Food pantries in New York City are turning people away.

While we have been marveling at the returns from the S&P 500 and the Nasdaq in the past few months, more and more peoplle are starving and less and less assistance is available to help them as the virus people no longer believ in continues to rage out of control.

I don't want to be your Cassandra, my "gloomy" outlook costs us the subscribers who like to hear BUYBUYBUY to confirm their bullish bias and, these days – there's a lot of them! Still, like the prophet, I am cursed to utter truths, yet I am rarely believed.

One reason for that is that I operate on a longer time-frame than most people. I'm always looking at the Future but the Future is a muky place and it's very hard to judge distance – even when the direction is very clear. With the virus it's all been about the numbers and we could tell by those numbers that the lockdowns were ending too early. How early? Who knows? Just early and then how damaging? Also don't know – but we are now finding out the hard way.

The Food Banks, for example, are 39% closed due to lack of funding, lack of food or lack of workers in a city that has been devastated by the virus. In the Bronx (Black Neighborhood) 87 of 174 Food Banks were forced to shut down – HALF! When you lose a food bank you lose their donor base but you don't lose the NEED for food and people from the Bronx then have to travel to other places to get it and that puts more pressure on those Food Banks – a very bad cycle.

The Food Bank provides 21M meals per quarter and the US Government has dropped $2.7Tn (so far) in direct stimulus which has (so far) made the World's top 400 Billionaires $565Bn richer since the pandemic began. As I mentioned above, I do a lot of math and $5 x 20M = $100M and there are 27 THOUSAND $100Ms in $2.7Tn so it would take 1/27,000th of the aid (or 1/5,650th of the Billionaires' gains) to COMPLETELY solve the food problem for the poor in New York City, which has 20% of the nation's virus cases – yet they do nothing…

The Food Bank provides 21M meals per quarter and the US Government has dropped $2.7Tn (so far) in direct stimulus which has (so far) made the World's top 400 Billionaires $565Bn richer since the pandemic began. As I mentioned above, I do a lot of math and $5 x 20M = $100M and there are 27 THOUSAND $100Ms in $2.7Tn so it would take 1/27,000th of the aid (or 1/5,650th of the Billionaires' gains) to COMPLETELY solve the food problem for the poor in New York City, which has 20% of the nation's virus cases – yet they do nothing…

Can you PLEASE write to your Congresspeople and tell them to DO THEIR F'ING JOBS!!!! Thank you.

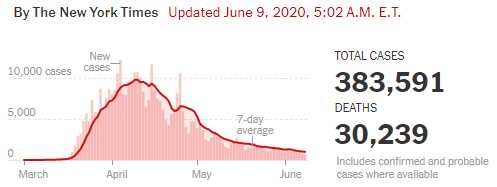

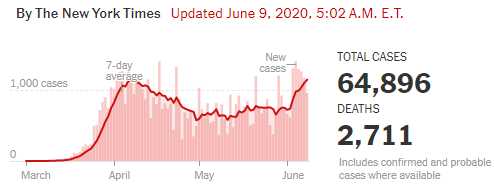

But this isn't about how callous we are towards the suffering of others – this is America! This is about our callous attitude towards human life as we throw our wives and children back on the streets long before this virus is under control to "save" the economy but, as a Florida resident, I'm not sure I find this chart very encouraging as we HAD gotten our new infections down below 500 in May and so we opened back up (with restrictions) and now we're back to 1,000 per day just two weeks later.

But this isn't about how callous we are towards the suffering of others – this is America! This is about our callous attitude towards human life as we throw our wives and children back on the streets long before this virus is under control to "save" the economy but, as a Florida resident, I'm not sure I find this chart very encouraging as we HAD gotten our new infections down below 500 in May and so we opened back up (with restrictions) and now we're back to 1,000 per day just two weeks later.

