3,135.

3,135.

That's the 10% line above our Must Hold Level of 2,850 on the S&P 500. If we can get over that and hold it, then we will have secured the rising 50-day moving average which will "Life Cross" over the 200-day moving average around June 19th and THAT would be a very bullish set-up into the summer – assuming the re-opening is getting into full swing by then.

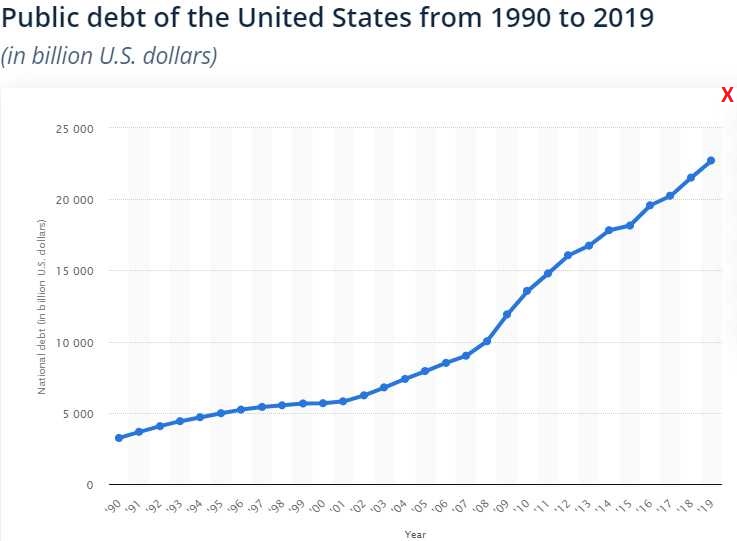

So TECHNICALLY, the markets are in good shape but let's keep in mind that it cost us $6.7Tn to buy this technical rally and it's likely to cost another $2.3Tn to keep it going and that will put the National Debt around $28Tn more than 3 TIMES the $9Tn of debt we had in 2007 – before the Financial Crisis. $10Tn was added during Obama's 8 years in office and now another $10Tn is being added during just 4 years of Trump (so far) – that's a much faster pace than Covid was spreading back when Trump said we shouldn't worry because we only had 5 cases in the US!

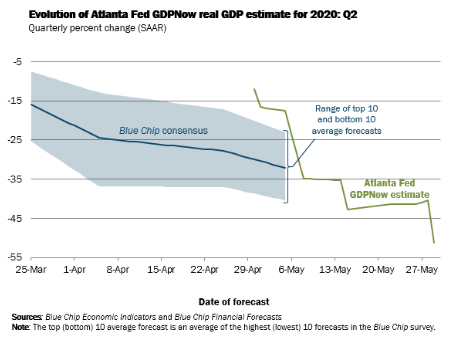

That's a huge discrepancy – usually they are off by no more than 1% but it will take until July 30th before we get our first official estimate of Q2 GDP so, until then – let the speculators have their fun.

Tomorrow we get the actual Non-Farm Payroll Report for May and it will be very hard to top April's loss of over 20M jobs, which wiped out all the jobs gained by Trump and all of the jobs gained by Obama so we're right back to the level of employment we had during the Bush crisis – which cost us $10Tn to get out of.

Of course President Trump believes you can buy your way out of anything – so did President Bush. Spoiled, privileged children from rich familes who get bailed out of all their mistakes by their wealthy, connected parents never learn how to actually work on a problem, do they? They also don't understand the struggles of people who didn't grow up in such advantaged circumstances.

The Trump Administration clearly doesn't understand the struggle that massive unemployment causes for the Bottom 90%. States are already running out of Unemployment Insurance funds yet all the Trump Administration is worried about is keeping them from protesting – or voting.

The virus hasn't gone away either, on May 3rd, we had 1.15M infections in the US and yesterday (June 3rd), we had 1.85M infection so 700,000 (60%) more in 30 days is 23,000 new infections per day DURING THE LOCKDOWN. That's almost double the population of Williamsburge, Virgina infected every single day yet the market is partying like it's 1999.

