Goldman Sachs made money!

Yes, I know, that's not really a surprise but the markets are acting like it is this morning and the Dow is up almost 500 points, pre-market with Goldman Sachs (GS) contributing 50 points with their $9 (4%) jump on better than expected earnings. Mainly we're up because last night Moderna's Covid Vaccine showed positive immunity responses in all 45 people tested and now they are heading into a much bigger phase two study (30,000 subjects) at the end of the month.

The new “Cove” study, scheduled to start July 27, will aim to enroll about 30,000 adults at nearly 90 different U.S. locations. Many of the study sites will be in states where the virus is surging, such as Texas, Florida, California and Arizona, according to information posted Tuesday on a federal database of medical studies.

Among the people researchers plan to enroll are those at appreciable risk of infection because of where they live. Testing the vaccine in coronavirus hot spots could help generate answers about the vaccine’s efficacy sooner, because people there are more likely to be exposed to the virus in everyday living compared with people in places where new cases have declined.

Researchers, however, still don’t know what level of a neutralizing immune response would be needed to guard against either infection or severe disease, and for how long a vaccine could provide such protection.

More than half of the study participants had side effects including fatigue, chills, headache and injection-site pain. Three participants who received the highest dose level tested had one or more severe adverse events, the researchers said. That highest dose level isn’t being tested in the large phase 3 study.

This should give everything a nice boost but hopefully not Tesla (TSLA), which is killing our Short-Term Portfolio (see yesterday's review) but, fortunately, great for the Long-Term Portfolio, which closed yesterday up 80% for the year at $900,238 and should make a quick $50,000 today if we hold this pre-market rally.

Let's take a quick look at the LTP. I've been itching to cash it out and stop the madness but, every time we review it, the positions are too damned good to sell! In the interest of time, I'm not going to say anything about positions that are "on track" that we're not even considering removing. I just want to shed a little light on my internal thoughts regarding our positions.

On the macro level, I think we have more stimulus coming though the Unemployment Bonuses run our in two weeks -that would be bad if the don't cover it but I think they will and Q2 earnings aren't terrible so far – or no more terrible than expected – and that's a positive!

