That's the mantra of the day as the S&P 500 tests our 10% level, again. As you can see on the chart (click to biggerize), we bounced right off the 200-day moving average at 3,011 last week and we consolidated for 2 days and now we're going to take another run at the 10% line but I doubt we make it today – unless more stimulus is announced and that happens every other day anyway.

You wouldn't know we need stimulus in DelRay Beach, where I live, as the restaurants are packed and the streets are crowded. That's why Florida has added 1,300 new virus cases per day in June and 1,700 yesterday (so it's accelerating) and there's 30 days in the month so maybe 45,000 new cases is half as many cases as all of China's total in a single month and la di dah – NO ONE FREAKIN' CARES!!!

WTF is wrong with you people? I mean really! Florida already has 77,326 Covid patients so 45,000 more puts us well over 100,000 – and Disney hasn't even opened yet – what a party that's going to be! Please people, fly from all over the World to the airport in Orlando and let's re-infect every country from Florida's petri dish!

So far (it takes time to go critical), 12,015 of the 77,326 infected people have had to be hospitalized so I guess this is a make-work program for hospitals or is our goal to save the Social Security Program by eliminating the recipients? Before the re-opening, Florida had 700 new cases per day so, for you Fox fans, 1,700 per day is more than that.

This is what I keep telling you guys – re-opening is a disaster when you haven't actually controlled the virus! We are starting the re-infection process from a MUCH larger base than the 15 us cases we had when the virus first began spreading here in February and now we're STARTING AGAIN but from a base of hundreds of thousands of actively infected people standing next to you in the supermarket. How do you THINK that is going to go?

This is what I keep telling you guys – re-opening is a disaster when you haven't actually controlled the virus! We are starting the re-infection process from a MUCH larger base than the 15 us cases we had when the virus first began spreading here in February and now we're STARTING AGAIN but from a base of hundreds of thousands of actively infected people standing next to you in the supermarket. How do you THINK that is going to go?

The US leads the World with 2M of the 8M infections but Brazil is catching up to us with 888,271 followed by 544,725 in Russia, 343,091 in India and 298,315 in the UK – ALL countries run by populist leaders who "go with their gut" and ignore the scientists. Great job team Apocalypse – 4 more years!!!

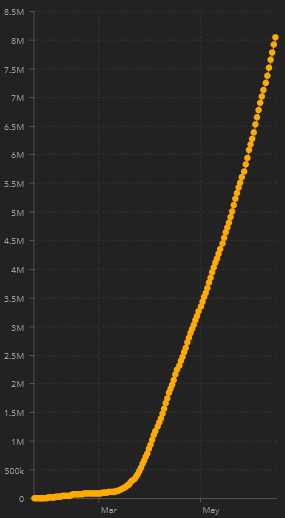

As you can see from the chart, infections are going parabolic again and nobody seems to notice, nobody seems to care… I literally feel like an idiot talking about it because I seem to be the only person who thinks it's bad to allow this virus to continue to spread with only the smallest of effort being put forth by our Government to contain it.

The ECONOMY, on the other hand, they HAVE to save but save our citizens from the virus – not so much. Corona infects and kills twice as many poor people as rich people and that's easy to understand as I, for example, only shop in Whole Foods, where they are fanatical about keeping it clean and safe and I only dine outside at very nice (and not crowded) restaurants which I feel are taking extra care to be careful – I can afford to make those choices, others cannot. I don't have to take a public transportation, I don't live in a crowded place, I can afford good PPE equipment – of course the rich are less likely to get infected and we can afford the best care if we do get infected while many of our fellow citizens have no care at all.

Still, unless something worse happens (and whatever happened to poor Dr Fauci, by the way?), Americans have gotten used to dying by the thousands every day (how do you think we got to 116,127 deaths in 3 months?) for the cause of Capitalism so let's enjoy it while we can (or until we run out of citizens).

We'll see how the S&P holds up at 3,135. As long as we can stay over 3,000, the 50 dma will continue to climb and then we're about two weeks away from a bullish cross over the 200 dma and the market would officially be back on a bull track. I think $1.5Tn ought to get it done….

Powell is speaking to the Senate at 10, I have no idea why the Futures think that's going to go well…

And we have a 20-year Bond auction tomorrow – that will be interesting and Powell speaks to Congress just ahead of that (12) and that too, will be interesting because he has to scare some people into bonds or the auction could be a disaster.