First you go low on high volume, then you go high on low volume.

That's one of the tricks "THEY" do when "THEY" want to reel in retail suckers to take stocks off their hands at high prices. Keep the headliners like Apple (AAPL) rolling up the market while doing massive selling like we saw into Friday's close – a 100-point drop in the S&P 500 (3.2%) during the trading session but then a 60-point "recovery" when the markets closed and there was no volume – a time when it's MUCH easier to manipulate the markets, as well as the news.

Yes, we used to only have to worry about fake Financial News, the kind Jim Cramer boasts about routinely placing in this video. As Cramer says, if you are running a hedge fund and you are not manipulating the markets – you're just not doing your job. If you think that's not true today – just look at that action on the S&P and read the headlines of SOME papers and you tell me if we're still being manipulated or not.

I know not all of you are Economists but I'll save you 2 years of graduate school by saying down 45.5% is BAD! What's also bad is that the average range of pundits is more like -35% so the public is in for a big disappointment if the Atlanta Fed is right and the random idiot on TV is wrong.

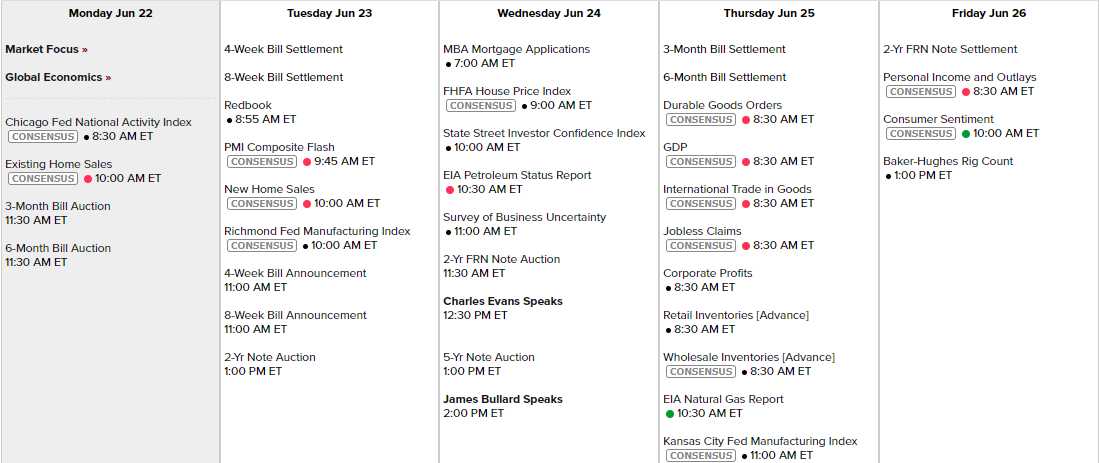

We get the final GDP Report for Q1 on Thursday (8:30) and that will be down 5% with Consumer Spending down 6.8% and that only reflects the last two weeks of March when we were locked up (hey, Trump did it, he locked us up like he promised!). If we were down about 50% for two weeks and the other 10 weeks of the quarter we were flat, then 50/10 = 5% – wow, math! So, in Q2, we began locked up on April 1st and we stayed locked up until late May so let's call that 7/12 weeks of VERY BAD GDP and, of course, 30M people lost their jobs during that period too but, don't worry, 2.5M (maybe) got their jobs back – so all fixed according to the President.

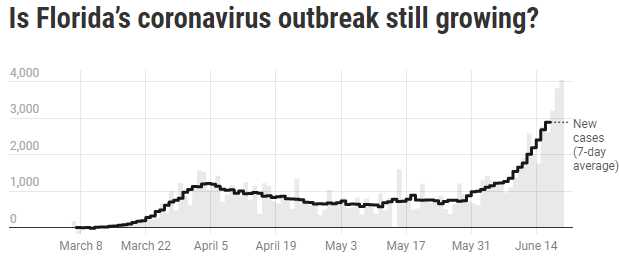

I went out for dinner on Thurday and the very nice restaurant I was supposed to eat at was gone. It was there last week and now it's gone. I went to another restaurant and, because this is Floriday, the staff had neither gloves or masks on – I was not happy! As I predicted on Friday (again, math), 10,000 more Floridians caught the virus over the weekend and by tomorrow we will celebrate our 100,000th infection – come on down and enjoy the beaches!