Is our plan to wait until we are at 2,000 per day before the Government admits it was a mistake? This is simply not rational behavior people – not from people who want to live. And, if it were possible that the people who want to go out and risk their lives could do so without endangering everyone – I'd have no problem with that because I don't run around knocking cigarettes out of people's mouths either and, if I were younger and thinner – I'd be happy to risk it as well BUT, what is the reality of lifting the lockdown?

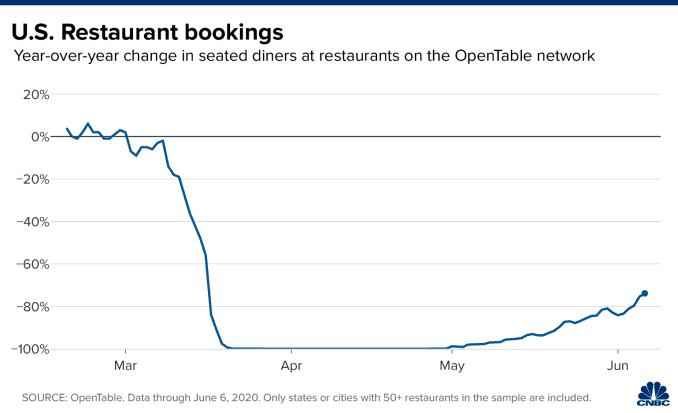

Last month, NO ONE was going to my local restaurant so I (a shut-in) could order food knowing that the Chef and the people in the restaurant were tested and my risk level was very low and the delivery person was probably the most dangerous point of contact – as he visited many homes. Now, with the lockdown lifted, even limited at half-capacity, the restaurant seats over 100 people per day so there are 100 chances for the staff to become infected and pass it on – EVERY DAY and now I can't trust the whole process.

Last month, NO ONE was going to my local restaurant so I (a shut-in) could order food knowing that the Chef and the people in the restaurant were tested and my risk level was very low and the delivery person was probably the most dangerous point of contact – as he visited many homes. Now, with the lockdown lifted, even limited at half-capacity, the restaurant seats over 100 people per day so there are 100 chances for the staff to become infected and pass it on – EVERY DAY and now I can't trust the whole process.

That goes for grocery stores and everything else as well and I am not a germaphobe or terribly paraniod about the virus but I can SEE the statistics forming and they are NOT favorable at all!

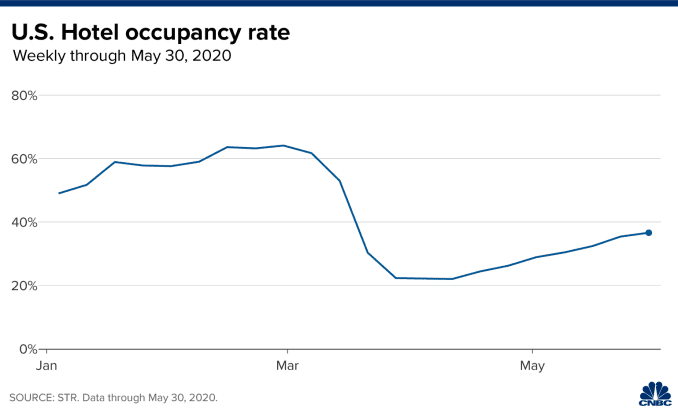

Of course the shut-down is terrible and expensive but it wouldn't be if the $6.7Tn that's been pushed out by the Government and the Fed had actually gone to the people who needed it. Our entire US GDP is $19Tn so $4.5Tn per quarter and we took a 50% hit by shutting things down for 3 months (we didn't even make it to 3 months) so that's $2.25Tn in real damage that could have been funded for 6 months had it been distributed properly and, by then, the virus could have been completely eradicated.

Of course the shut-down is terrible and expensive but it wouldn't be if the $6.7Tn that's been pushed out by the Government and the Fed had actually gone to the people who needed it. Our entire US GDP is $19Tn so $4.5Tn per quarter and we took a 50% hit by shutting things down for 3 months (we didn't even make it to 3 months) so that's $2.25Tn in real damage that could have been funded for 6 months had it been distributed properly and, by then, the virus could have been completely eradicated.

