50,000 new infections!

50,000 new infections!

That's right, that's the 5th time in the past 7 days the US has hit new all-time single-day highs in infections. Over in Japan, six weeks after Tokyo lifted it's State of Emergency, they are back to their May highs in daily infections. At this point, I don't think there is much to do about it. Clearly humanity has no taste for the obvious way to control the disease and very clearly Americans don't. Maybe the "herd immunity" crowd was right – cows don't go into lockdown when a disease strikes – some die, some don't and the rest of the herd moves on…

I don't suppose a cow puts much thought into it's vulnerability or what will become of it's children and loved ones or how it's business will survive or how it's carelessness might affect his fellow cows – AND NEITHER DO AMERICANS APPARENTLY! Maybe we just eat to many cows and we are starting to think (or not think) like them? Texas eats a lot of meat and they had 8,000 new infections yesterday but Arizona, which has 1/4 of Texa's population, had 4,700 new cases – more than half, so about 5 times the infection rate of Texas.

From Japan and other countries that have had re-infections, it's very clear that bars are a major cause of the spread of the infection yet the bars are open in most states for what is usually a big drinking weekend as we bow to pressure from the Liquor Lobby to keep things flowing while completely ignoring the Rational For God's Sake Will Humanity at Least Try to Save Itself Lobby – as usual. As noted by David Leonhardt:

From Japan and other countries that have had re-infections, it's very clear that bars are a major cause of the spread of the infection yet the bars are open in most states for what is usually a big drinking weekend as we bow to pressure from the Liquor Lobby to keep things flowing while completely ignoring the Rational For God's Sake Will Humanity at Least Try to Save Itself Lobby – as usual. As noted by David Leonhardt:

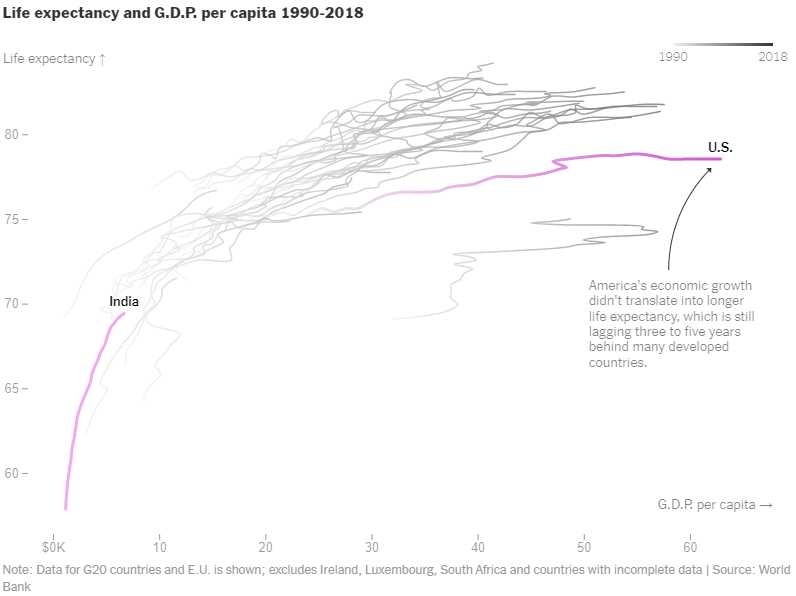

Government policy and economic forces have combined to make corporations and the wealthy more powerful, and most workers and their families less powerful. These workers receive a smaller share of society’s resources than they once did and often have less control over their lives. Those lives are generally shorter and more likely to be affected by pollution and chronic health problems.

That chart is from 2 years ago but you can already see what these policies cost the average American in terms of years of their lives. Americans now live 3-5 years less than the average human being in other developed parts of the World and this virus is going to make things so much worse. The media has people so brain-washed and focused on triviatlities that it's unthinkable that America would ever focus on leading the World in "life expectancy" – it's not even a thing we usually discuss and that's because the 5 companies that control 90% of the media don't want you discussing it – so it's a non-topic.

“We hold these truths to be self-evident, that all men are created equal, that they are endowed by their Creator with certain unalienable Rights, that among these are Life, Liberty and the Pursuit of Happiness.” Let's see how the last 3.5 years have been going: Did Donald Trump fulfill Jefferson's dream? Life is on the decline, both the life of the animals we share the planet with and now our citizens themselves are in danger. Liberty? Nope, we can't even leave the county anymore. Trump has built a wall alright, it's a wall of travel bans from other countries who don't want disease-ridden Americans crossing their boarders. Pursuit of happiness? Well, I did win my Fortnite battle last night – that made me happy….

Tomorrow the markets are closed and we've been considering closing out our portfolios but there's likely to be one more round of stimulus into the elections. The last $6.7Tn boosted Trump's polls for about 2 months but now he's back in the danger zone so we can expect them to pull out all the stops as we head towards Novemeber – only 4 months until the election now.

5% of all the people who have had the Coronavirus are dead but half of those infected are still actively infected so it's very possible the death rate is closer to 10%. Trump/Fox argues that "many" people are infected and don't even know it and, hopefully, that's the case. About 10% of the population have coronavirus anti-bodies (not enough testing to be certain) so only 10% of those people are actually counted officially, which would drop the death rate to 1% – 3M Americans as this virus runs it's course. Those are the dice the Trump Administration is rolling with our lives.

Of course the virus may be seasonal, which means we'll have to learn to "live" with it – and life expectancy in the US will be trending lower for a very long time.

Have a great holiday,

– Phil