$1,000,000,000,000.

$1,000,000,000,000.

That's enough money to give all 1,000 Billionaire in the World another Billion Dollars. Oh wait, we did that already. Well it's enough money to give one Million Millionaires another Million Dollars. What? We did that already too. Well it's enough money to buy 3,000 masks for every man, woman and child in the country so we wouldn't need to spend Trillions of Dollar propping up the economy or it's enough money to continue giving $600 unemployment bonuses to 30M people for an entire year.

ROFL!!! Who are we kidding, this is America, we're going to give it to the rich people again!

The funny thing is the rich people are pissed that they are ONLY getting $1Tn this quarter (they got $6.7Tn last quarter) so the Futures are tanking and we're losing all of Meaningless Monday's gains. The biggest stimulus issue will hit us on Friday, it's the end of the $600 weekly unemployment bonus and the Democrats in the House wanted to extend it through Christmas while the Scrooges in the Senate said not only do they want it dropped to $200 now but they want all unemployment capped at 70% of wages AFTER it's combined with any State Benefits people are receiving.

The funny thing is the rich people are pissed that they are ONLY getting $1Tn this quarter (they got $6.7Tn last quarter) so the Futures are tanking and we're losing all of Meaningless Monday's gains. The biggest stimulus issue will hit us on Friday, it's the end of the $600 weekly unemployment bonus and the Democrats in the House wanted to extend it through Christmas while the Scrooges in the Senate said not only do they want it dropped to $200 now but they want all unemployment capped at 70% of wages AFTER it's combined with any State Benefits people are receiving.

The Republicans also want to cut dependent checks down to $500 while the Democrats want to increase them to $1,200 for up to 3 children, so people with more than 7 children come out ahead on the Republican plan! Democrats also want to spend $430Bn to make our schools safe enough to attend and providing $50Bn for child-care facilities to keep our toddlers safe while the Republicans think $70Bn is plenty and the kids can take their chances with the rest of us.

Democrats have also propose $1Tn in aid to local Governments while the GOP just says no to that and again, they want the cities and states to fight the virus with the same budgets they had when there was no virus – even though those budgets weren't enough anyway and now revenues are dropping sharply, causing cascading fiscal failures all around the country.

Democrats have also propose $1Tn in aid to local Governments while the GOP just says no to that and again, they want the cities and states to fight the virus with the same budgets they had when there was no virus – even though those budgets weren't enough anyway and now revenues are dropping sharply, causing cascading fiscal failures all around the country.

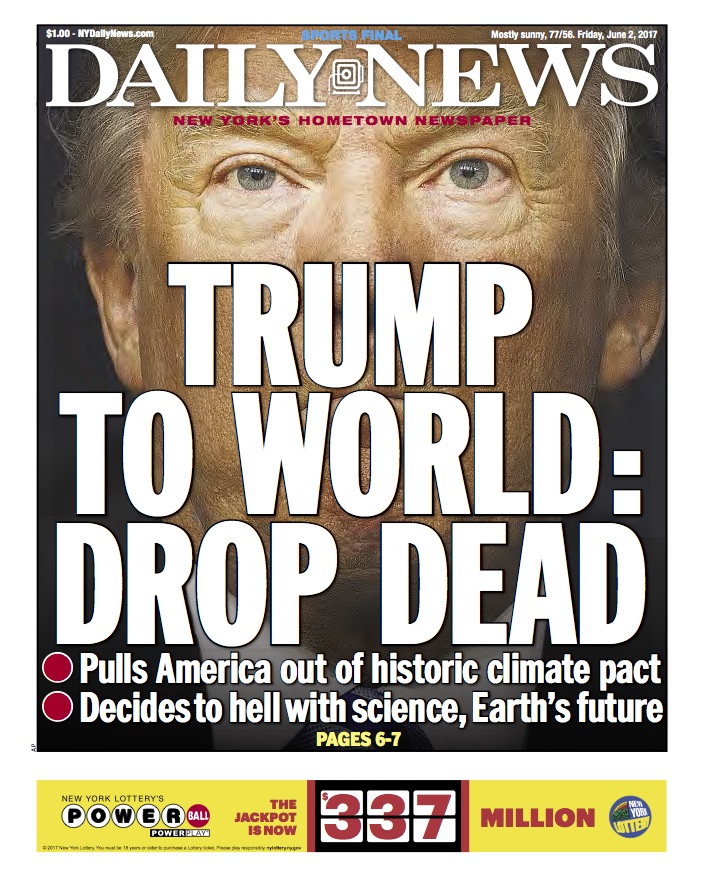

This is simply a continuation of Trump's usual policy of Global Genocide – it's just taken him a few years to get around to actually exterminating Americans.

The Democrats also wanted $3.6Bn to help ensure election security and the Republicans… ROFL!!! The Democrats’ plan would spend $194 billion to expand a wage subsidy to cover up to 80% of wages and benefits through the end of the year, up to qualified wages of $45,000, and fixed costs like rent. The GOP plan would expand a wage subsidy to cover up to 65% of $30,000 in annual wages.

The Democrats are up against a wall because the Senate delayed their response until yesterday making all these negotiations very last minute with benefits running out on Friday and Congress heading into their summer break. If there's no deal by next Friday and Congress takes a break then: