Buckle up, it's going to be a bumpy ride!

Buckle up, it's going to be a bumpy ride!

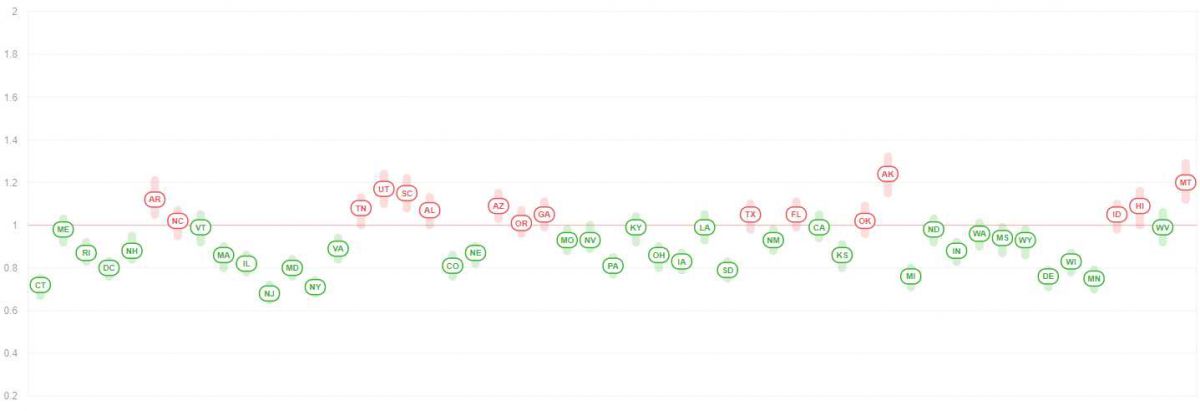

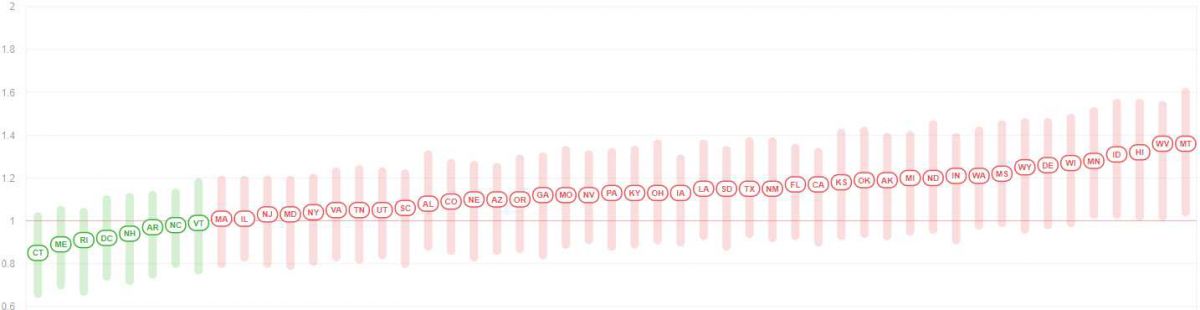

We're 10 days into the third quarter and look how well things are going with almost every state having the virus under control except for a few idiot red states that think they are immune but, either way, the daily briefings and general public awareness have certainly turned the tide and…. what? That's the chart from May? Oh gosh, I'm sorry – let's take a look at the same chart as it is today thanks to our completely inept leadership:

Oh my God – get me out of this country!!! What? We aren't allowed to leave because we're too likely to be infected? Inept is not the right word for our leadership then, is it? "Contrary to the continued existence of American life" is a more accurate description for these morons, really. You would think this is all some kind of plot to destroy America that was set into motion by a foreign Government, setting up a puppet leader who would send America spiraling down a path of division and destruction. Nah….

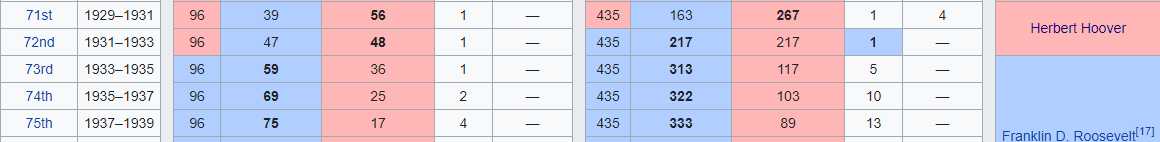

The only good news here is the same good news I predicted back when Trump was first elected – this may be the end of the Republican Party – just like Herbert Hoover in 1929-1933 led to over 20 years of Democratic rule. When Hoover was elected, the Senate had 56 Republicans and just 39 Democrats and the House had a 267-163 Republican majority and, just like they did 100 years later, they raped and looted the land and destroyed the economy and, just 4 years later, there were 59 Democratic Senators and just 36 Republicans and, in the House, there were 313 Democrats and just 117 Republicans and, by 1937, Republicans almost qualified for endangered species protection with only 17 remaining GOP Senators and just 89 House Members.

