This could be the short of a lifetime.

This could be the short of a lifetime.

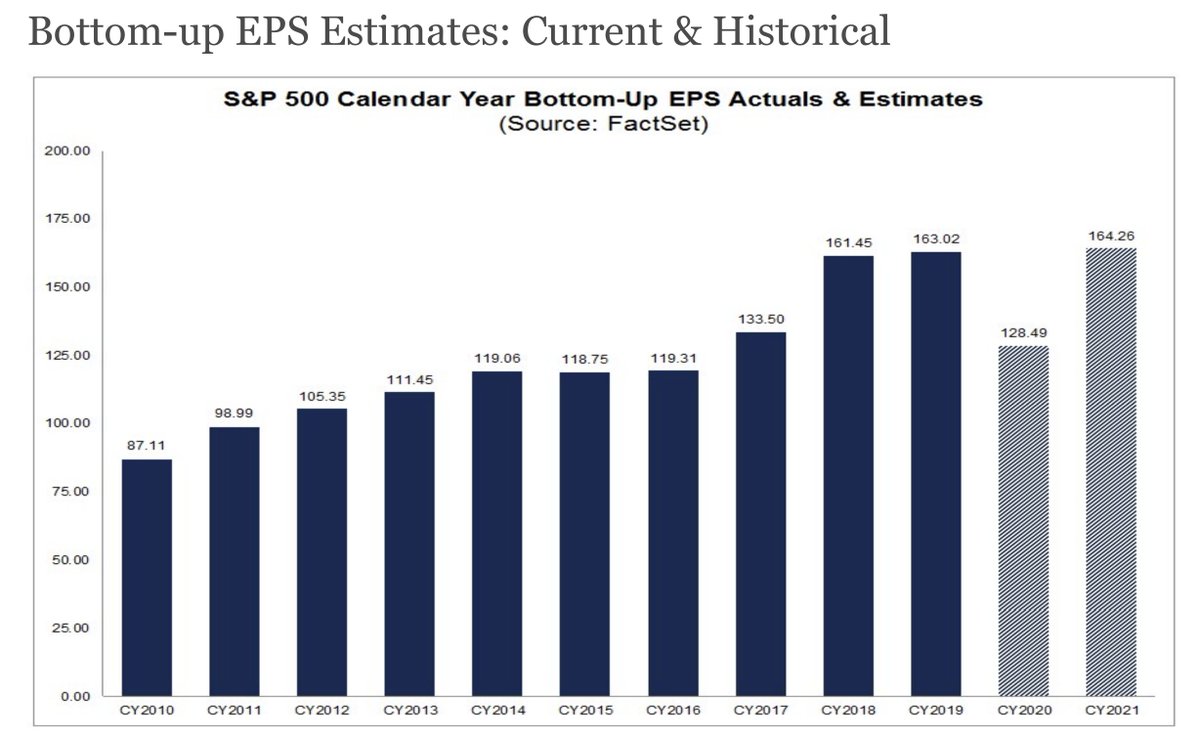

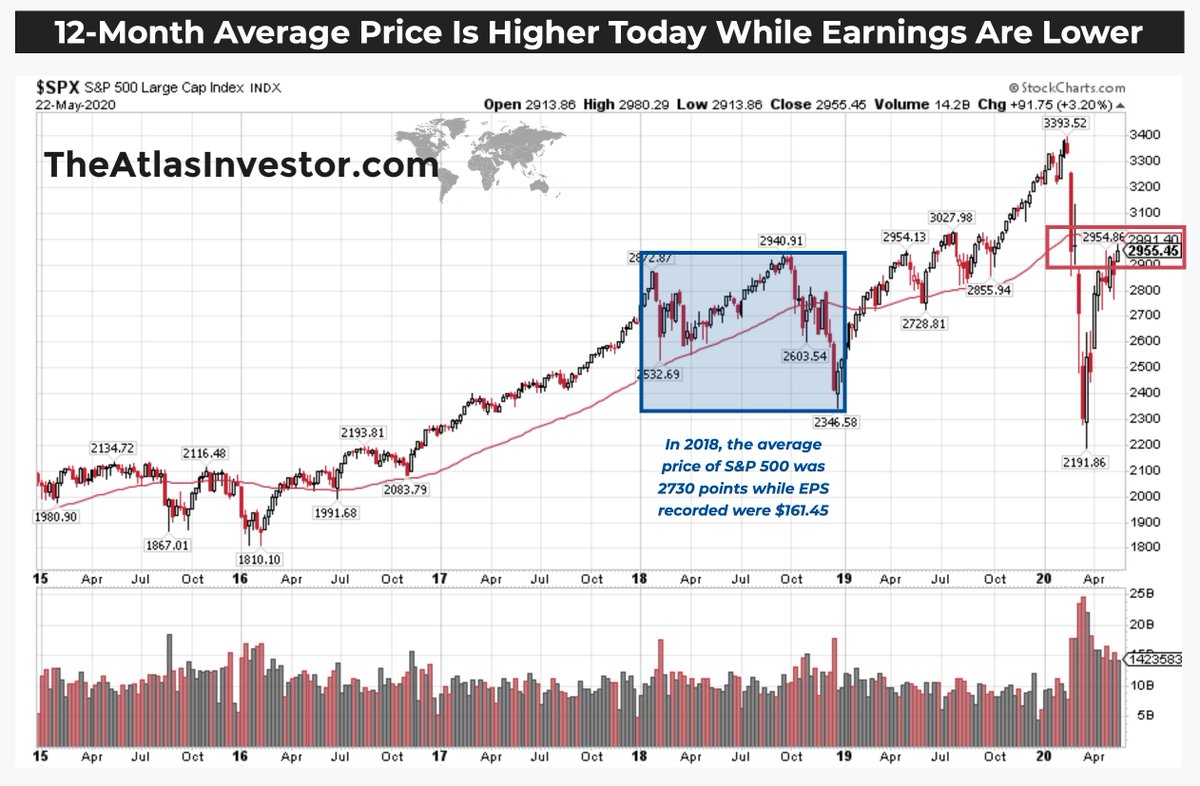

Once again we're over 3,000 on the S&P 500 – at 3,035 early this morning and 3,030 now, at 7am and it's RIDICULOUS because 2020 earnings are forecast (even WITH re-opening now priced in) to be $128.49 for the S&P 500 so, at 3,030/$128.49, you are paying 23.5 times earnings for 2020 and next year – even if we do improved to $164.26, 3,030 will still be 18.4x earnings.

While 18.4 doesn't sound terrible, historically, the S&P 500 trades around 15x earnings or 2,464, which is where we were in 2018, when the S&P was making $161.46. In 2015 and 2016, the S&P was trading at 2,100 and earnings were $119(ish) – that was 17.64 – a bit high but tolerable. 23.5 is 33% above 17.64 – 33% more than tolerable. If it were a stove, you'd say ouch but probably not a severe burn but any higher than this and, like Icarus, this market will burst into flames.

So, WTF is going on with the S&P and the market in general, for that matter?

Well, the Government is pumping $6.7Tn into the economy and that's about 1/3 of our normal GDP, so we should be able to breeze through 4 months of suffering with only the hangover you get from having $26Tn in debt to pay off one day.

Since we haven't had anything near a total GDP wipeout (revision to Q1 comes Thursday, Beige Book today) and we're already re-opening, there should be PLENTY of money sloshing around to provide liquidity for a rally but it was applied in a very mess, haphazard manner and really only benefitted the Top 1% (as most things do these days) while there is still a lot of suffering for small business and individuals.

Since we haven't had anything near a total GDP wipeout (revision to Q1 comes Thursday, Beige Book today) and we're already re-opening, there should be PLENTY of money sloshing around to provide liquidity for a rally but it was applied in a very mess, haphazard manner and really only benefitted the Top 1% (as most things do these days) while there is still a lot of suffering for small business and individuals.

And, of course, there are many people, including the President, who seem to believe the virus is gone and won't be back and the re-opening is a huge success – all with very little evidence backing it up.

What's real and what's not remains to be seen but one thing I do know is real is earnings and MATH is also very, very real and the math we apply to the earnings tells us the S&P 500 and the other indexes are historically over-priced – even for a market that isn't hanging under the threat of a Global Pandemic, a Trade War between China and the US, Explosive Debt, Massive Unemployment and waves of Small Business Bankruptcies and Loan Defaults still to come.

Traders may choose to ignore these things but investors should not.

We will continue to adjust our hedges to lock in the gains from our long positions. I'd rather sacrifice 1/3 of the upside than watch the whole thing evaporate if this fantasy begins to unravel and the wax melts in Icarus' wings – we all know how that story ends.