"At least one more cycle."

"At least one more cycle."

That's what former FDA Commissioner Scott Gottlieb said he expects for the US as the virus moves into the fall and winter when, presumably, it's more active. U.K. Health Secretary Matt Hancock said the country is at a “tipping point” and more measures will be taken unless people comply with rules to contain the resurgent coronavirus. He didn’t rule out national action.

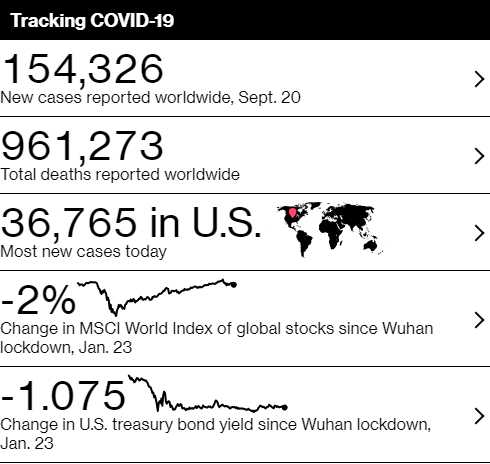

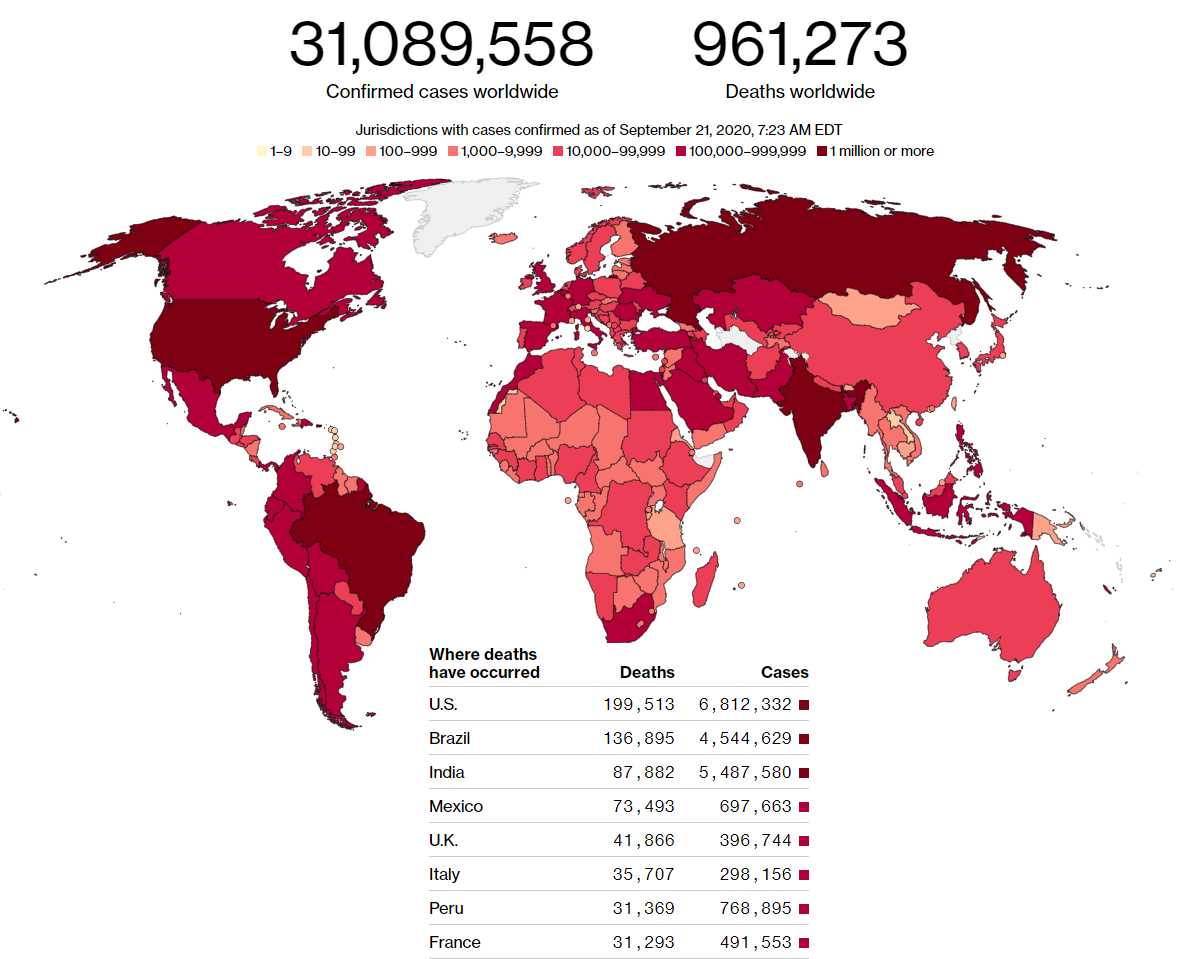

There were 36,765 new cases in the United States YESTERDAY – the most new cases on the planet Earth and almost half as many people that have been affected in China, TOTAL, in a single day – yet Trump still calls this the "Chinese Virus" despite America being the epicenter of the World since March.

If, as top scientists fear, we are heading into a second cycle of viral infections, we are now starting off a base of 31,089,558 cases in September vs 100,000 in March that expanded over 300 times in 6 months. Despite the cautions we have in place, 36,765 people in the US caught the virus yesterday – that's 1% of all the cases in the World, that's 30M cases in 100 days kind of pace. We are FAILING to contain the virus bigly:

“We have a very serious situation unfolding,” said Hans Kluge, the World Health Organization’s regional director for Europe. For the first time, he wore a mask at the press conference on Thursday. “The September case numbers should serve as a wakeup call for all of us.”

I'm sorry, I know this is depressing and not what we want to talk about in a stock market newsletter but this is REALITY and, as an investor, you can't afford to put your head in the sand and hide from unpleasantness because denying the reality of the situation can lead to even more unpleasantness in your portfolio when ignoring a problem doesn't make it go away.

I'm sorry, I know this is depressing and not what we want to talk about in a stock market newsletter but this is REALITY and, as an investor, you can't afford to put your head in the sand and hide from unpleasantness because denying the reality of the situation can lead to even more unpleasantness in your portfolio when ignoring a problem doesn't make it go away.