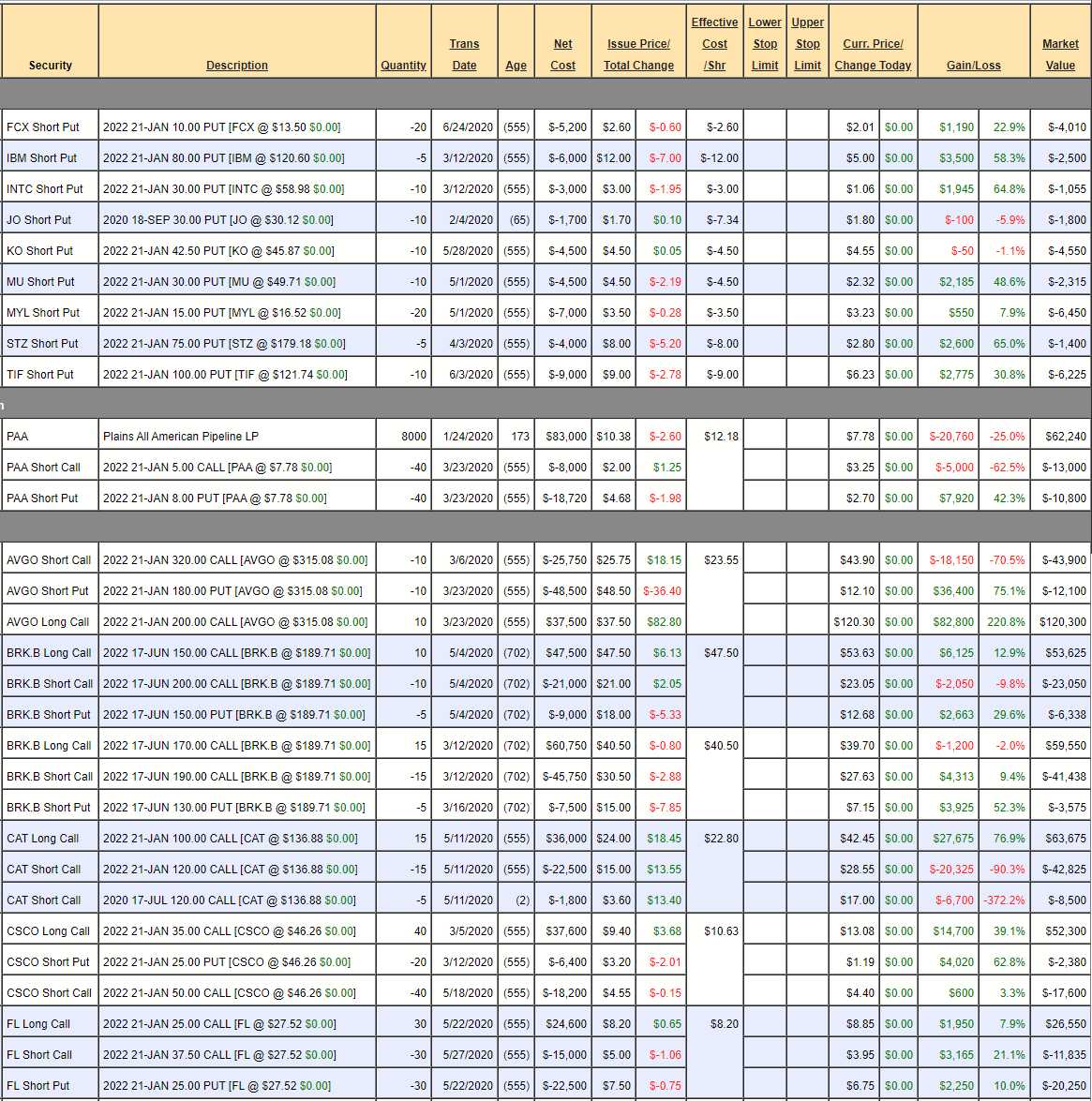

- Short Puts – All great stocks we offered to buy at very low prices so I'm not worried.

- PAA – Performing badly so far but paid us an 0.18 dividedn on 4/30 and 0.36 on Jan 30 so our net cost per share is $3.16 on 8,000 shares and, if we get assigned 4,000 more at $8 our net cost goes to $5.58 and 4,000 get called away at $5, which would be an 0.58 "loss" on the sale so the net of the remaining 4,000 would be $6.16, which is our true, uncovered cost on 4,000 shares. Meanwhile, if we collect another 0.32 in dividends this year and 0.68 next year, our net cost will be down to $5.16 ($20,640) – so this is a keeper, even though it looks bad on paper at the moment.

