Holy cow!

Holy cow!

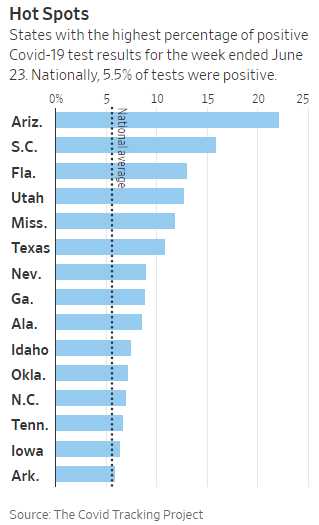

As you can see from the chart, over 20% of the people who are tested in Arizona do, in fact, have the Covid Virus. Not much better in Florida and anywhere were 1 out of 10 people have the virus it's pretty much game over for containing it. We did have it contained – but Trump was so eager to call that a victory that he opend up the cages and now we are all Christians that have been thrown to the viral lions by our modern-day Commodus. Maybe in the future, we'll call the toilet a Trump, instead of a commode in his "honor"…

That's right, Commodus was the son of the popular Marcus Aurelius but, as Gladiator fans surely know, his reign was one of rot and corruption as he surrounded himself with incompetent toadies and managed to intiate the complete anhilation of the Roman Empire after 12 years of incompetent rule (he was assassinated):

During his solo reign, intrigues and conspiracies abounded, leading Commodus to an increasingly dictatorial style of leadership that culminated in a god-like personality cult. His assassination in 192 marked the end of the Nerva–Antonine dynasty.

Commodus had upset the peaceful balance that Rome had enjoyed for almost eighty years. Currency was devalued and the economy collapsed, leading the country into a civil war that lasted four years. His rule was the beginning of the end for that most famous empire..

Yikes, sounds a lot like the movie we are all currently starring in, doesn't it? I think we're just about in the middle of act two:

In context, the Latin panem et circenses (bread and circuses) identifies the only remaining interest of a Roman populace which no longer cares for its historical birthright of political involvement. Here Juvenal displays his contempt for the declining heroism of contemporary Romans, using a range of different themes including lust for power and desire for old age to illustrate his argument.[6] Roman politicians passed laws in 140 BC to keep the votes of poorer citizens, by introducing a grain dole: giving out cheap food and entertainment, "bread and circuses", became the most effective way to rise to power.

[…] iam pridem, ex quo suffragia nulli / uendimus, effudit curas; nam qui dabat olim / imperium, fasces, legiones, omnia, nunc se / continet atque duas tantum res anxius optat, / panem et circenses. […]

… Already long ago, from when we sold our vote to no man, the People have abdicated our duties; for the People who once upon a time handed out military command, high civil office, legions — everything, now restrains itself and anxiously hopes for just two things: bread and circuses.[7]

—Juvenal, Satire 10.77–81

Sadly, the decline of the Roman Empire was a 5 act play and it was all downhill from there for the next 200 years.

So how about those markets! Wheeee – Nasdaq back over 10,000, mostly because AAPL has blasted up to $365 a share – up $25 (7.5%) since last week. Apple makes up 12% of the Nasdaq and 12% of 7.5% is about 1% (too early for math) and the Nasdaq is pretty much flat since last week and, as our Members well know, Apple is often propped up to mask the selling going on in the broader market as $25 also equals over 200 Dow points and AAPL is 3.5% of the S&P 500 as well.

AAPL is up 14% in June and the Nasdaq has gained 600 points or 6.3% so, essentially all of June's gains so far have come from Apple's $45 run and, in the Dow, each component $1 is worth about 8.5 Dow points (yes, it's an idiotic index) so AAPL contributed 382 points to the Dow's 400-point gain for the month. That would be 95.5% of the gains…

You know how someone is driving and you are sitting next to them and they are talking to you as if you are home on the couch and you see a car too close ahead and you don't want to say anything because you don't want to insult their driving skills but then you get even closer and there's that moment you finally decide you have to yell "CAR!!!" or something because you think the margin of safety is passing?

CAR!!!

Have a great weekend – I have to take a Trump,

– Phil