$1,566,572!

$1,566,572!

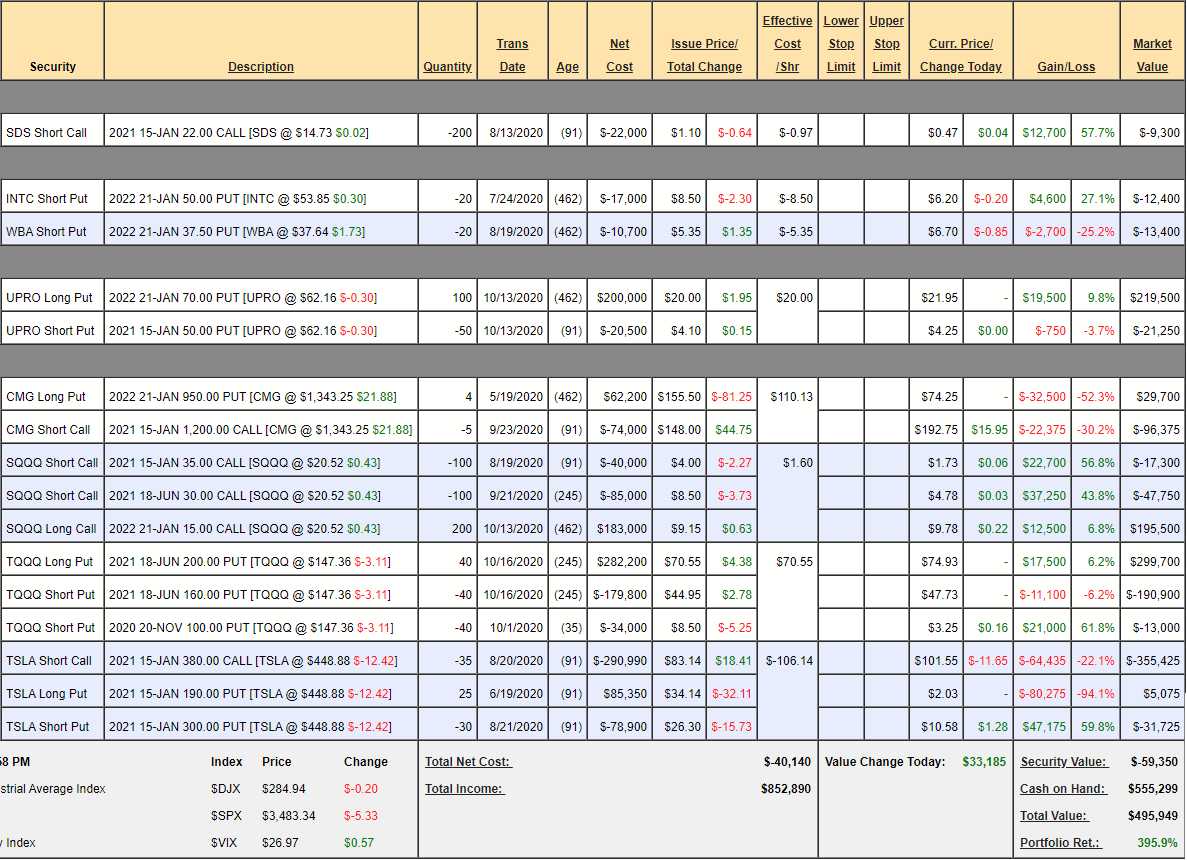

That's up $361,550 for our paired portfolios since our September 18th review and we only made one change in our Long-Term Portfolio – selling 5 calls against our Berkshire Hathaway position. The LTP went from $1,039,240 to $1,070,623 but the big move was the Tesla (TSLA) postion in the STP, that went from -$881,087 to -673,065 (including our 50% cash-out), accounting for over $200,000 of the gains. Because of the cash-out, TSLA is now less volatile for us as we wanted to be sure our hedges were true hedges into the Elections, Earnings and the Holidays – all hitting us bang, bang, bang for the next and last 77 days of 2020.

