiologists say that amount is much lower than what many of them believe the country needs. Acquiring tests involves reliance on national and international supply chains, which are challenging for many states to navigate.

“That’s our biggest question, that’s out biggest concern, is the robustness of the testing supply chain, which is critical,” Scott Becker of Public Health Laboraties said. “You can’t leave it up to the states to do it for themselves. This is not ‘The Hunger Games.’”

As it stands, US cases are increasing at a rate of 1.3% per day, which is 40% per month but actually worse as the number compounds daily so we'll see how it goes now that we've decided that's too low at 1.5M cases. Deaths from Covid-19 are "only" increasing by 1% per day as we pass the 100,000 mark and that's "only" 30% per month so, at the moment, we'll be at 130,000 deaths by the end of June and 2M cases – assuming the numbers don't bump up from the re-openings.

This is going to be a "watch and wait" week for us as we won't have any real facts until next week – which will culminate with next Friday's Non-Farm Payroll Report. This week we have the 2nd Q1 GDP Report on Thursday – that will be BAD. We have Fed speakers every day, including Powell on Friday (11) to give us some spin after we see Pesonal Income, Retail Inventories, Chicago PMI and Consumer Sentiment. Until then – these are the headlines:

- Media Exposes 100s Of Uncounted COVID-19 Fatalities As Japan Lifts State Of Emergency; US Death Toll Just 700 Shy Of 100k: Live Updates

- Virginia Reports Record Jump In New Cases Two Weeks After Reopening: Live Updates

- China’s ‘Bat Woman’ Warns Coronavirus Is Just Tip of the Iceberg

- Mexico City Deaths Rise 4 Times Official Virus Count, Study Says

- Global Trade Volumes Fall the Most in More Than a Decade

- Poor Countries Weigh Easing Lockdowns as Virus Cases Rise

- Trump slams NC gov over coronavirus lockdown rules, says GOP may need new convention site

- Doctors face pay cuts, furloughs and supply shortages as coronavirus pushes primary care to the brink

- "The US Is Bluffing": China Claims Trump Too "Weakened" By Pandemic To Intervene In Hong Kong

- Beijing says it will unilaterally impose national laws in Hong Kong 'without delay' as thousands take to the streets in protest

- Goldman: The Default Cycle Has Started

- The Fed Is Now The Proud Owner Of Bankrupt Hertz Bonds

- The Arrival Of The "Unavoidable Pension Crisis"

- Rabobank: "Quite A Market Disconnect Has Formed: We May Be Just Weeks Away From The Levee Breaking"

- German economy enters recession as GDP falls 2.2%

- "Only A Matter Of Time Before Developing-Market Stocks Unravel In An Unruly Manner"

- Hedge Fund CIO: "We Have Reached The Point Where The Entirety Of Future Prosperity Has Been Pulled To The Present"

- TINA's Orgy: Anything Goes, Winners Take All

It is a LOT of money to throw at a temporary problem but it's nowhere near enough if the problem hasn't actually gone away so, please – be careful out there!