Well, that was predictable.

Well, that was predictable.

How predictable? So predictable that I wrote on Sunday:

Remember, the 5% Rule™ is not TA, TA is nonsense, the 5% Rule™ is MATH! Math is how we describe the universe – including the market universe. The math of the 5% Rule™ tells us that 25% (3,562) is just the 20% line (3,420) with an overshoot but now the key is how much of a pullback do we get? If the 20% line holds, then this could be bullish consolidation for a move up but, if it fails, then we can expect at least a 20% retrace of the 20% move up (-4%) and that would be 3,420-2,850 = 570 x 0.2 = 114. So 3,420 – 114 = 3,306 – that's the pullback line we need to keep an eye on.

As usual, the bounce is more predictable than the recovery but the bottom line is both parties are, once again, talking about stimulus because they know as well as I do that failing to hold 3,306 would take us down to the strong retrace line at 3,135 and that would be more than a 10% correction off the 3,588 high (3,229), which would set off all kinds of panicky indicators so GAME ON for more stimulus talks – even if it is the same BS they were arguing over in June and July with no resolution (they took August off to watch the country burn).

So of course we're going to bounce off the line we predicted we'd bounce off. The question is – how much? Here's where the 5% Rule™ gets a little tricky because there's two zones we're looking at. One is easy, that's simply the total drop from 3,600 (we give them the extra 12 points) to 3,300 and that's 300 points so we expect 60-point bounces to 3,360 (weak) and 3,420 (strong) and, since 3,420 is our 20% line – that's going to be a very serious win/lose line for the S&P 500.

The other calculation we can do is going to be more accurate and that's using our 5% lines from 2,850, which is the Must Hold line on the S&P 500 (the line below which we are no longer in a bull market) so 3,420 is the 20% line and 3,562 is the 25% line and we overshot that a little but we'll ignore that for the moment. 3,277 is the 15% line so that's the real zone the S&P is in at the moment, between the 15% and 25% lines so that's the range we need to pay attention to!

Notice the 200-2 hour (what that chart's units are measuring) moving average is also coming up to meet the weak bounce line and almost right at our 3,306 prediction as well. That means there is a lot of support there but it also means failing that will mean there isn't any further support until the 200-day moving average at 3,100 where it will meet our Strong Retrace line at 3,135 and, by the way, the 50-day moving average for the S&P 500 is 3,305.37 this morning – right on the money for our 3,306 prediction.

That's why the 5% Rule™ is better than TA – TA only tells you what did happen after the fact, the 5% Rule™ tells you what the chart will look like well in advance (see: "Charts From the Future: 5% Rule Update" and "5% Rules! How Can We Be So Right?").

And, of course, the 5% Rule™ doesn't tell us what's going to happen – it only tells us where the resistance points are – it's our Fundamental Analysis that tells us what is likely to happen and then we calculate the resistance points and THEN we run FA again to determine whether or not the resistance points are likely to be overwhelmed by the Fundamentals and THEN we have a prediction. This is our key advantage over lazy TA people who don't do FA as well as Fundamentalists who don't take TA into account.

And, of course, the 5% Rule™ doesn't tell us what's going to happen – it only tells us where the resistance points are – it's our Fundamental Analysis that tells us what is likely to happen and then we calculate the resistance points and THEN we run FA again to determine whether or not the resistance points are likely to be overwhelmed by the Fundamentals and THEN we have a prediction. This is our key advantage over lazy TA people who don't do FA as well as Fundamentalists who don't take TA into account.

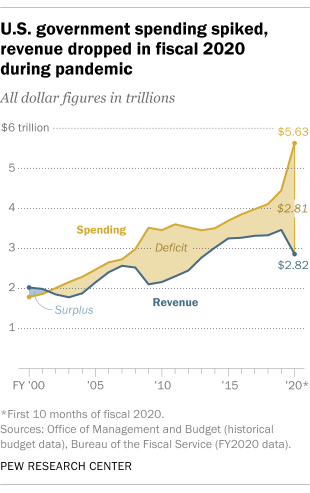

So what is going to happen? Well now it's Macro FA time and the big swing factor is stimulus. The Republicans are willing to sign off on $1Tn and the Democrats want $3Tn but Trump doesn't want a $7Tn deficit for 2020 as it might make him look bad (ROFL!) or he may have to admit he hasn't really defeated the virus yet, which is kind of his whole re-election platform.

Of course the connundrum is that more stimulus weakens the Dollar which helps boost the market and, as we expected, the Dollar bottomed out last week and has bounced back a bit and $1Tn addtitional stimulus is baked in already and even a compromise of $2Tn is to be expected so we're not going to weaken the Dollar much more, pre-election, without a $3Tn stimulus bill so below $2Tn would actually be a disaster for Trump as it would not be enough to strengthen the economy nor would it be enough to weaken the Dollar.

But Trump doesn't care about what's actually good for the economy, only what's going to get him re-elected in two months. That means his best play is the Brexit play (also orchestrated by Russia to destroy an economy) in which NOTHING happens at all and all the fighting is a huge distraction that the British Conservatives (also backed by Russia) were able to play off in order to consolidate their power. So it's more likely we don't get a stimulus deal pre-election or maybe an October surprise deal Trump can take credit for but, in the short-term, we are heading for virus spikes during back-to-school season and no proper stimulus so no, I don't see the market poppng back over 3,420.

If 3,420 (the 20% line) becomes the top of the pre-election range then 3,135 (the 10% line) is hopefully the bottom and that's the line where I'd expect the GOP to capitulate and pass some stimulus before we find ourselves on the way to a 20% market plunge right into the election.