Apple $425, Nasdaq 11,000 – Yipee!!!

As you can see on the chart, AAPL is up almost 40% for the year and AAPL is 15% of the Nasdaq so it's responsible for 6% of the Nasdaq's rise from 9,000 to 11,000 (22%) for the year so 27% of the Nasdaq's rise is due to one stock and then you have to consider the suppliers Apple boosts along with their own stock.

Apple is having a break-out moment as $425 per share is a $1.8Tn market cap so we're just 10% away from $2Tn in valuation at $470 – get your party hats ready. $2Tn is the GDP of Italy (#9 in the World) or Brazil (#8) with France, India and the UK, with population of 65M in France, 1.4Bn in India and 67M in the UK doing a piss-poor job comared to Apple's 137,000 employees. Is the average Apple employee 10,000 times more productive than the average Indian? If so, it's hard to explain the valuation of Infosys (INFY).

Speaking of companies that are worth $1.5 Trillion (yes, there's more than one now), Microsoft (MSFT) is trying to buy TikTok's North American operations so they can have something cool in their portfolio (now that's they've given up on Bing). President Trump has been helping Microsoft by threatening to ban TikTok in the US, devaluing their platform and scaring the company enough for MSFT to swoop in and make an offer – good old-fashioned strong arm tactics from your favorite Oiligopolists:

“Microsoft appreciates the U.S. Government’s and President Trump’s personal involvement as it continues to develop strong security protections for the country,” the company said in its statement.

The deal would land Microsoft the breakout social-media player of this decade. It would give Washington a win over Beijing by bringing a Chinese technology crown jewel under U.S. ownership. For TikTok parent ByteDance it would resolve the national-security concerns that threatened to thwart its U.S. operations. The proposed transaction gained the blessing of senior Trump officials, including Treasury Secretary Steven Mnuchin, who saw value in an American company getting access to sophisticated TikTok algorithms that decide what videos users are served.

The deal would land Microsoft the breakout social-media player of this decade. It would give Washington a win over Beijing by bringing a Chinese technology crown jewel under U.S. ownership. For TikTok parent ByteDance it would resolve the national-security concerns that threatened to thwart its U.S. operations. The proposed transaction gained the blessing of senior Trump officials, including Treasury Secretary Steven Mnuchin, who saw value in an American company getting access to sophisticated TikTok algorithms that decide what videos users are served.

“Now I will tell you the answer to my question. It is this. The Party seeks power entirely for its own sake. We are not interested in the good of others; we are interested solely in power, pure power. What pure power means you will understand presently. We are different from the oligarchies of the past in that we know what we are doing.

All the others, even those who resembled ourselves, were cowards and hypocrites. The German Nazis and the Russian Communists came very close to us in their methods, but they never had the courage to recognize their own motives.

They pretended, perhaps they even believed, that they had seized power unwillingly and for a limited time, and that just around the corner there lay a paradise where human beings would be free and equal.

We are not like that. We know that no one ever seizes power with the intention of relinquishing it. Power is not a means; it is an end. One does not establish a dictatorship in order to safeguard a revolution; one makes the revolution in order to establish the dictatorship.

The object of persecution is persecution. The object of torture is torture. The object of power is power. Now you begin to understand me.” ? 1984

Despite the glorious leadership of Big Brother Trump, we will be shorting the Nasdaq (/NQ) Futures at the 11,000 line with tight stops above, any time we get a break below this week – starting with this morning. Apple had their eanings report but now we hear from the rest of the Qs and some of them are bound to be ugly.

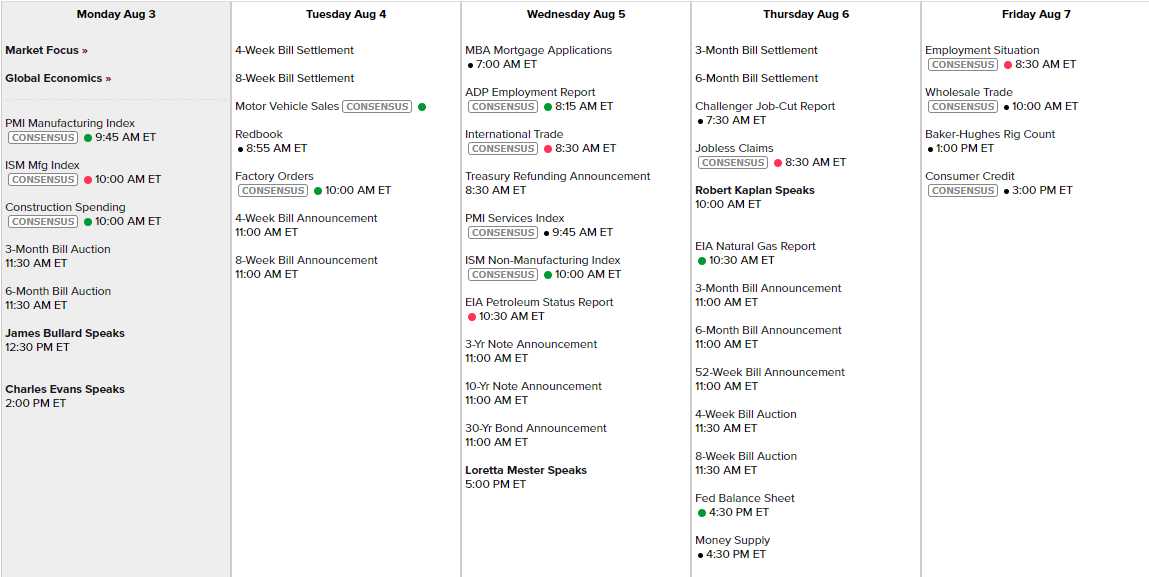

We have our Non-Farm Payroll Report on Friday, PMI, ISM and Contstruction Spending today, Factory Orders tomorrow and PMI & ISM Services on Wednesday, so some good data to chew on along with 4 Fed speeches but the real news is the earningspalooza this week with about 1/4 of the S&P 500 reporting:

God money's not looking for the cure.

God money's not concerned with the sick among the pure.

God money let's go dancing on the backs of the bruised.

God money's not one to chooseHead like a hole.

Black as your soul.

I'd rather die than give you control.Bow down before the one you serve.

You're going to get what you deserve.