Yawn!

Yawn!

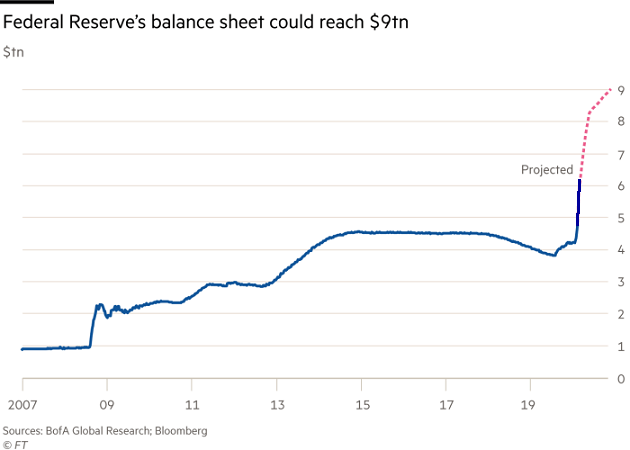

This is getting boring. Every day the stock market goes up and up while we read about the Protests and the Riots and the Cold War with China and the Unemployment and the Virus and the Debt and the Economic Slowdown…. None of that matters on Wall Street because the World's Central Banks printed $20,000,000,000,000 of new money this year and almost all of that money went into the stock market. So much so that the Fed now directly buys ETFs.

The five largest purchases by the Fed, in order, were iShares iBoxx $ Investment Grade Corporate Bond ETF (LQD), Vanguard Intermediate-Term Corporate Bond Index Fund ETF Shares (VCIT), Vanguard Short-Term Corporate Bond Index Fund ETF Shares (VCSH), iShares iBoxx $ High Yield Corporate Bond ETF (HYG) and SPDR (JNK).

That's right, the Fed now buys junk bonds and the majority of these ETFs are managed by Blackrock (BLK), who also runs the Fed's debt-buying programs (once again, the Fed is NOT a Government Agency – it is a Banking Cartel made up of Bankers to protect the interests of Bankers). Still, even for bankers, this seems a little fishy.

That's right, the Fed now buys junk bonds and the majority of these ETFs are managed by Blackrock (BLK), who also runs the Fed's debt-buying programs (once again, the Fed is NOT a Government Agency – it is a Banking Cartel made up of Bankers to protect the interests of Bankers). Still, even for bankers, this seems a little fishy.

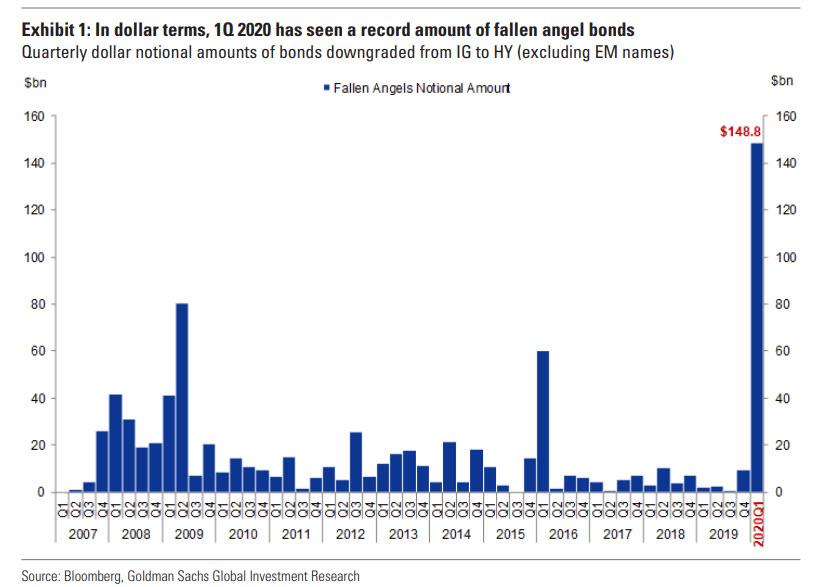

Buying Junk Bonds is a round-about way of giving CASH!!! to Corporations but in a way that the average American does not understand. The companies issue bonds that normally would not get purchased at low interest rates but the Fed steps in and buys them all at the issue price so they are effectively giving the companies ($148Bn in Q1) loans far below the fair market value and ignoring the risks involved. Since the only people that can be hurt by this are the taxpayers – why the F not?

That $148Bn will be dwarfed by the Q2 lending, which is still underway and you can see what a party this is for Blackrock, whose stock jumped 20% on massive volume as the Fed started buying everything they had to sell. This is simply a long-term game-changer for BLK and other Junk Peddlers – ALL bonds get sold – no one goes Bankrupt.

This allows the entire S&P 500 to kick the can down the road while Main Street goes bust, which is then even better for Wall Street as they hire the workers for half the wages and replace all the local businesses with chain stores and fast food restaurants. Of course, this has been going on for many years (as noted by George Carlin), these are just the opportunities for Crony Capitalism to expand.

All is well for investors and there seems to be no end in site as to how long we can ignore reality with the Nasdaq making a new all-time high this morning. We'll see if we can break over 9,700 but, until we do – it's a good shorting line on /NQ (Nasdaq Futures) with tight stops above and that's going to line up with 26,000 on the Dow Futures (/YM) – also a great shorting line.

We have PLENTY of longs – that's why we're looking for shorts – to protect ourselves. Just in case reality ever rears its ugly head…