We just did our STP review on Tuesday and we got much more aggressively short in order to cover our now $1M gain for the year. It should be noted there was an error in the price of the SQQQ June $30 calls, which were sold for $8.50, not $11.70 (the put price) but, fortunately, our other positions acquited themselves and made up for the downward adjustment. We're also half CASH!!! in the STP and that means we're flexible and ready to take advantag of earnings season and we will be looking for bullish bargains because we have PLENTY of downside protection at the moment.

- UPRO is our new hedge and the short $50 puts are rollable so, in a catastrophe that brings us down to $30, we expect to be able to roll the short puts and end up with $400,000 from the long puts from our net $179,500 entry. If that does not happen, then the short puts will pay us $20,500 in January (already in the net) and another $80,000 over the next 4 quarters so the net cost of our $400,000 insurance policy should be about $100,000 when all is said and done.

- CMG – has earnings next week (21st)

- SQQQ – cost us net $58,000 and it's at least a $300,000 potential spread (rollable as well) and, of course, we will sell more short calls to pay down that $58,000 too.

- TQQQ – was net $68,400 and it's 100% in the money on the $160,000 spread so the only way we can lose money here is if the Nasdaq goes higher – which would be good for our longs. Also, if the Nadaq goes higher, we sell more short puts and pay off the $68,400 – THAT is how you hedge!

TSLA, of course, can pay us $380,000 if all goes well – that's nice too!

I'm not going to call TSLA a hedge as it's more like a bet, which is why we cut the short $380s down by 50%, as it was too volatile and we NEED to be sure the STP hedges pay off. Those 3 hedges are good for about $550,000 if the market tanks and that's half the value of the LTP, so I feel good about the hedges and our overall balance at the moment.