I went out for dinner on Thurday and the very nice restaurant I was supposed to eat at was gone. It was there last week and now it's gone. I went to another restaurant and, because this is Floriday, the staff had neither gloves or masks on – I was not happy! As I predicted on Friday (again, math), 10,000 more Floridians caught the virus over the weekend and by tomorrow we will celebrate our 100,000th infection – come on down and enjoy the beaches!

Look at the headline on the chart from the Tampa Bay Times. Isn't that the whole problem that they put it in the form of a question when only DJ Trump could ignore this FACT. Keep in mind that's the 7-Day AVERAGE – it's much slower to move than the actual graph, with 4,700 new infections on Saturday and 3,494 new infections. 1 in 200 people in Florida are now infected, that's double in the last 10 days. Go out to a store and try not to be in contact with 200 people or the things they've touched (door handles, credit card machines, counters, chairs…). I have said before that 1/200 is the critical juncture because, once you get to 1/100 – you may as well get it over with and kiss infected people…

Yes, that's right, someone actually said that. Disney Springs (the mall/restaurant area) has already re-opened, allowing people from all over the World to literally shop 'till they drop in a state that now has 25% more infections than all of China. And nobody tries to stop this because this is America and, even worse, Florida and people do whatever the F they want regardless of the consequences. The park itself is scheduled to re-open on July 11th, just 3 weeks away and, at this rate, Florida could have 200,000 cases and that would mean 1/100 people you see at the Magic Kingdom may be magically infecting you!

Yes, that's right, someone actually said that. Disney Springs (the mall/restaurant area) has already re-opened, allowing people from all over the World to literally shop 'till they drop in a state that now has 25% more infections than all of China. And nobody tries to stop this because this is America and, even worse, Florida and people do whatever the F they want regardless of the consequences. The park itself is scheduled to re-open on July 11th, just 3 weeks away and, at this rate, Florida could have 200,000 cases and that would mean 1/100 people you see at the Magic Kingdom may be magically infecting you!

We own Disney stock but from the crash prices, because, well because, for example, they are already selling Disney Character Face Masks – these guys will make money in any Apocalypse… Capitalism aside though, WTF are we doing here people? We are opening a global tourist attraction in one of the most infected places on Earth? We are enticing children to come to a state that has 3 times more infected people in it than China did when Trump proudly "banned" China travel to save us from the virus.

Hong Kong Disneyland closed January 26th and, to this date, Hong Kong only has 1,131 TOTAL infections. Florida has over 100,000 infections, that is 100 times more than 1,000 (math) yet Florida Disney World thinks opening now is a great idea. How much more clearly does it have to be illustrated that we live in a World where your life matters much less than a rich person's money. Isn't that kind of the theme of the 21st Century so far?

On January 26th, all of China had 2,075 infections and they were already shutting everything down, including Disney. Nonetheless, by Feb 26th, there were 78,166 infections in China but, fortunately, the mostly had their virus under control at that point and, 4 months later, there are 84,573 total infections in all of China – 20% less than Florida alone and 1/100th of the global total (8,975,776), despite having 20% of the World's population.

America, on the other unwashed hand, has 2,280,969 KNOWN infections (we don't really test people) and that is 25% of the World's total infections shared among 4% of the World's population. That is, as we say in the science world – not good.

Brazil had their 1,000,000th infection this weekens. At that pace, they won't be in second place for long but the US has kicked it up again so it's going to be a race for the bottom but I have full confidence in the Trump Administration to keep it great and win this virus race for America.

Data this week includes the Chicago Fed, Housing Data, Richmond Fed, Investor Confidence, GDP the KC Fed, Consumer Sentiment and Personal Income. Only two Fed speakers are scheduled around the 5-Year Note Auction – no auctions can fail or we could turn into Greece overnight, of course.