This is how the Fed "fixes" the market.

Yesterday, the Chicago Fed's Charlie Evans said he would be "quite pleased" with 2.5% core inflation, a 25% increase in the Fed's Inflation Target. That was at 10:30 and the Dollar took a nose-dive all day, lifting the market over key techincal lines to give us the impression of market strength but, what we really got was Dollar weakness.

Equities are priced in Dollars so, if the Dollar is weak, you need to trade more of them for the same share of stock – the stock didn't get more valuable, your Dollar got less valuable but the chart doesn't know that, does it? Here's an interesting way to look at the market: This is the S&P 500 priced in Gold:

That's interesting, isn't it. Priced in Gold, this market peaked out back in 2018 at 2.450 and fell almost 50% to 1.325 (SPX/Ounce of Gold) and is now back to 1.78, still 27% off the highs. Of course gold isn't an absolute measure of the market but there's a reason GOLD (Barrick Gold) was our Stock of the Year for 2020 – inflation was always going to happen given our current monetary policies – the question was only "how much" and the Fed is now saying "a lot".

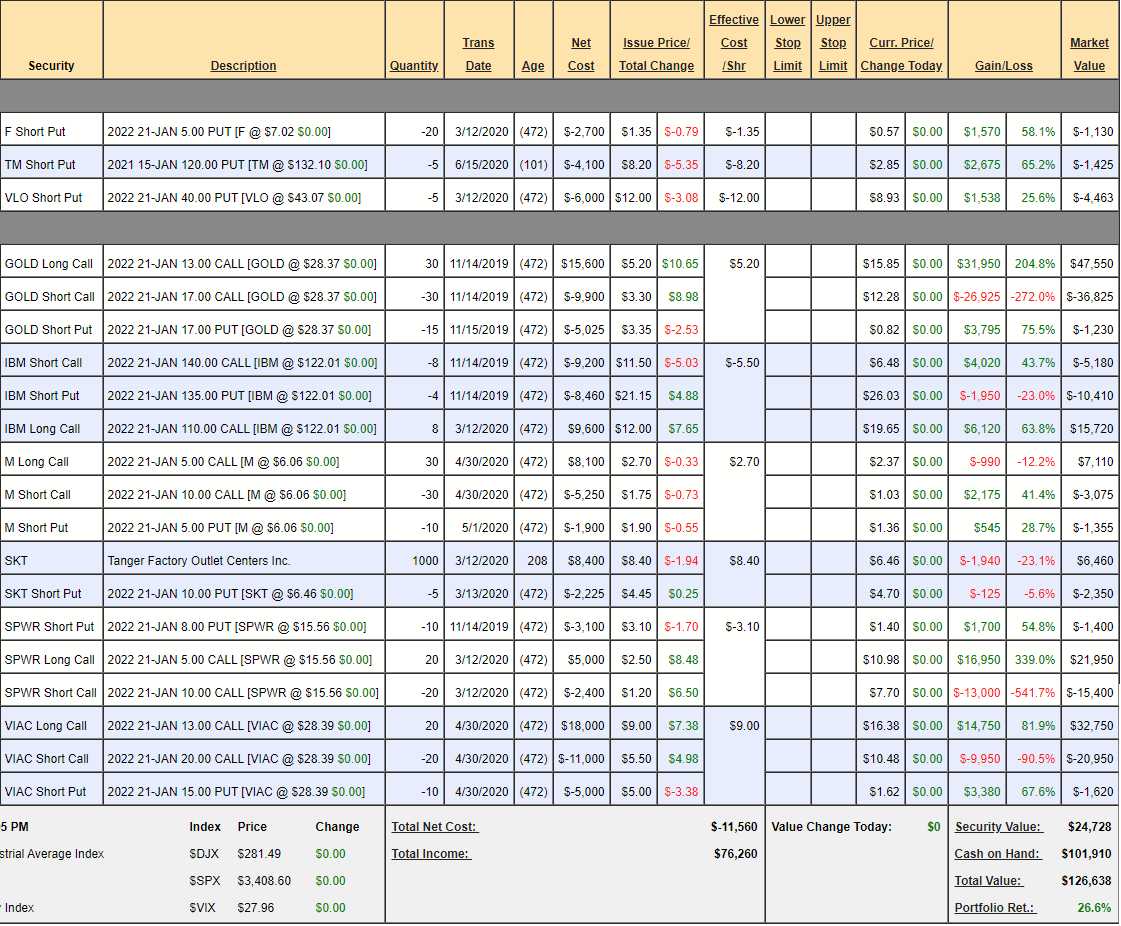

Speaking of our Stock of the Year, I'm going to be taping a segment for Money Talk this evening for airing tomorrow and we'll be talking about our Money Talk Portfolio, which features our Stock of the Year and plenty of other good picks so let's see who we want to add. Remember, the rules of the Money Talk Portflio are we only make our trades once per quarter, on the show, so we weren't able to take full advantage of the sell-off but we are still chugging along with a very nice 26.6% gain for the year so far:

- F – If we were assigned this position our net entry would be $3.65 so I'm not worried about this one. $1,130 (42%) left to gain.

- TM – This one is too expensive if it goes wrong so we should cash it out to reduce our downside risk.

- VLO – I think it's a fantastic value down here and we have $4,463 (75%) left to gain.

- GOLD – Our Trade of the Year has exploded past our expectations and we're 165% in the money so we're sure to collect the full $12,000 in 2022 and we're already at net $9,495 so $2,505 (26%) is respectable but we can replace it with 5 short GOLD 2023 $25 puts at $5 ($2,500) so let's cash this trade in and leave just those short puts. Our worst case scenariou would be having just 5 longs at net $20, so we'd start our cycle all over again.

- IBM – Our 2019 Trade of the Year is in the porfolio for a second round and pretty much on track but still only net $130 out of a potential $24,000 so this could be our 2021 Trade of the Year as well with $23,860 (17,142%) upside potential.

- M – Still a long way from gaining traction but we got in at a good price and we're at net $2,680 out of a potential $15,000 so still $12,320 (459%) left to gain if M can get back to $10 but anything over $7 in 16 months is going to be great for us.

- SKT – I love them as a long-term play. They are an outdoor mall operator and so undervalued. We have the stock because they used to pay a nice dividend (suspended) but I see no reason to let them go.

SPWR – They exploded higher and are now net $5,150 out of a potential $10,000 if they simply hold $10 so $4,850 (94%) to gain in 16 months is worth holding onto.

- VIAC – It was driving me crazy how cheap they were back in April and now taking off nicely and we're deeply in the money on our $14,000 potential trade, currently at net $10,180 so $3,820 (37%) left to gain over the next 16 monthhs is respectable enough to keep for now.

So the current positions in the Money Talk porfolio are already up $26,638 and, over the next 16 months, we expect to gain another $52,943 in upside potential so we hardly need a new trade but we did a Top Trade Alert recently on Pfizer (PFE) and that value, at 10x earnings, is too good to pass up and, as a bonus, they are a leading contender for the Covid vaccine as well.

We discussed PFE in the Morning Report: The Week Ahead – 3,350 is Critical for the S&P 500

Let's add PFE officially to the Money Talk Portfolio as it's a solid entry:

- Sell 5 PFE 2023 $35 puts for $6.25 ($3,125)

- Buy 10 PFE 2023 $30 calls for $8.30 ($8,300)

- Sell 10 PFE 2023 $37 calls for $5.00 ($5,000)

That's a net $125 credit on the $7,000 spread so our upside potential is $7,125 (5,700%) and our worst-case scenario is owning 500 shares at $35, which I doubt will be a bad thing.