Instead, we squandered $6.7Tn, didn't fix anything or cure anything and now we are recklessly re-exposing ourselves in an economy that is only 1/2 open BECAUSE WE DIDN'T REALLY FIX ANYTHING and, at some point, the death toll will become so great that we'll have to shut everything down again. Yes, I'm pissed off!!!

The stock market is rallying because $6,700,000,000,000 is a LOT of money and BECAUSE it's not going to the people who do need it – it's going to the people who DON'T need it and those people are the kind of people that put excess money into the markets, which causes the market to go higher. It has nothing at all to do with the Fundamentals of running a business during a Recession/Depression.

The stock market is rallying because $6,700,000,000,000 is a LOT of money and BECAUSE it's not going to the people who do need it – it's going to the people who DON'T need it and those people are the kind of people that put excess money into the markets, which causes the market to go higher. It has nothing at all to do with the Fundamentals of running a business during a Recession/Depression.

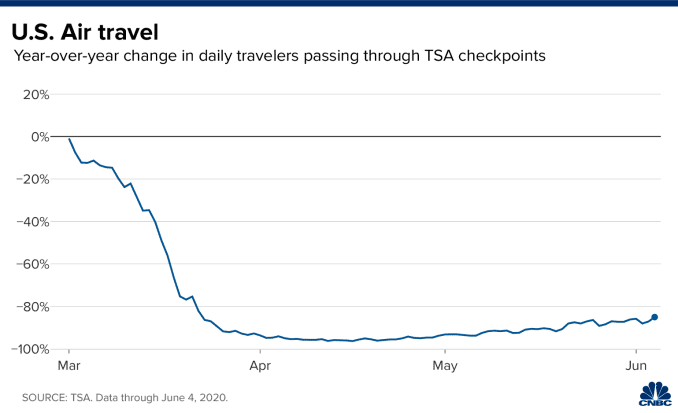

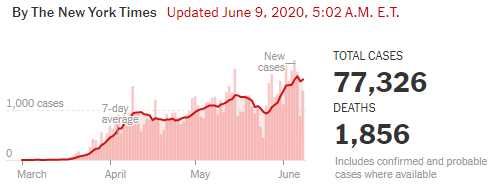

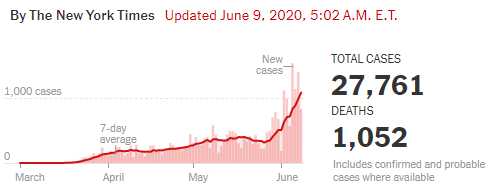

That's right, this economy is still miles away from "normal" and it's going to be a lot harder to get back to normal when 2,000 people a day are being infected in Texas and Florida and 1,000 people a day in Arizona (all above), etc. Nationwide, we had 30,000 new infections yesterday, that's running at a rate of 7.3M more infections in a year but that's WITH lock-down protocols still in place.

113,125 Americans are dead already and we passed our 2,000,000th infection this morning and only 773,509 people have recovered, only about 1/3 of the people infected so far have had outcomes and, out of those people, 14.6% are dead. With 2,027,438 total infections that's 1,253,929 people who are still infected and, potentially, 200,000 more deaths at the current rate and that's going to double in 12 months – even if the infection rate stays flat but, as we can see from the charts above and from the national count – it's not going to stay flat.

Without the PPE and without simply saying to certain businesses like Amusement Parks, Movies, Sporting Events, ect (sorry DIS) – we are NOT going to get on top of this virus and, ultimately, that is NOT going to be good for our economy. What it will do is give Mr. Trump a chance to get his hands on more aid money and make himself (#72 on that list of Billionaires who got $565Bn richer during the crisis) and his friends even more money while everyone else gets much, much poorer.

And the debt for all that stimulus? Well that's going to be your problem – not his…