No stimulus for you!

No stimulus for you!

President Trump returned from the hospital yesterday and decided to cancel the stimulus negotiations despite the constant cries from the Fed that the Government NEEDS to do something to get the economy back on track. Trump doesn't want to add to his deficit total, which will be about $4,000,000,000,000 this year, and his score is, of course, far more important than helping the people who elected him, right?

Trump did say he wants the Fed to cut rates a full point (to -0.75%?) and double down on QE as those are off the books measures that would work out very well for a Real Estate Tycoon who's about to be kicked back into the private sector.

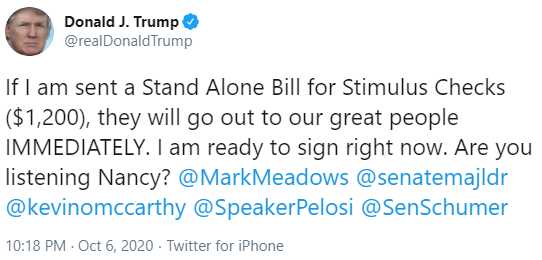

After getting blowback all night on stopping the stimulus talks, Trump tweeted at 10pm that he would sign a bill for stimulus checks and another tweet that Congress should approve $25Bn for Airlines and $135Bn for a Paycheck Protection program so, of course, after cancelling the negotiations to provide stimulus he can now claim he is trying to get more stimulus. When do we get to vote him out? Twitter responded:

After getting blowback all night on stopping the stimulus talks, Trump tweeted at 10pm that he would sign a bill for stimulus checks and another tweet that Congress should approve $25Bn for Airlines and $135Bn for a Paycheck Protection program so, of course, after cancelling the negotiations to provide stimulus he can now claim he is trying to get more stimulus. When do we get to vote him out? Twitter responded:

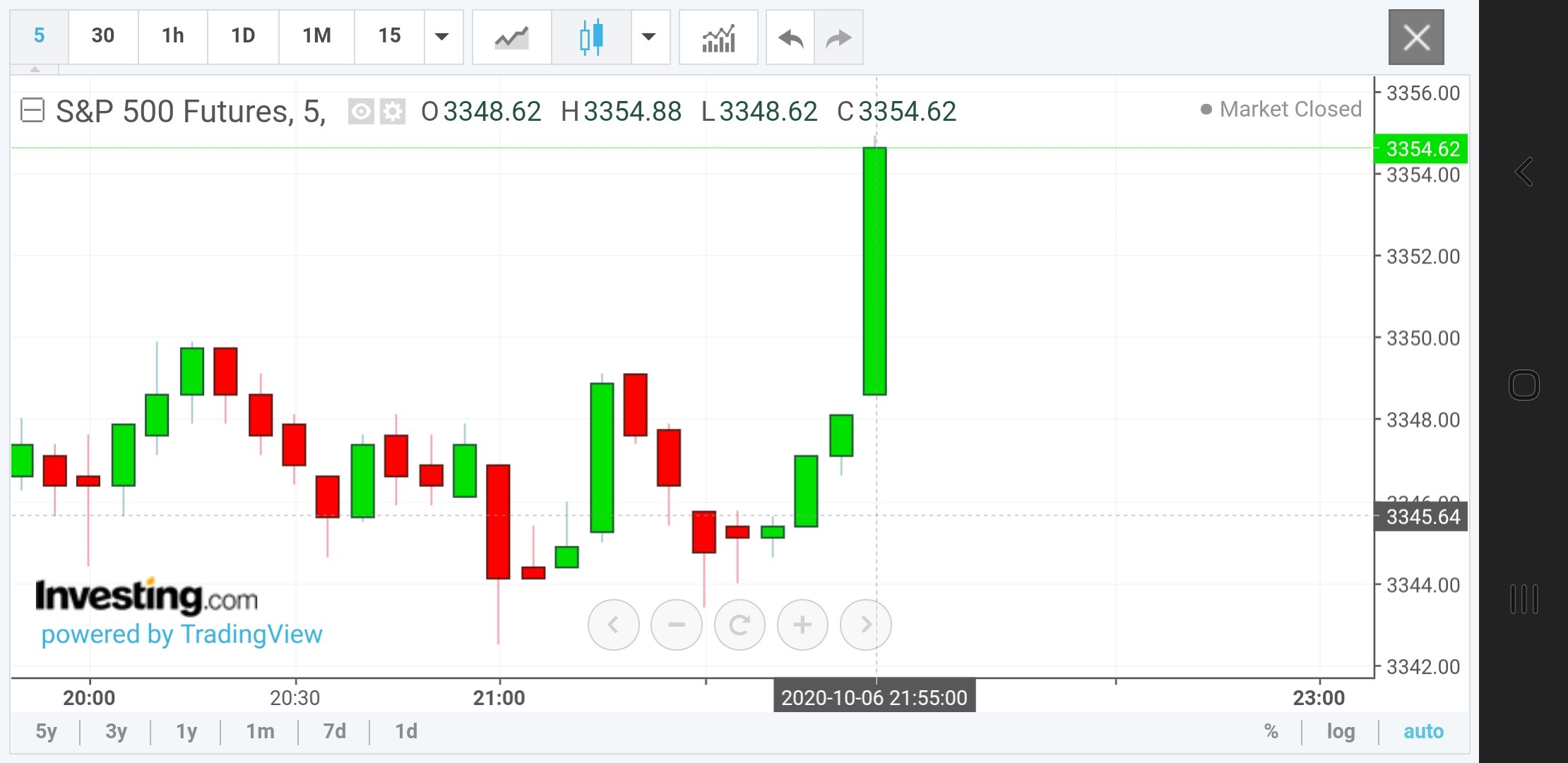

He's clearly spooked about Tuesday's stock market crash and sees that the Dow futures look ugly too, so naturally he's doing an about face and panic tweeting late into the night.