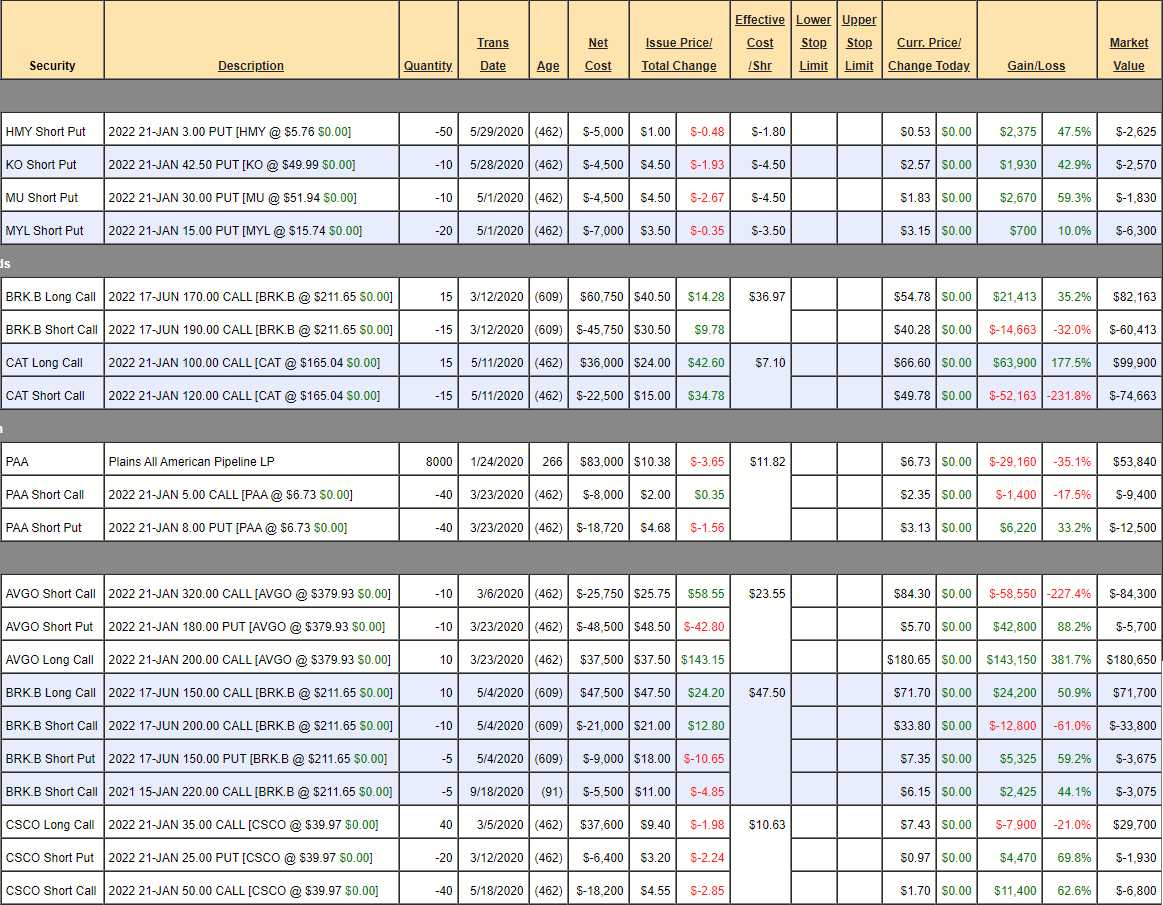

Long-Term Portfolio Review (LTP): As noted above, we're up a bit since our last review and that's fine with me as I'm happy just to maintain a double in this portfolio to close out the year. Remember: It's not a profit if you don't cash it in! Too much uncertainty ahead to gamble but we've purged these positions so many times there's nothing left in this portfolio that we don't love as a long-term play.

Short puts – We will certainly be adding more of these during earnings season. Getting paid to promise to buy a stock for less than it's currently trading for is the cornerstone of our long-term strategy!

I'm not going to do a big review as everything is on track at the moment, just a note if I have a conern or comment.

- GILD – Great for a new trade still. $45,000 potential at net $4,300 and all it has to do it get over $65 in 15 months.

- GS is brand new. This is a $40,000 potential spread at a net $650 credit – also with a very conservative $2.10 taget and 2 years to get there! If they are just going to give money away like this – you should take it!

- IBM also has that new trade smell. $30,000 potential at $125 (where it is now) and only net $3,150.

- IMAX – Well we're not coming back by December so let's roll those 40 Dec $10 calls at $1.95 ($7,800) that we paid net $2.75 for, to 50 of the 2023 $10 calls at $4 and we'll sell 50 of the June $12 calls for $2 for net $2 ($10,000) and we'll roll our 20 short Dec $15 puts at $4 ($8,000) to 20 short 2023 $12 puts at $4 ($8,000) so, in total, we're spending $2,200 to go from a $20,000 to a $20,000 spread that has 2 more years to go and can be rolled to a wider spread AND we're lowering our put obligaion by $6,000 (20%) – that's a good deal!

- MIDD – I don't want to risk the Dec $100 calls so let's be happy with $9.85 and cash out. I'm not worried about the short puts and the bull call spread is fully valued so we can take that off the table too.

- MO – Let's take advantage of the dip and buy back the short 2022 $50 calls for $1.22.

