This is how we now treat Freedom of Speech and Assembly in America.

Day 7 of the protests and the President is ratcheting up the rhetoric, telling the Governors they have to "DOMINATE" the streets and, yesterday afternoon, in a scene you would think was from a movie where they want to establish that the Leader is an evil man who could not care less about his people, a PEACEFUL crowd was violently cleared from the President's path so he could walk to a church, hold up a prop Bible and make a speech threatening to use the US military to put an end to the protests.

This is the point in the movie where you cut away to the heroes working from their basements with a plan to overthrow the monstrous tyrant, right? Well, here's two such heroes who are willing to speak up – one from an attic and one from a garage:

And how are the markets reacting to the violence and the chaos all across America? Well the Dow Futures are up 170 points (0.666%) this morning at 25,630 and if that's not a sign to short /YM, I don't know what is! There is now a total disconnect between the markets and reality as many stocks are now making all-time highs on the premise that the pandemic is ending – which it clearly is not.

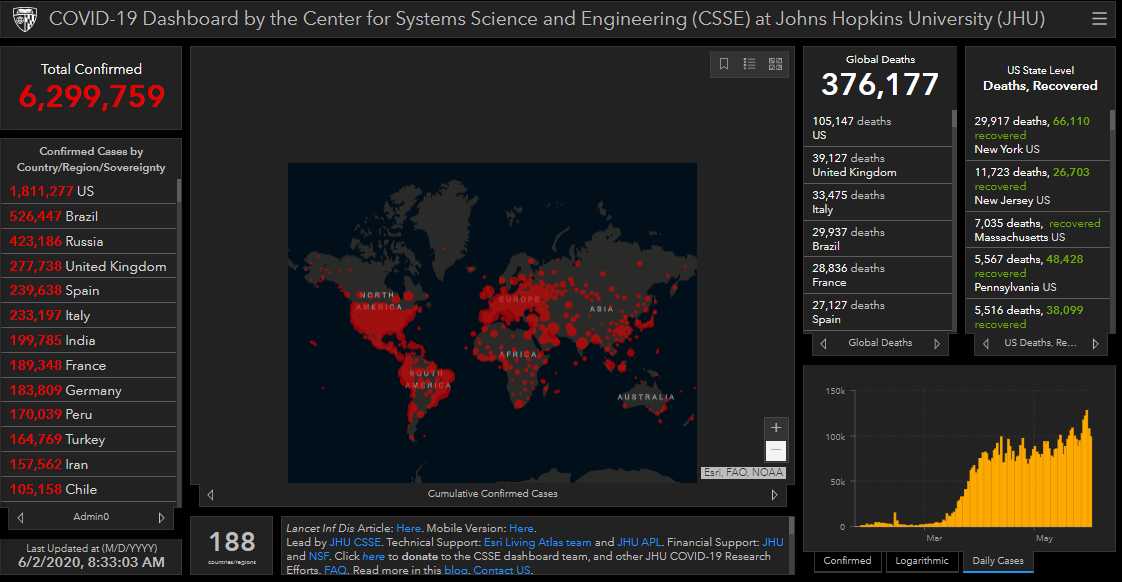

On Friday morning, we had 1,734,586 infections in the US and just over 100,000 deaths in Trumpland. This morning we have 1,811,277 infections and 105,147 deaths so, in 4 days, we have 76,619 NEW infections – almost as many as China had TOTAL – and we've had 1,200 American's per day DIE of the virus. 1,200 per day is a rate of 438,000 per year and, of course, those people are disproportionately black so at what point would you take to the streets to fight for your people and your children's right to life, liberty and the pursuit of happiness – the principles this country were once founded upon?

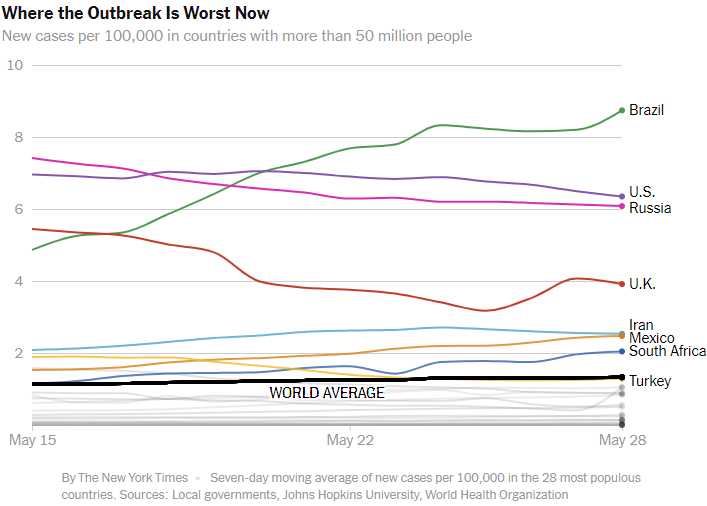

Aside from the US (1,811,277 infections), 3 other countries in the World which account for over half the World's virus cases (and are also growing the fastest) also have Conservative, Populist, Authoritarian Leaders: Brazil (526,447 infections), UK (277,738 infections) and Russia (423,186 infections). All 4 countries share the common theme of their leaders denying they had a problem for far too long – allowing the virus to become entrenched in the population and now very difficult to stamp out.

This pattern isn’t a coincidence, many political scientists believe. Illiberal populists tend to reject the opinions of scientists and promote conspiracy theories. “Very often they rail against intellectuals and experts of nearly all types,” Steven Levitsky, who conducted the Harvard study said. The leaders “claim to have a kind of common-sense wisdom that the experts lack. This doesn’t work very well versus Covid-19.”

In Brazil, Mr. Bolsonaro fired his health minister and has repeatedly called for states to end stay-at-home orders. In the United States, Mr. Trump rejected the views of experts for almost two months, predicting the virus would disappear “like a miracle.” In Britain, Mr. Johnson’s government initially encouraged people to continue socializing, even as other countries were locking down.

In Brazil, Mr. Bolsonaro fired his health minister and has repeatedly called for states to end stay-at-home orders. In the United States, Mr. Trump rejected the views of experts for almost two months, predicting the virus would disappear “like a miracle.” In Britain, Mr. Johnson’s government initially encouraged people to continue socializing, even as other countries were locking down.

All four leaders also flouted guidance on personal protective measures early on, refusing to wear a mask or continuing to shake hands. Often, leaders who responded more slowly have cited the need to prioritize economic growth. But the trade-offs between the economy and public health may not actually exist, scientists and economists say: The fastest route to economic normalcy involves controlling the spread of the virus.

This market is not rationally taking into account the ongoing crisis(es) and I strongly urge caution here. These are the FACTS two weeks apart, note that Global Infections have grown from 4,718,215 to 6,299,759 in the past two weeks – that's 33% more people infected in just two weeks!!!

You can see the spike that is being caused by re-opening yet we are barreling ahead with those plans anyway and now we are nicely distracted away from that danger while the protests are essentialy "super-spreader" events all over the nation.

So please, be careful out there!