GDP is coming at 8:30 and it's going to suck.

GDP is coming at 8:30 and it's going to suck.

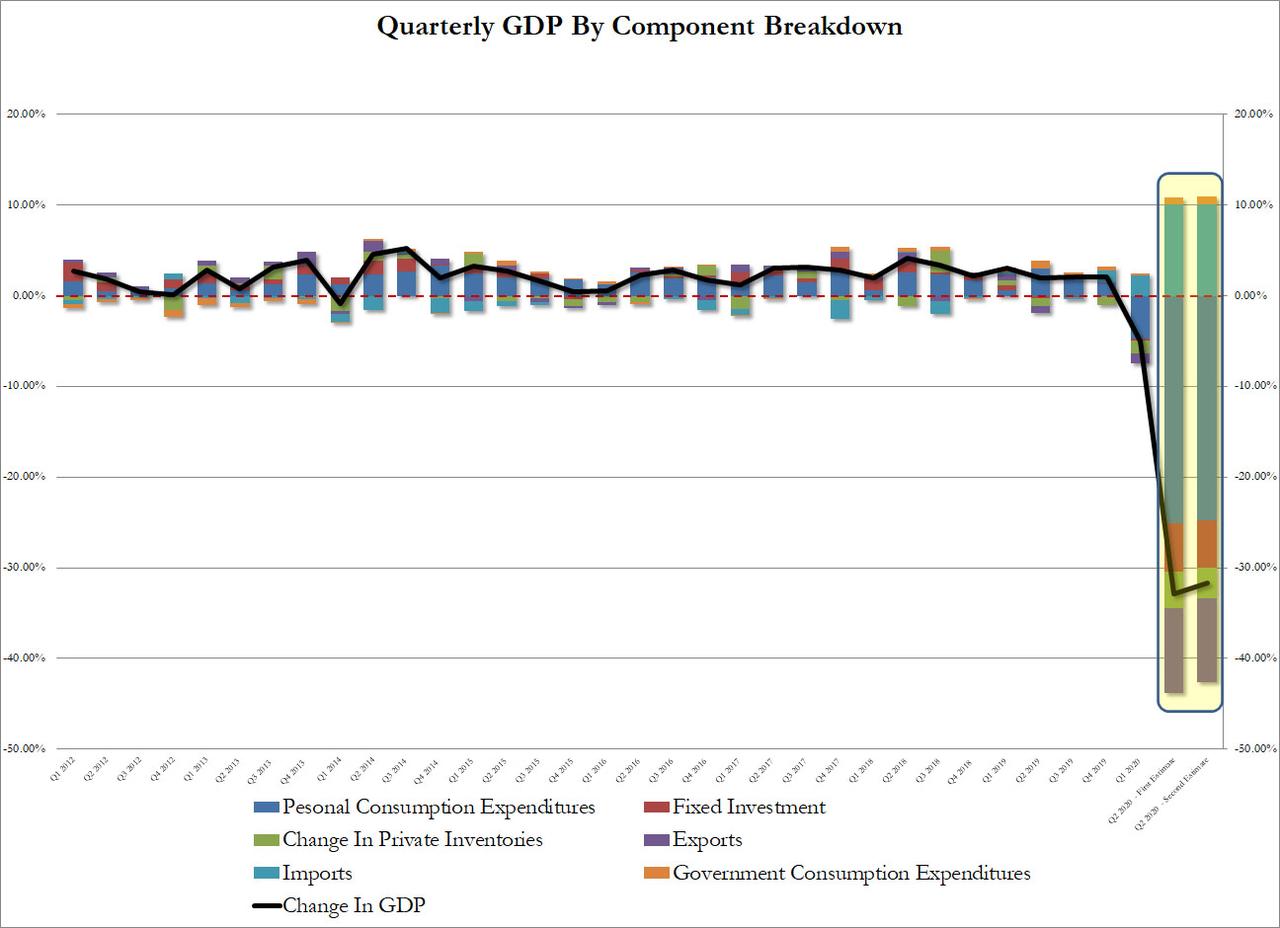

-32.5% is expected and it's the 2nd revision to Q2's GDP, so there's not likely to be anything very surprising. As we noted yesterday, what really matters is how much Q3 improves but we're a long way from finding that out so people will speculate off Q2 and that's why Powell is scheduled to speak at the market open – in case we start selling off as people realize a -32.5% GDP doesn't quite square with record-high equities.

