The US "is not in total control".

The US "is not in total control".

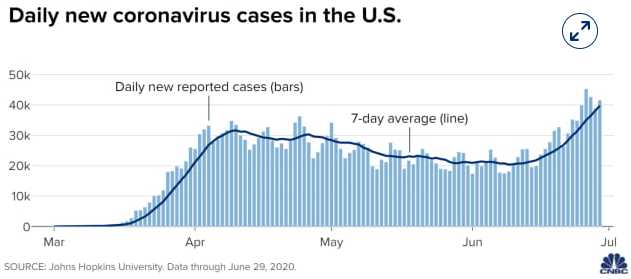

That's quite the understatement from Dr. Anthony Fauci, who warned the Senate yesterday that daily new virus cases in the US were trending towards 100,000 per day. That would knock out the entire population of Wyoming in 15 days! The country is now reporting nearly 40,000 new coronavirus cases every day – almost double from about 22,800 in mid-May – driven largely by outbreaks in a number of states across the South and West. “I can’t make an accurate prediction but it’s going to be very disturbing,” Fauci told the Senators.

“Well I think the numbers speak for themselves. I’m very concerned and I’m not satisfied with what’s going on because we’re going in the wrong direction if you look at the curves of the new cases, so we really have got to do something about that and we need to do it quickly.”

Outbreaks in states like Florida and Texas also threaten to disrupt the progress states like New York and New Jersey have so far made in driving down the outbreak in the Northeast, Fauci said. New York, New Jersey and Connecticut last week announced they would mandate 14-day quarantines for any travelers coming from a states with rapidly expanding outbreaks. Nonetheless, Fauci said increased infection anywhere in the country threatens to spread everywhere.

Keep in mind that 100,000 people a day is 3M people per month which means 1% of our population will be infected each month and that means that in two months, 1 in 50 people will have the virus and how likely is it that we can stop the spread at that point? 1-2 months later, 1 in 25 and 1-2 months after that 1 in 12. Hey I know – let's keep doing almost nothing, right?

The S&P 500 has pretty much done nothing since the end of April. Well, it's gone up and down but, on the whole, not much higher than that peak which is still much lower than the pre-virus peak yet people are still acting as if we're in a raging bull market – which we should be after $6.7Tn in stimulus, shouldn't we be? So, if $6.7Tn isn't enough to get us to new highs – what will be?

The Federal Reserve is now one of the Top 5 holders of the biggest Corporate Bond ETFs. That's right, the money YOU borrowed for this bailout is mostly going to Corporations (Trillions!) who are issuing bonds with terrible credit ratings that are being snapped up by the Fed at ridiculously low interest rates (the rates the Companies should be paying YOU, the taxpayer, for lending them the money). What could possibly go wrong?

The Federal Reserve is now one of the Top 5 holders of the biggest Corporate Bond ETFs. That's right, the money YOU borrowed for this bailout is mostly going to Corporations (Trillions!) who are issuing bonds with terrible credit ratings that are being snapped up by the Fed at ridiculously low interest rates (the rates the Companies should be paying YOU, the taxpayer, for lending them the money). What could possibly go wrong?

$51.5Bn in additional Junk Bonds were issued in June but the Fed, through the ETF's is buying the old ones too and that in turn is bailing out their Member Banks like BAC, JPM, BLK, C, etc. who were "stuck" in major junk positions and had no buyers to exit their positions (until the Fed came). Now YOU are buying all the crap the Fed's Member Banks are dumping while the markets are being propped up and the Government messaging (other than Fauci) is that you should ignore the virus and focus on the pretty rally.

We're not that dumb, are we?