Back to our highs, again.

Back to our highs, again.

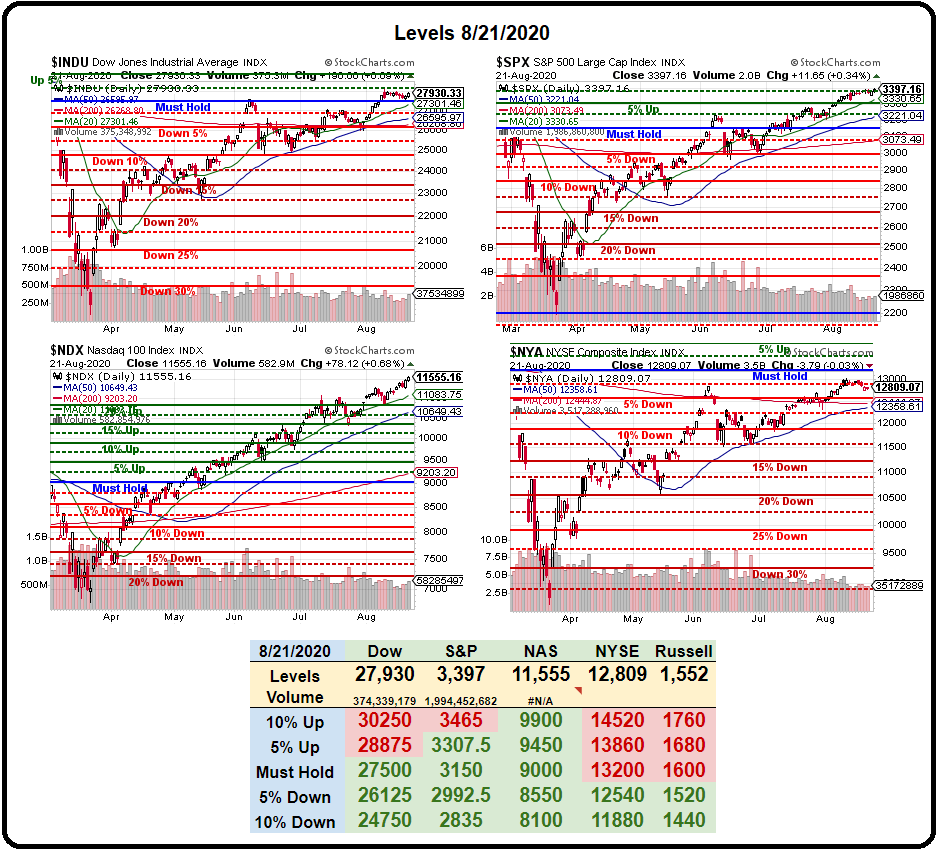

And what do we do when we hit the 20% line at 3,420 from below? NOTHING!!! What do we do when we cross under it from above shortly after that? We short it! That's right, the 5% Rule™ is not very complicated. In fact, this chart is saved in my StockCharts profile as "S&P 500 Large Cap Index ($SPX) Feb 6 2020" which means we've been using the SAME chart since before the crisis and we're STILL right where we expected to be over 6 months ago.

Remember, the 5% Rule™ is not TA – it's just math! Math is real, TA is not…

Math told us we'd bottom out at 2,280 and we went long at 2,280 and did very well and math told us we'll top out at 3,420 and we got much more bearish last week and now we'll see how that plays out. Hopefully, for the sake of the investors that are irrationally exuberant, we won't go down as sharply as we did in March. In fact, we can go down 20% and still be on a bullish track – as long as our "Must Hold" levels do continue to hold.

Unfortunately, the Must Hold levels are NOT holding on the NYSE and the Russell 2000 – our two broadest market indicators. That's because, as I noted in yesterday's Report, this is a very narrowly focused rally led by the Tech Titans. In the Dow 30, the Nasdaq 100 and the S&P 500, it only takes a few strong stocks to lift the entire index but in the Russell 2,000 and the NYSE (2,800) we get a much broader measure of the market and that measure is NOT GOOD.

Unfortunately, the Must Hold levels are NOT holding on the NYSE and the Russell 2000 – our two broadest market indicators. That's because, as I noted in yesterday's Report, this is a very narrowly focused rally led by the Tech Titans. In the Dow 30, the Nasdaq 100 and the S&P 500, it only takes a few strong stocks to lift the entire index but in the Russell 2,000 and the NYSE (2,800) we get a much broader measure of the market and that measure is NOT GOOD.

The NYSE was at 14,183 in January and now it's under 13,000 so about 10% down for the year and the Russell topped out at 1,700 and is now 1,568 – also down about 10% for the year. When you think about it, that does seem about right considering the economic mess we're in but optimists that we are, we focus on the indexes that are perfoming well and ignore the ones that are performing poorly even though, historically, the NYSE is a much better indicator of overall market direction than the smaller indexes.

In fact, in order to keep up appearances, the Dow Jones is kicking out Exxon (XOM – $42), Pfizer (PFE – $38) and Raytheon (RTX – $62), who they only just added in April (to replace UTX) and is replacing them with much more exciting SalesForce (CRM – $208), Amgen (AMGN – $235) and, coming back from vacation (they were kicked out in 2008) – Honeywell (HON – $169). I'm sure some of you are clever enough to see a pattern – they are replacing the stocks with much more expensive stocks and that matters a lot because the Dow is a price-weighted index so a 10% gain in XOM would be $4 x 8.5 points per $1 would add 34 Dow points but a 10% gain in AMGN would be $23 x 8.5 = 391 Dow points added.

So you can see how these shufflings can drastically influence the index and give us a very false impression of the market's performance since, Globally, the Dow is the leading indicator for the US markets, even though it shouldn't be (see "Doubting the Dow"). On the other hand, should the market turn south, the additional weighting of these new components, which are all trading at highs, could lead to catastrophic losses in the index. AMGN and HON are both good stocks and strong values but CRM at $208 has a $187Bn market cap after climbing 25% this year but they only generate about 125M in profits so $187Bn is 1,496 times earnings and total sales were only $17Bn last year so you're paying 11x sales for CRM – steep by any standards.

When you invest in a Dow index fund (and almost anyone who has a retirement account does that) you are forced to buy the good with the bad and CRM is definitely the bad from a value perspective. The Dow (/YM) is very close to 28,500 this mornng so it makes a good short and, as noted above, we short the S&P (/ES) when it crosses below 3,420 and, of course, stop out if it crosses back above.

Be careful out there!