Debtors Delight

Courtesy of Almost Daily Grant's

Debtors Delight

Instructive bond market action Down Under: Yesterday evening, Australia’s Treasurer Josh Frydenberg presented a budget to parliament anticipating an A$214 billion ($152 billion) deficit in the fiscal year ending June 30, equivalent to 11% of gross domestic product, as the country tries to climb its way out of its coronavirus-related economic hole. The economists’ consensus calls for an 8% unemployment rate by year end, a figure which would represent a 22-year high.

Australia’s sovereign creditors, already under the yoke of “yield-curve control” (the ReserveBank of Australia has established a 25 basis point ceiling on debt out to three years), reacted to the news of runaway deficits with something less than alarm. The yield on three-year government bonds sank to a record-low 12 basis points, down from 16 basis points on Tuesday. The 30-year bond yield, which is not under the yoke of yield-curve control, stayed little changed at 1.77%.

Trickled Pink

The fiscal stimulus saga continues apace in the nation’s capital, as President Trump tweeted yesterday evening: “If I am sent a Stand Alone Bill for Stimulus Checks ($1,200), they will go out to our great people IMMEDIATELY.” That’s a change from roughly eight hours prior, when POTUS declared: “I have instructed my representatives to stop negotiating until after the election.” Naturally, those conflicting tweets sent asset prices into spin cycle.

The fiscal stimulus saga continues apace in the nation’s capital, as President Trump tweeted yesterday evening: “If I am sent a Stand Alone Bill for Stimulus Checks ($1,200), they will go out to our great people IMMEDIATELY.” That’s a change from roughly eight hours prior, when POTUS declared: “I have instructed my representatives to stop negotiating until after the election.” Naturally, those conflicting tweets sent asset prices into spin cycle.

As the political class continues to bicker and markets gyrate, our monetary mandarins strike a consistent chord. Fed chair Jerome Powell seemingly addressed the fiscal powers-that-be in a speech yesterday: “The recovery will be stronger and move faster if monetary policy and fiscal policy continue to work side by side to provide support to the economy until it is clearly out of the woods.”

By Powell’s reckoning, the more the better: “At this early stage, I would argue that the risks of policy intervention are still asymmetric. Too little support would lead to a weak recovery, creating unnecessary hardship. . . even if policy actions ultimately prove to be greater than needed, they will not go to waste.”

“He’s become a broken record,” Diane Swonk, chief economist at Grant Thornton, tells The Wall Street Journal. “There is nothing all that new in the message, but the urgency is getting greater.”

From an output perspective at least, there is good reason for concern. As Bianco Research notes today, Wall Street economists now expect fourth quarter GDP to expand at a 3.6% annualized rate, a solid figure in normal times but far below the 11.5% fourth quarter estimate seen on June 11, as the U.S. economy wrapped up its worst quarter on record with a 31.4% sequential annualized contraction.

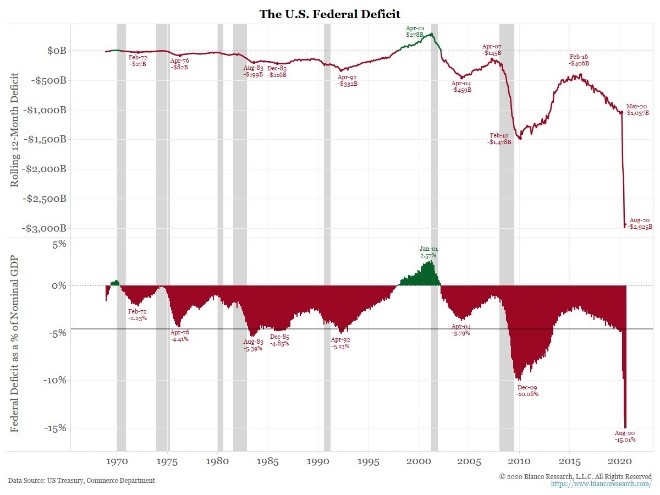

Then again, existing programs, like the $2 trillion-plus CARES Act signed in March, have pushed government red ink to previously unimaginable levels. A striking chart, posted on Twitter yesterday by Bianco Research co-founder and eponym Jim Bianco, puts this year’s exertions into historical context:

This afternoon’s release of the minutes from the Sept. 15-16 meeting of the Federal Open Market Committee laid out one argument for returning to the fiscal well : “Participants viewed fiscal support from the CARES Act as having been very important in bolstering the financial situations of millions of families, and a number of participants judged that the absence of further fiscal support would exacerbate economic hardships in minority and lower-income communities.”

Of course, Mr. Market hasn’t waited for Congress. Instead, ultra-loose monetary policy has seemingly done the trick, as evidenced by euphoric price action in stocks and speculative corners of the bond market since the spring.

One constituency seems to be faring pretty well in this pandemic-plagued 2020. The Financial Times relays some striking data, courtesy of UBS’s recently published annual report documenting the richest of the rich. The Swiss bank finds that the billionaire cohort had amassed a record $10.2 trillion of wealth as of July, topping the prior high-water mark set in 2017 and well above the $8 trillion logged in April.

The report puts it this way: “When the storm passes, a new generation of billionaire innovators looks set to play a critical role in repairing the damage.” Investment from tech-oriented billionaire investors, the report argues, “has the potential to help bridge financial social and environmental deficits.”

Or, perhaps, the opposite.

RECAP OCT. 7

Stocks raced higher with the S&P ripping nearly 2% to close within 4.5% of its Sept. 2 high-water mark, while Treasurys gave back some of yesterday’s feverish late rally with the 30-year yield rising to 1.58%. WTI crude fell below $40 a barrel following an unexpected weekly inventory supply build, while gold slipped back below $1,900 an ounce and the VIX retreated toward 28.

– Philip Grant

Image via Pixabay