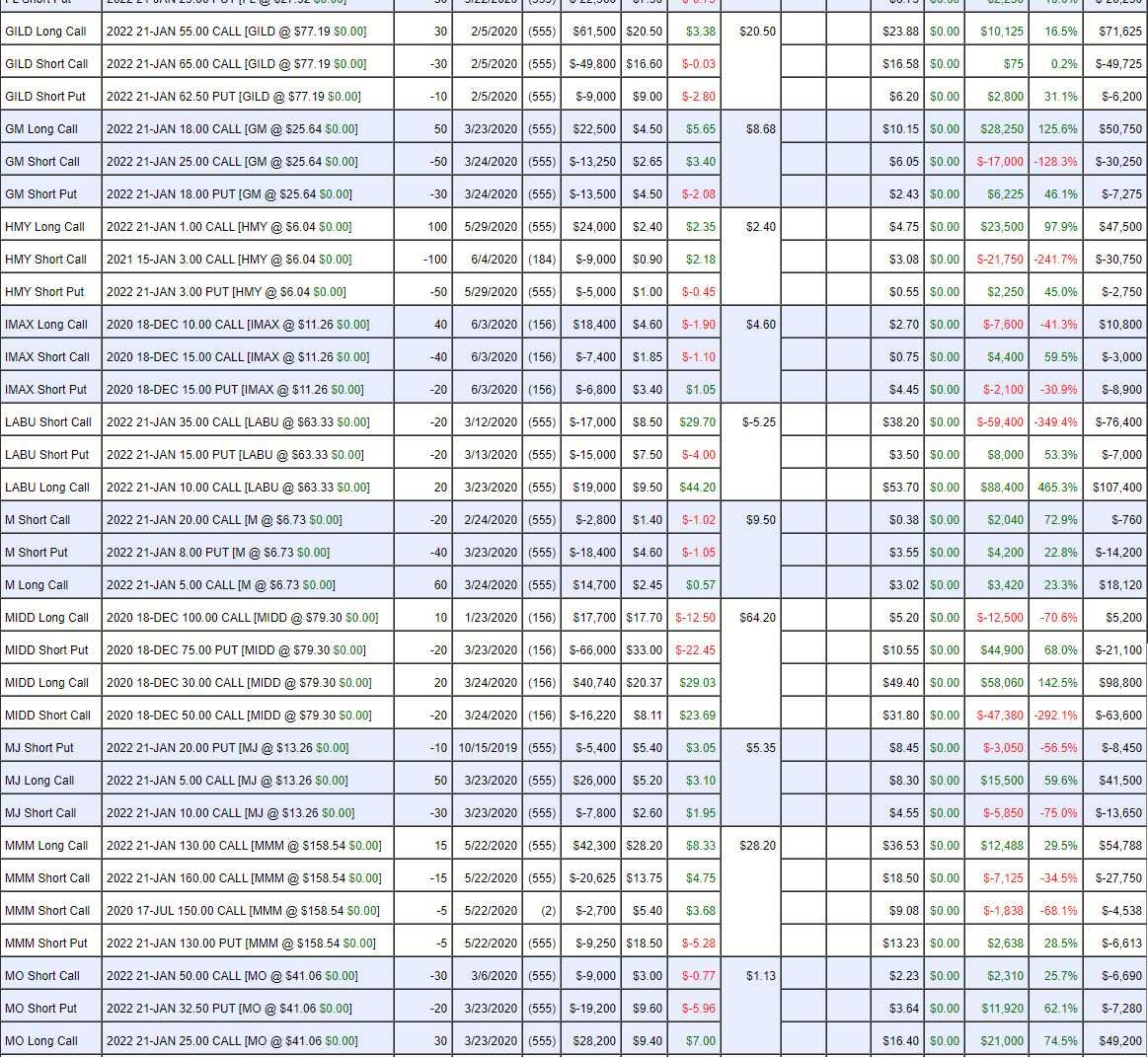

- AVGO – Through the roof.

- BRK/B – If they don't do well, we should be out of everything.

- CAT – Still good for a new trade. Biden says $2Tn for infrastructure so the CAT comes back. We have 5 short July $120 calls and they are in the money at $17 and we're going to roll them along to 5 short Aug $125s at $14.50 so we're paying $2.50 to roll up $5.

- CSCO – Almost at goal already.

- FL – On track

- GILD – Another contender in the virus race but a great overall company.

- GM – At goal already.

- HMY – Miles over our modest target.

- IMAX – March options should be out soon and I don't want to pull the plug vs giving them more time to recover.

- LABU – Biotech! How can we not love it?

- M – Still not dead. It's a real estate play.

- MIDD – I knew they'd come back, already over our goal line on trade 2 and we may even recover trade 1 (we bought back the profitable legs already).

- MJ – Finally in the green on our MJ stocks!

- MMM – We have the short July $150 calls at $8 and we can roll them to the Sept $155 calls at $109 so let's do that as we're going up $5 and getting paid $2! Still good protection – though I don't think we'll need it.

- MO – Gotta love the sin stocks.

