5,045,564.

5,045,564.

That's how many cases the US officially has (not that we are counting). 162,938 Americans are dead, that's much harder to cover up. Globally we are about to cross 20M cases at 19,877,261 with 731,570 deaths so the US has more than 25% of the global cases and 22% of the deaths – despite having just 3.7% of the population so Trump is right – America is leading the world by a factor of 6 – no one transmits the virus or dies from the virus like we do! MAGA!!!

The markets don't seem to mind and we're still up around record highs as the worst things are for the American people, the better things are for American Corporations, apparently, as the stimulus fairy comes and pays them visit after visit. President Trump played the fairy this weekend, waving his executive action wand and unconstitutionally wishing for various bribes to the voters:

- $400/week supplement to unemployment checks (states need to pay for it and Federal supplement comes from Disaster Fund that's meant for hurricanes, etc).

- Suspend payments on Student Loans through 12/31 (but not the interest).

- Extend eviction protection through 12/31 (the courts can't handle the backlog anyway)

- Defer Payroll Taxes through 12/31 (a disaster for the Social Security and Medicare System and also puts a huge tax burden on the employees at the end of the year they are unlikely to manage for, which will be blamed on Biden as a tax increase, of course)

In other words, Trump's Executive Orders are a whole lot of nothing but Congress and the White House have still failed to reconcile Democrats' $3.4Tn coronavirus-relief plan and Senate Republicans' far smaller $1.1Tn proposal. The Paycheck Protection Program expired Saturday. The future of the small business rescue plan is in limbo. “Meet us halfway and work together to deliver immediate relief to the American people,” Pelosi and Schumer said in a joint statement. “Lives are being lost, and time is of the essence.”

Joe Biden, noting that Trump signed the “half-baked” orders at his golf club in New Jersey, said they short-change the unemployed and trigger a “new, reckless war on Social Security." “These orders are not real solutions,” soon to be President Biden said. “They are just another cynical ploy designed to deflect responsibility. Some measures do far more harm than good.”

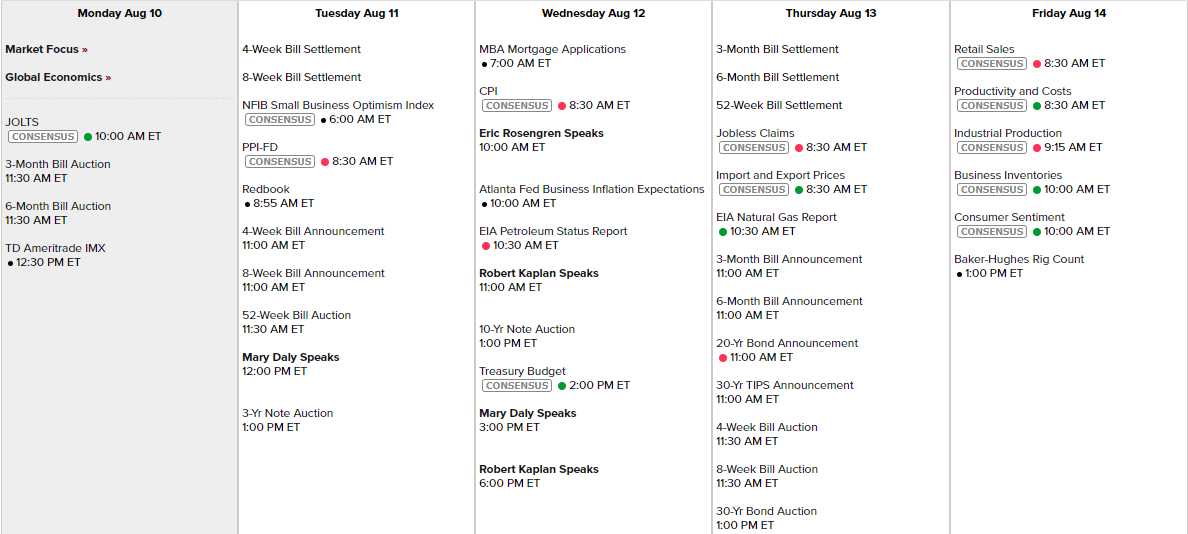

There's not a lot of data but 4 Fed speakers surround the 10-year note auction on Wednesday and we have a 30-year auction on Thursday and usually they like to scare investors out of stocks and into bonds ahead of these auctions so we're looking for the opportunity to short the Dow Futures (/YM) at 27,500 and the S&P Futures (/ES) at 3,350 and the Russell Futures (/RTY) at 1,580. The Nasdaq we leave alone as it's too crazy. You want to short the lagging index that crosses under and very tight stops above those lines!

We're still very busy with earnings season, which hasn't gone too badly so far – considering:

Now we're into the smaller companies though and we'll see how they held up in Q2.