Covid cases are over 24M this morning around the world and India is seeing a record spike and South Korea, Italy and France reporting the most new daily infections in months. The US has gotten their infections under control by no longer testing people. The U.S. Centers for Disease Control and Prevention’s shift in guidance on Covid-19 testing away from asymptomatic individuals this week alarmed many public-health experts who say it’s a wrong turn that could restrict how many tests are performed.

CNN reported on Wednesday that the CDC guidance change was due to pressure from Trump administration officials, citing an unidentified official. New York Governor Andrew Cuomo called the move “political propaganda” and an effort by President Donald Trump to bring down the number of cases with less testing.

CNN reported on Wednesday that the CDC guidance change was due to pressure from Trump administration officials, citing an unidentified official. New York Governor Andrew Cuomo called the move “political propaganda” and an effort by President Donald Trump to bring down the number of cases with less testing.

Public health experts said the new guidance, released as part of an unpublicized update to the CDC’s website, could in fact cut down on testing. “This makes no sense,” wrote Leana Wen, a physician who formerly led Planned Parenthood and currently serves as visiting professor of health policy and management at George Washington University, in a tweet late Tuesday. “We need more testing, not less.” Howard Forman, director of the Yale School of Public Health’s health-care management program, called the shift “insane and counter to all the best evidence that we have about how testing is supposed to work and appears to work.”

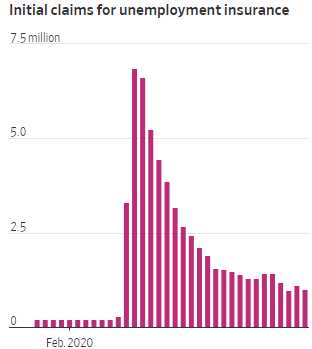

Speaking of work – another 1M people got laid off this week, indicating the jobs picture is getting worse, not better. Also, keep in mind that the unemployment bonus has now beek gone for a whole month and Congress took a vacation instead of extending it and they are gone for 2 more weeks so we are only just starting to see the repercussions of lower consumer spending.

Speaking of work – another 1M people got laid off this week, indicating the jobs picture is getting worse, not better. Also, keep in mind that the unemployment bonus has now beek gone for a whole month and Congress took a vacation instead of extending it and they are gone for 2 more weeks so we are only just starting to see the repercussions of lower consumer spending.

The index of Consumer Confidence dropped in August to its lowest level since 2014, the Conference Board said Tuesday, which some analysts said could reflect growing consumer concerns about the diminished federal aid. Weaker consumer sentiment also underscored Americans’ souring views about their labor-market prospects. The percentage of consumers in the Conference Board’s survey saying jobs are plentiful dropped to 21.5% in August from 22.3% in July. Meanwhile, those claiming jobs are hard to get rose to 25.2% this month from 20.1%.

With Stimulus Checks on Hold, Americans Are Spending Less at the Grocery Store

“It’s massively concerning that five months into this crisis we are still seeing those levels,” said Ann Konkel, an economist at the job site, Indeed, “It’s just really pointing to how much economic pain there is right now, and I don’t really expect that to change anytime soon.”

Job postings on Indeed declined for two consecutive weeks in August, which Ms. Konkel said could point to an economic backslide. Indeed job listings for higher-wage occupations have declined more than for lower- and middle-wage positions. Such a trend could point to long-term uncertainty among employers, as those in higher-wage sectors might plan their head counts based on projections for business demand several quarters into the future, according to Indeed.

8:30 Update: We dodged a bullet so far as GDP has been revised slightly higher (slightly less lower, actually) at -31.7%. That's better than being revised down but keep in mind we re-opened Mid-May and a lot of people ran out and partied and then, in mid-June, we realised that was a bad idea and began shutting down again. Now we're sending our children back to school because sending them to the beaches worked so well – so we'll see how this little experiment goes in Q3.

Powell is making all the right noises in his speech, saying the Fed is willling to allow inflation to move above the 2% line in order to get the economy back on track so the markets are flying higher once again. I was going to call for shorts but it's best just to sit back and wait to see when and if the markets do ever calm down. This will also push the Dollar lower and support oil. Look for 3,500 on /ES to provide some resistance but this is a major policy change that's very bullish.