As noted above, the global markets are only down 2% since Wuhan was first locked down on January 23rd yet the Global Economy has taken a 20% hit in Q2 and is likely 10% down in Q3 so, if we're not out of the woods as we begin Q4 on October 1st – what the Hell are the markets so happy about?

We saw this coming (early) back on August 22nd, in our first Newsletter, where my opening line was: "GET OUT!!!" The S&P 500 was at 3,373 at the time and we did move up to 3,600 but now we're back at 3,254 and we'll be lucky to hold 3,200 with 3,000 being a more likely target for the next down move.

This morning, some of the largest technology companies, which helped drive the market to record highs over the summer, are now dragging it down. Sentiment has soured as investors assess an array of risks including delays to additional fiscal-stimulus packages, an increasingly heated U.S. election campaigning season, continuing tensions with China, and the threat of renewed lockdowns in many places because of higher coronavirus infections.

“The worry is definitely that we’re going to see restrictions on economies and that’s going to have a big negative impact going forward,” said Altaf Kassam, head of investment strategy for State Street Global Advisors in Europe. “There’s the noise from politicians across Europe on the threat of further lockdown, that we’ve reached a tipping point on the rate of infections.”

The Euro Stoxx Index is down 3.5% this morning and we're following suit in our own Futures. That 8/22 Newsletter was titled "View from the Top: Hedging for Disaster" and our two primary hedges were 10 TQQQ March $125/95 bear put spread at net $11 ($11,000) and 5 (post-split) TSLA March $400/October $400 calendar put spreads at net $37 ($18,600).

TQQQ is down to $111 this morning and the spread is $43/17 for $26,000 – a gain of $15,000 (136%) and the TSLA spread is now $90/40 at net $50 ($25,000) for a gain of $6,400 (34.4%). While it seems like the TQQQ spread is doing better, we only sold 2 out of 8 potential months of TSLA so far and those short October $40 puts are out of the money and stand to gain another $20,000 in 25 days if TSLA is over $400. This is how we use premium decay to our advantage in our hedges.

