Another day another 1.5% gain.

Another day another 1.5% gain.

This is why we can't cash out our long portfolios, as much as we'd like to. The problem is we are going to have a very hard time protecting our ill-gotten gains from the correction – if and when it ever does come but, so far, the flow of money from the Fed and the endless stimulus by the Government is the rising tide that is floating all boats – no matter how rough the waters.

Investors are "exhberant" but is it really irrational when so much money is being thrown at the stock market? This is historically unprecedented. Here we are at the start of Q3 and we already heard on Friday that Q2 was a disaster for the Auto Industry and Earnings Reports kick off next week with PEP, C, JPM, WFC, UAL, BK, GS, PNC, PGR, USB and UNH reporting by Wednesday. This week we have just a few but nothing terribly exciting so we'll have to wait until next week to see if the markets can skip over Q2's almost certain disaster:

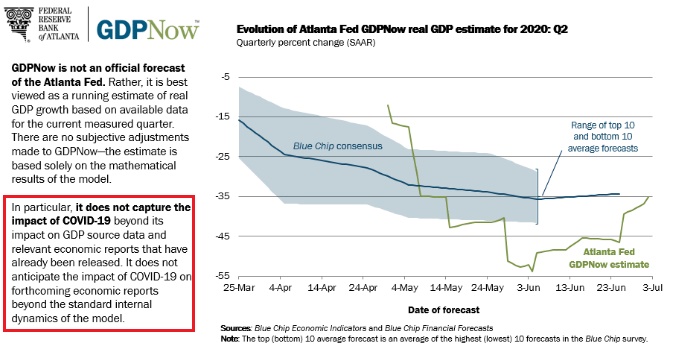

The Atlanta Fed has increased their GDP Now Forecast to -35% from -54% for Q2 so I guess that's great news. I'm not sure if -35% deserves new record highs in the stock market but it is certainly better than -54% thanks to that very clever re-opening thing we've been doing for the past month under the guidance of Supreme Leader Donald Trump.

The Atlanta Fed has increased their GDP Now Forecast to -35% from -54% for Q2 so I guess that's great news. I'm not sure if -35% deserves new record highs in the stock market but it is certainly better than -54% thanks to that very clever re-opening thing we've been doing for the past month under the guidance of Supreme Leader Donald Trump.

According to our President, a few people "caught the sniffles" this weekend – a record amount, in fact – but it's nothing to worry about and no reason to chicken out and go back to our cowardly lockdowns that were damaging his economy. I know I'm inspired.

"Experts say the president appears to have seized only on a death rate estimate of 1 percent or less that does not capture the entire impact of the disease, and excludes a multitude of thousands who have spent weeks in the hospital or weeks at home with mild to moderate symptoms that still caused debilitating health problems.

"A crude calculation of the U.S. death rate, based on the total number of deaths officially attributed to the virus and the number of cases diagnosed through testing, suggests the mortality rate is higher, with 4.5 percent of those infected dying.

“It’s always tricky to do this in the midst of a pandemic,” Dr. Jha said. “There are a lot of factors that go into it. But let’s say you took 1,000 Americans at random who were all infected. Our best guess is that between six and 10 would likely die of the virus.”

So go markets! The President says we have beaten this thing after 40M tests have been administered (to people who actually thought they had the virus) and only 2.8M of those people were actually infected and the rest were just whiners, not winners. Now it's time for the other 290M of us to get out there and party like it's 1999 or like it's 1918, when we thoght we beat the Spanish Flu (I heard on Fox it was really from China) but then it came back stronger and then we thought we beat it again and it came back again. 50M people died after affecting 500M people, 1/3 of the World's population at the time. Now we have 8Bn people but this time is different, right?

So go markets! The President says we have beaten this thing after 40M tests have been administered (to people who actually thought they had the virus) and only 2.8M of those people were actually infected and the rest were just whiners, not winners. Now it's time for the other 290M of us to get out there and party like it's 1999 or like it's 1918, when we thoght we beat the Spanish Flu (I heard on Fox it was really from China) but then it came back stronger and then we thought we beat it again and it came back again. 50M people died after affecting 500M people, 1/3 of the World's population at the time. Now we have 8Bn people but this time is different, right?

Meanwhile, think of the rally like a Toga Party – we know it's stupid but that doesn't mean we can't just enjoy it and we know it's going to end with people getting sick, hurt and arrested and of course there is going to be some property damage but FUN WHILE IT LASTS! For those of you who live in other countries and can't understand the mentality of Americans in this crisis – this clip should help:

These are the 65-80 year old people who now run our Government so why should we be surprised when they say Phucket, something I told you would happen way back in April, while we were still on Double Secret Probation: "Monday Morning Math Notes – Looking Ahead in a Viral Market." At that time we were also contemplating cashing out our portfolios, which had just gotten back to even and I said:

THAT is the question I've been pondering this weekend as we've had an excellent run in the markets off the bottom and all of our Member Portfolios, except the Dividend Portfolio, are back in the black and we should be THRILLED, in this kind of market – just to get our money back. Still, the thing is – if we go back to cash – then what? This is where the Fear of Missing Out (FOMO) comes in because, while we are comfortable that we can take our cash and make money in any kind of market – we still don't want to miss out on deals of the century, do we?

…So a fairly unchecked spread that infects all 330M Americans could kill 1.5M people but identifying sick peolple quickly through stepped up testing and "flattening the curve" could keep us under 500,000 deaths and will spread those deaths out over at least a couple of years – even if there is no vaccine and no cure. Horrible as that is, ECONOMICALLY, we can live with that.

…One thing they don't mention about "flattening the curve" is that the aim is not to prevent you from getting the virus – you WILL get the virus – it's just a matter of WHEN. Given that everyone will be exposed to the virus eventually (unless we go to a permanent lock-down until the virus is completely dead in the wild), policy makers don't want the curve TOO flat – as that just drags things out longer than they have to. What they want is to keep people exposed at a level our Health Care system can handle and let's hit that line and get it over with. They don't tell you that but it's true and it drives the policy in the background.

…So, if we assume Q2 is shot (ends June 30th) and we're down 30% but then only down 15% in Q3 and down less than 10% in Q4, I don't see the overall economy being down much more than 10% overall and that's $2Tn and the Government has put more than $2Tn into the market and is certainly willing to put in more so I don't think we should sell our long positions UNLESS we start seeing re-spreads of the virus in places where restrictions are easing.

Otherwise, PHUKET!

Well said Phil (that's why I read that guy every day). We are simply living through the early stages of re-opening, as we expected and it remains to be seen how bad the consequences of re-opening are going to get. As long as our hospitals are AT capacity and not OVER capacity, then things are actually going according to plan – the plan they don't tell you about because who want's to be the guinnea pig?

TOGA!!!