Wheeee, that was easy money!

Wheeee, that was easy money!

In yesterday's Live Trading Webinar, we were watching the Fed report live and we didn't see what people were being so bullish about so I made a call to short the Russell (/RTY) and the S&P 500 (/ES) Futures, which I reiterated in our Live Member Chat Room:

"In the Webinar we decided to short /ES at 3,250 and /RTY at 1,500. GDP tomorrow is likely to be ugly."

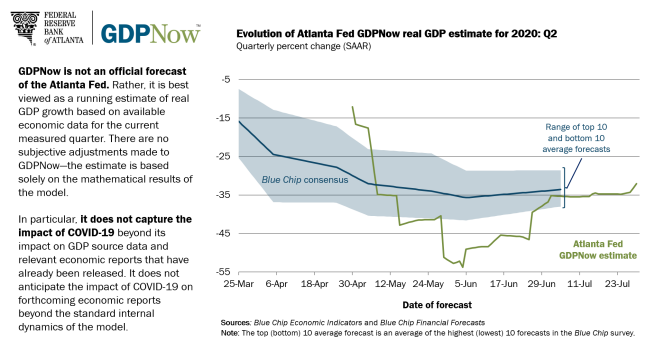

As you can see, we've already gained over $1,000 per contract and we haven't even had the GDP Report yet (8:30) and that is expected to show a horrific 30+% drop in US economic activity for the 2nd Quarter. It's POSSIBLE we have an upside surprise – thanks to $5Tn of stimulus spending during Q2 but, either way, we're in the middle of an economic disaster with not end in near sight.

Germany's GDP was down 10.1% this morning and that is twice as bad as it was in 2009, the second-worst on record (only records since 1970) but Germany, unlike the US, had a plan to fight the virus and has things more or less under control with 208,892 – about as many cases total as the US has deaths (150,716 so far). Germany has just 9,137 deaths to date, both about 5% of the US's totals although they have 25% as many people (84M).

8:30 Update: Officially we're down 33% DESPITE the $5,000,000,000,000 boost by the Fed and Congress (see yesterday's Report for breakdowns) so I'm very glad we put on those extra hedges as things could get pretty ugly although it's really right in-line with the drop that has been projected since early June. Still, just think about how COMPLETELY misused that $5Tn must have been to have not been able to boost a $4.5Tn Quarterly Economy to more than 66% of it's usual level. That's like a doctor saying he put 10 pints of blood into a patient but he only has 6 pints in him (10 is normal) – either somebody is incompetent or there's a MASSIVE leak somewhere.

We know where our leak is – it's in the President's pocket as he's redirecting as much Covide Relief Money as possible into his own projects and projects by his friends and family

RIGHT NOW

President Trump suggested for the first time on Thursday that the November election be delayed.

We'll see how the markets digest this GDP Report – it's only AS BAD as expected, not worse but it's certainly nothing to celebrate and the Fed has already fired their guns so now it's up to Congress to save us as those unemployment bonuses run out TOMORROW.

Good luck!