Since we haven't picked up too many longs in our Newsletter Portfolio, we're in very good shape for a further sell-off and I'm not in the mood to add more longs until we see how this week shakes out. Of course there will be more stimulus but the Fed was already disappointing last week and can't reverse themselves less than a week later so it's not likely more stimulus talk is going to help as everyone focuses on 200,000 US deaths and then 1M global deaths this week so virus, virus, virus will be the week's major topic.

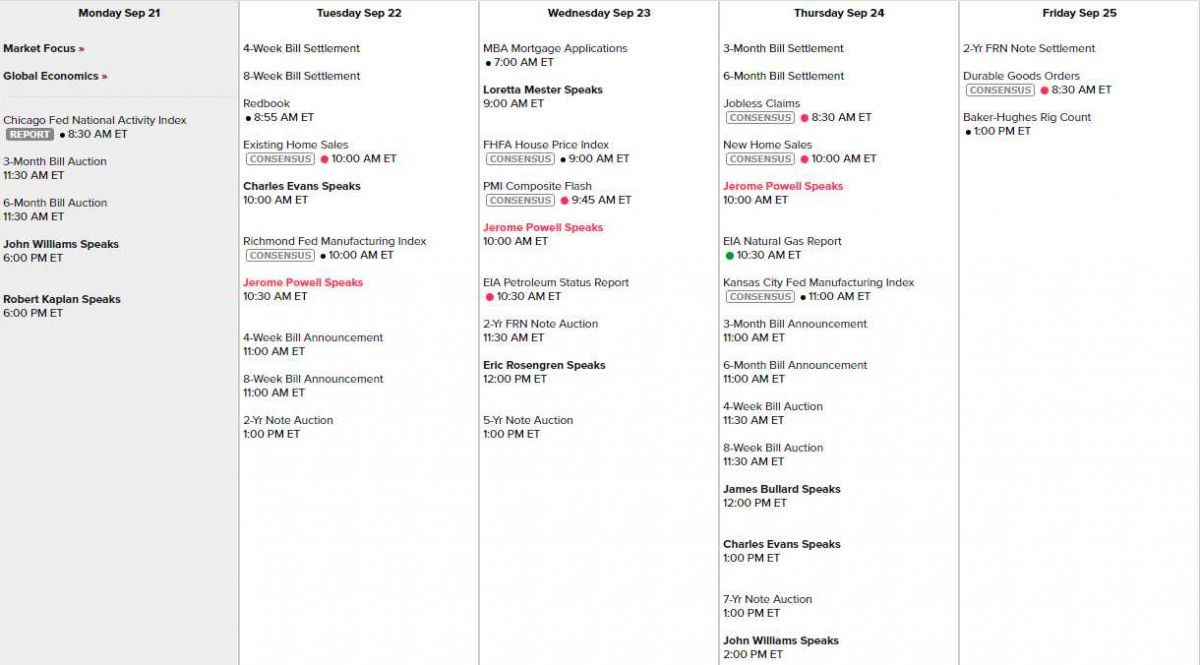

On the calendar, however, we have Powell speaking to Congress Tuesday, Wednesday and Thursday so maybe he can spin us a bit higher there. John Williams and Robert Kaplan speak this evening, Evans tomorrow, Mester and Rosengren surround Powell on Wedneday and 3 more Fed speakers on Thursday indicate that they are bound and determined to talk the markets up this week – whatever it takes (11 speeches, it seems).

Data-wise, we have the Chicago Fed, which already showed an anemic 0.79, down from 2.54 last month and tomorrow we have Home Sales and the Richmond Fed with PMI and Home Prices on Wednesday, New Home Sales and the KC Fed on Thursday and Durable goods bringing up the rear on Friday. Notice the Fed speeches are scheduled around the Fed reports so I don't think those reports are going to look very good – they already know that.

As predicted by our 5% Rule, we slipped to the 15% line on the S&P at 3,277 so we'll see if we can get back over that but, if we don't, we have a "death cross" on the 100-hour moving average (call it a week) moving below the 400-hour moving average (month) and that would not be good in the short-term for the markets:

Be careful out there.