While it's still too early for the Democrats to throw Putin a thank you party for installing the Puppet of Doom for the GOP in the White Hosue, it's certainly looking like more of a Blue Tsunami than a "Blue Wave" is shaping up for the upcoming elections (if we have them). Trump is close to 10 points behind Biden (what ever happend to that guy?) in battleground states like Pennsylvania, Michigan and Wisconsin and he's behind in Florida and North Carolina too. Even Georgia has gone from solidly red to "toss-up" for the President and Arizona is now leaning Biden too.

Arizona already flipped to Democratic Bisexual Senator Kyrsten Sinema who replaced Republican Jeff Flake and now Democrat Astronaut Mark Kelly (Gabby Gifford's husband) looks like he'll be replacing Matha McSally after just 2 years (she was appointed by GOP Governor Doug Ducey (not his real name), who has just two years left before he will be thrown out). Arizona has been a Republican stronghold since the Goldwater Era but Trump has been the last straw for many formerly red states as Trump gambled and lost (as he often does) by aligning the fate of the Republican Party with an anti-science campaign to battle one of the worst epidemics in history.

Arizona already flipped to Democratic Bisexual Senator Kyrsten Sinema who replaced Republican Jeff Flake and now Democrat Astronaut Mark Kelly (Gabby Gifford's husband) looks like he'll be replacing Matha McSally after just 2 years (she was appointed by GOP Governor Doug Ducey (not his real name), who has just two years left before he will be thrown out). Arizona has been a Republican stronghold since the Goldwater Era but Trump has been the last straw for many formerly red states as Trump gambled and lost (as he often does) by aligning the fate of the Republican Party with an anti-science campaign to battle one of the worst epidemics in history.

Rabouin reports: "Betting markets have turned decisively toward an expected victory for Joe Biden in November — and asset managers at major investment banks are preparing for not only a Biden win, but potentially, a Democratic sweep of the Senate and House too…. The shift is the latest indicator of how quickly the political and business worlds have aligned in the view that Trump is unlikely to win a second term as COVID-19 infection numbers have spiked again and the economy looks to be stalling."

"A Citigroup poll of 140 fund managers released last week found that 62% expect a Biden win, compared to 70% who expected a Trump victory in the same survey in December. And according to Kace Capital Advisors Managing Director Kenny Polcari, 'Talk of a Democratic sweep (is) now common' among investors."

This is not an anti-Trump or anti-Republican tirade, you reap what you sow, as they say. This is about that last part – Fund Managers are already baking in a Biden victory and Democratic control of both houses and that means you shouldn't fall for that usual nonsense about how the market hates change, etc. Biden has already proposed bumping Corporate Taxes up to 28% and uncapping Social Security contributions, reigning in the debt but still spending $1Tn on vital infrastructure – especially of the sort that will finally contain this virus (if we last that long).

So Joe Biden is not going to destroy the markets or the economy – the real problem is he's still 6 months away and, meanwhille, we have to keep putting up with Trump, his antics and the lunatic asylum that enables him in Congress. The Congressmen seem to have no sense of self-preservation as they are still standing behind the President the way you stand behind a bullseye at an atomic testing ground – this guy is toast – save yourselves dummies!

So Joe Biden is not going to destroy the markets or the economy – the real problem is he's still 6 months away and, meanwhille, we have to keep putting up with Trump, his antics and the lunatic asylum that enables him in Congress. The Congressmen seem to have no sense of self-preservation as they are still standing behind the President the way you stand behind a bullseye at an atomic testing ground – this guy is toast – save yourselves dummies!

Speaking of saving ourselves – it's time for EARNINGS – or lack thereof. Bed Bath and Beyond (BBBY) lost $1.96 per share vs expectations of losing 0.65 per share – oops. Levi Strauss (LEVI) lost 0.48 per share vs. expections of losing just 0.05 but somehow HELE ($2.53), WBA (0.83), PSMT (0.41), WDFC ($1.06) and, very surprisingly PAYX (0.61) made money so we're off to a much better start than I thought though Carnival (CCL) may change that this morning.

Still, no technical reason to shut down the portfolios yet but I am worried that the S&P 500 is looking to finish the week below the critical 3,135 line. The LTP stands at $847,483, so up 69.5% for the year but the STP is down to $367,886, now "only" up 267.9% for the year, mostly because of our disastrous short on Tesla (TSLA). So we have a combined $1,215,369 and that's up a bit more than 100% from our $500,000/100,000 starting balances.

I have said that if we fail to hold a $1.2M balance in our combined portfolios I think we should cash out as it's not worth risking a double and we're not there yet and I certainly didn't expect TSLA to be responsible for $150,000 in losses but here we are. That can all revers and we can get back to $1.4M but it can also get worse and the market uncertainty continues and I continue to be unsure it's worth the risk. We'll see next week when we get earnings from bigger fish.

Have a great weekend,

– Phil