Up and up we go.

Up and up we go.

As we discussed last week (when we failed at 3,420), 3,420 is our Strong Bounce Line and the 20% Line so we knew we were likely to re-test it – the question is whether or not the S&P passes the test and we may find that out this morning as the Futures are pointing up yet another 1% – just like yesterday when we made most of our gains in the thinly-traded pre-market session.

We do have some actual good news this mornng as China's Retail Sales picked up nicely in August, which is good for the Chinese Economy but that has nothing to do with whether Western economies are picking up – we get our own Retail Sale Report on Wednesday. If that matches, then it's good but it's still not record-high good, is it?

China’s economic recovery accelerated in August, with retail sales, the last noncooperative component, returning to pre-coronavirus levels by showing their first month of growth this year.

Now, with no local cases reported in weeks, shopping malls, restaurants and gyms across the country are packed with consumers again. Movie theaters—the last major holdout among public venues—reopened in late July. During the last 10 days of August, official data showed box-office revenue returning to 90% of year-earlier levels.

“The retail sales data indicate that pent-up consumer demand was released in August when social-distancing rules were further relaxed,” said Larry Hu, an economist with Macquarie Group.

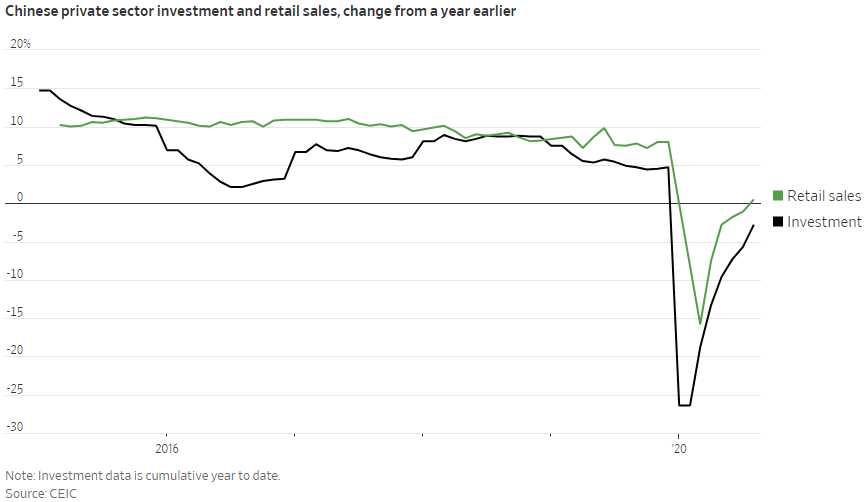

NO LOCAL CASES THIS WEEK! Is that a situation we are going to have in America this week? Next week? Next month? Then why would you react as if what's happening in China is going to happen here? Also, keep in mind that Retail Sales are up but up from a catastophe – not actually UP:

Just because a coma patient twitches his finger, you don't sign him up to run the Boston Marathon the next day! August data released Tuesday showed sales of retail goods moving back into growth territory for the first time this year, rising 0.5% from August 2019 levels. Private-sector investment, which tends to be tied to consumer-facing sectors, was still down in the first eight months of the year compared with the same period in 2019.

The data offer some vindication of China’s coronavirus-fighting strategy, which focused on tough shutdowns followed by substantial infrastructure investment and support for businesses, rather than measures to goose consumption. Western countries, with a larger portion of their economies tied to consumption, understandably have been more eager to support incomes – but we haven't stopped the virus and we haven't built any lasting infrastructure defenses – we're just hoping it all goes away still.

So we're sticking with our strategy of shorting the indexes (which didn't work yesterday) as we're likely to be rejected here (Dow (/YM) 28,100, S&P (/ES) 3,405, Nasdaq (/NQ) 11,475 and Russell (/RTY) 1,550) and, as usual, we can just short the laggards, which would be /ES crossing below 3,400 and /YM confirming below 28,000 – we should catch a quick ride down but the Fed goes tomorrow and that should give the marketsupport until they are disappointed by that so tight stops above!

Investors Push Back on Emerging Asia’s Record Borrowing Spree.

Oil Trapped Between Bearish Demand Outlook and Rallying Equities.

Citigroup to Resume Cutting Jobs, Ending Pause During Pandemic

Morgan Stanley Says a Stimulus Bust Delays Recovery Six Months.

Bill Gross Says Investors Should Play Defense as Stimulus Ebbs.

Amazon to Hire 100,000 in U.S. and Canada.

There’s $120 billion worth of commercial property debt threatened by West Coast fires.

BoJo Wins First Vote On Bill To Modify Brexit Deal, Infuriating Brussels.

Sunday Night Football Ratings Post "Steep Decline" Compared To Last Year.

Nikola Slides On Report SEC Is Examining Hindenburg's Fraud Allegations.