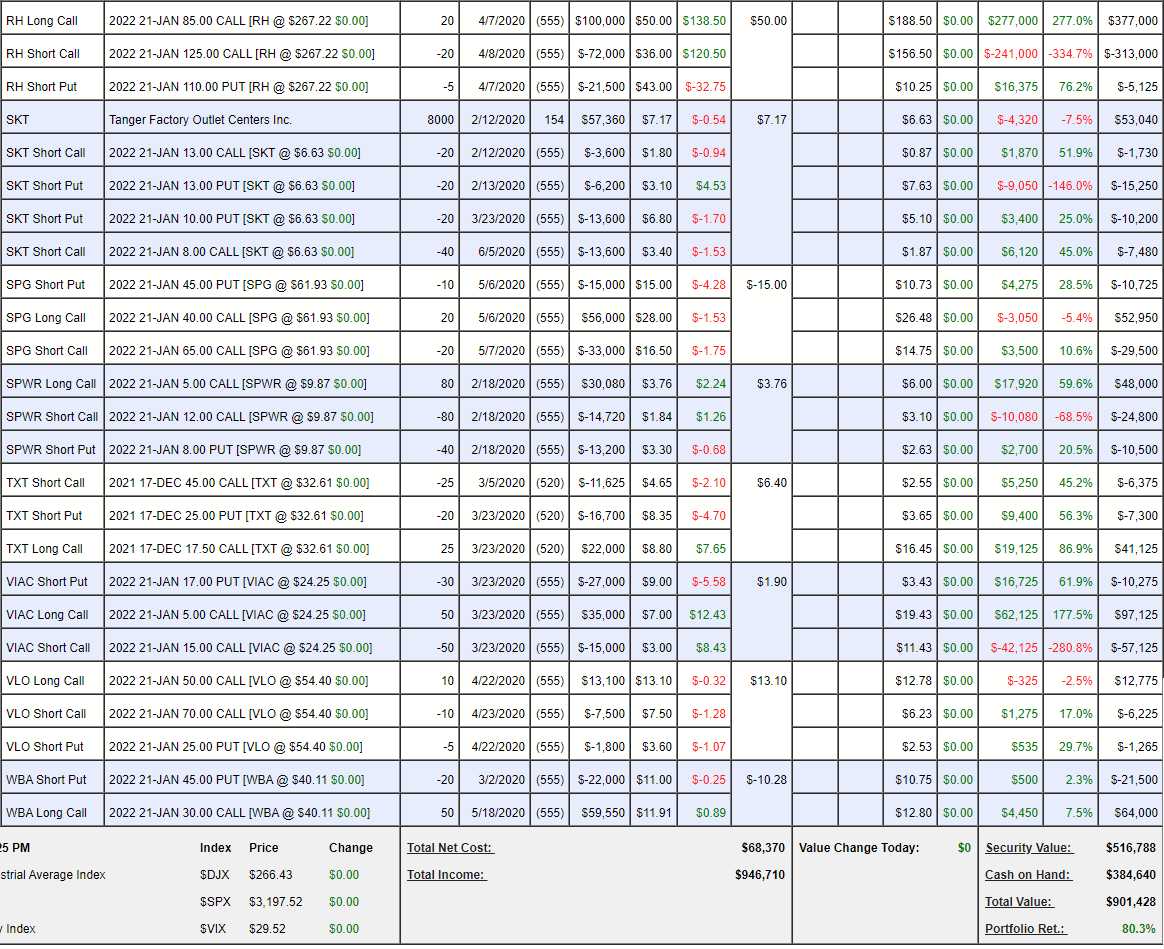

- RH – Gotta love the stocks that cated to the top 1%. RIDICULOUSLY in the money already.

- SKT – Still down in the dumps but I still love them long-term.

- SPG – Another mall REIT but this one doing well because we took a super-conservative entry and let premium decay do our job for us. Very clever!

- SPWR – See this morning's notes on how much I love them.

- TXT – Right on track and looking to break up.

- VIAC – I TOLD YOU SO!!!

- VLO – A great long-term inflation hedge.

- WBA – We got more aggressive with them so now we wait.

See, they are too good to close! Don't forget we've already done 3 purges this year in the LTP so these are the positions that we couldn't bear (don't say bear!) to part with each time. I can justify cutting IMAX and maybe even SKT (though it would make me cry), JO is a gamble but nothing else I wouldn't want to ride out since this portfolio can make another $400,000 from here as it stands.

We have huge protection in the STP and we're at about $1.3M vs our high of $1.4M in our paired portfolios so nothing really to worry about – as long as you don't consider giving up $100-200,000 of our $700,000 gains worrying because that's what's at risk as we go for $1.8M – keep that in mind – there's no free lunch here.