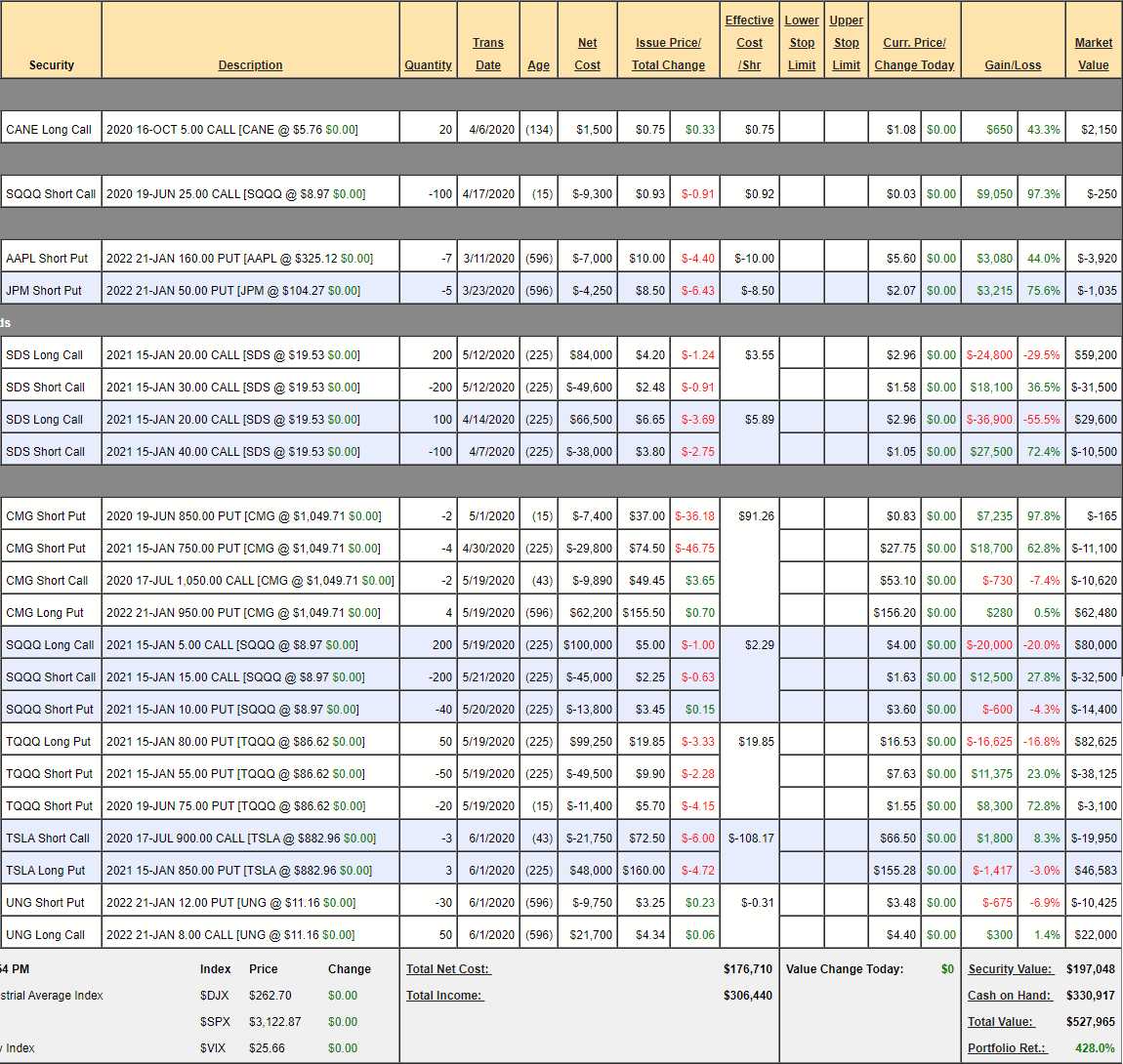

We reviewed our Short-Term Portfolio last Friday and it was at $560,870 (up 461%) at the time and, as of yesterday's close, we were down to $527,965 – down $32,905 for the weeek but that's the way it's supposed to be when the market races higher as the STP's job is to protect our long portfolios and our LTP popped all the way to $855,428 (up 71.1%) as of yesterday's close, up $181,188 from $674,240 back at our 5/19 review.

That's about the right proportion, we expect to give up roughly 1/3 of our upside in the LTP with losses in the STP so, to make sure we lose more money on the next leg up – let's make some STP adjustments as follows:

- SDS – Let's roll down all 300 SDS long Jan $20 calls at $3 to 300 SDS Jan $15 calls at $5 for net $2 ($60,000) so we are picking up $5 in position ($150,000) and increasing our upside Delta on the longs from 0.55 to 0.85. That will firmly lock in our recent $180,000 in LTP gains for $60,000 (1/3) – exactly the way we are supposed to.

- TQQQ – Let's roll our 50 Jan $80 puts at $16.50 to 50 Jan $90 puts at $21.50 so we're widening the spread by $50,000 for $25,000 and let's buy back the short June $75 puts for $1.55 ($3,100) as that's an $8,300 profit that helps pay for the roll and we'll pay for more on our next sale (but let's stay uncovered into the weekend to boost our hedge).

That's all we need to change for now and we can sleep well into the weekend with those hedges – not to mention tomorrow's NFP Report!