WHAT???? Bail out BIG BUSINESSES while AMERICANS ARE LOSING THEIR HOMES AND STANDING IN FOOD LINES!!!! BTW, that bs before, that you claimed was for small business was absolute bs! Larger businesses got it!!!

Airline payroll? Why not the 30 plus unemployed Americans who have been waiting on a real bill to pass since July? WTF Donald! Why Airlines first? Oh never mind That's right it's YOU who takes a personal hit if the airlines are unemployed………….

Walking away from the coronavirus relief talks just to shout on Twitter about your own agenda is something I’d expect a toddler to do. You’re the President of the United States. The American people are suffering. Yet you choose to play politics to benefit yourself. That’s crazy.

Thanks Donnie. I don’t know what else you might tweet tonight, but keep it pumping. Or dumping. I’ll follow the flow regardless.

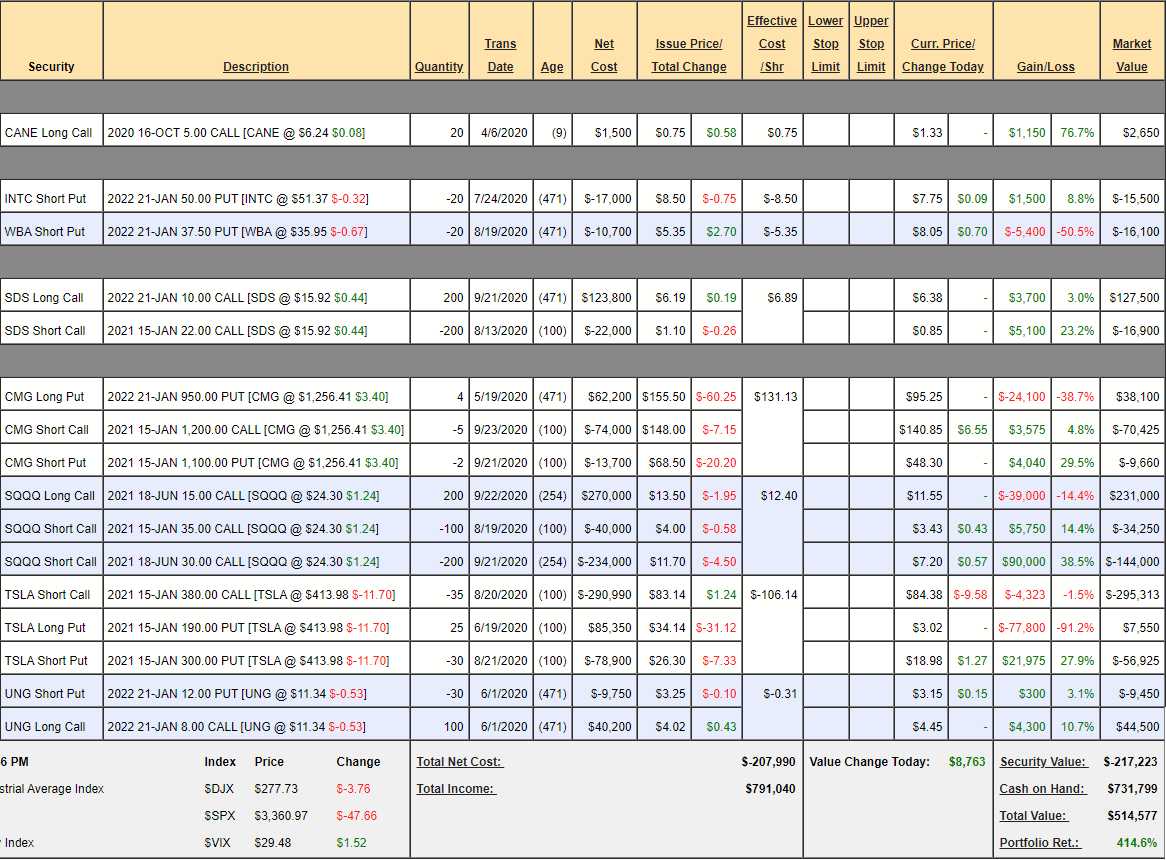

That's what we're doing at PSW, just going with the flow. We have some longs, we have some shorts and we try to keep things balanced while we wait PATIENTLY for the premium on the options we sold to decay. Last week, on the 28th, our Short-Term Portfolio (STP) was at $460,952 and our Long-Term Portfolio (LTP) was at $982,958 for a $1,443,910 total and, after yesterday's little dip, the STP is at $515,577 and the LTP is at $1,005,650, for a $1,521,227 total so we're UP $73,254 (5%) on that little correction – I'd say we're very welll-situated at the moment!

As anticipated in our last STP Review, we got back to even on our short TSLA calls so we thankfully exited half of those to remove some of the volatility of that position going forward. Those short calls are $84 and we certainly don't see TLSA being over $464 in January but – just in case, we're playing it a bit safer as it's been painful watching this portfolio go up and down based on that one stock. We need to be more sure about our hedges in these very volatile times ahead.