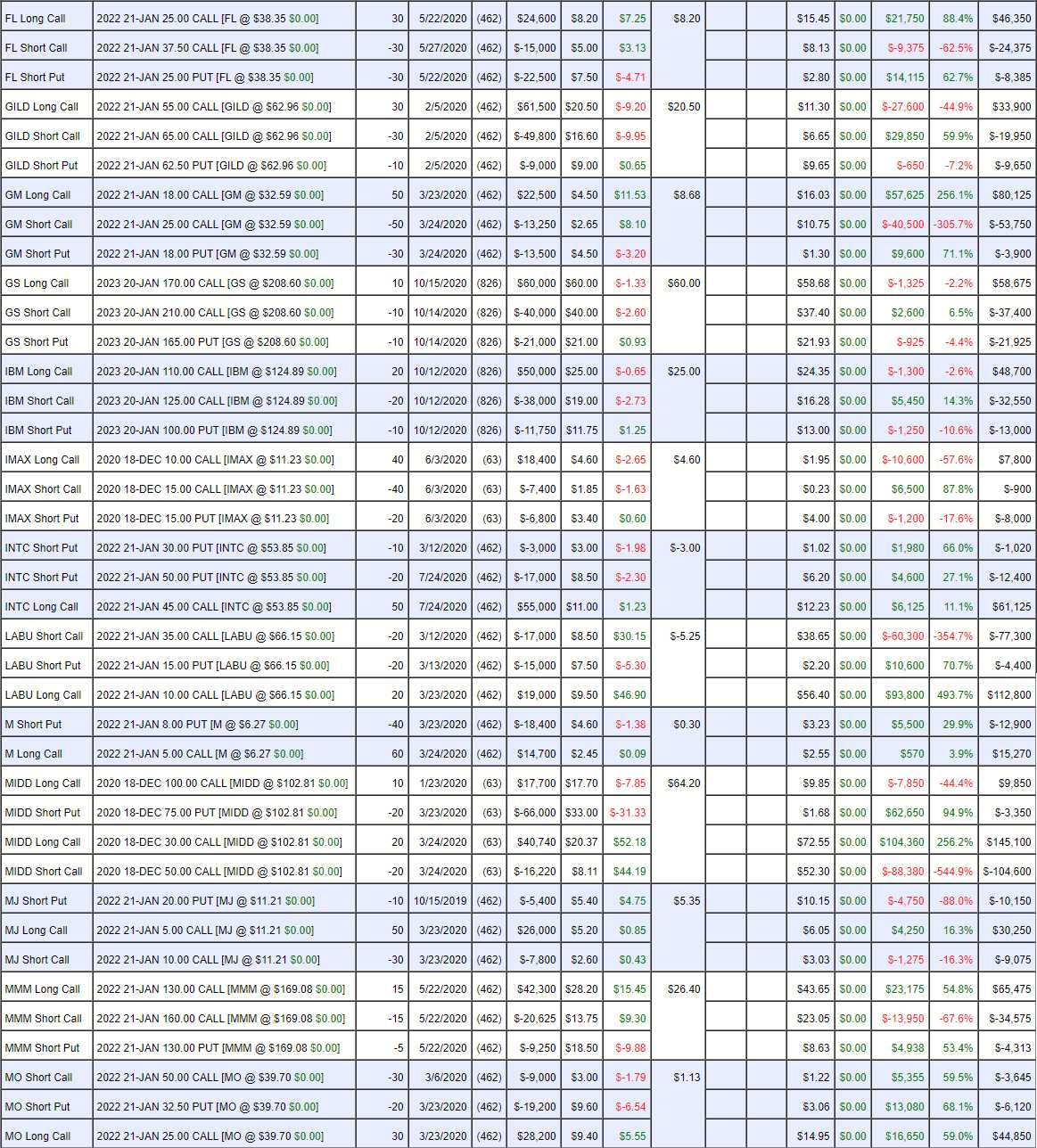

- PFE – Another new trade I like. $35,000 potential and still net $9,274 – even after we gained $2,175 in a few weeks.

- RH – $106,100 out of $120,000 potential means we have better things to do with the cash and margin than wait to make $13,900 more so let's take the CASH!!!

- SKT – Let's buy back the 40 short 2022 $8 calls for $1.15 and give it room to run. The 2023 $10 puts are $5.50 and our 40 short puts are $24,050 so let's roll them to 40 of the 2023 $10 puts at $22,000 to make things neat. We've collected $19,800 selling the original puts less the $2,050 cost of the roll is $17,750 so net $4.44 gives us a net entry of $5.56 if assigned – sounds good to me!

- SPWR – I just want to point out that this is a $56,000 spread you can still buy for $27,620 (over 100% upside potential for a spread that's 130% in the money) EVEN THOUGH we already made $25,460 off our net $2,160 entry. Aren't options fun?!?

- T – It's a new trade but it got cheaper so we'll take advantage by rolling the 2022 $28 calls at $2.31 ($17,325) to 100 2023 $25 calls at $4.30 ($43,000) and the rest we can leave for now. So we added 33% more and rolled the 75 calls $3 ($22,500) in the money and gave ourselves another year to grow AND now we can roll the short calls higher (2023 $35 calls are $1.10) or sell more for more money and all that cost us was another $25,675 on top of the net $6,875 we started the position with. THAT is how you scale into a position!

Scaling in doesn't always mean a bigger position – it's about increasing your ALLOCATION to a position. Improving your strikes, widening your spreads, buying more time to grow – those are all ways to improve your position besides increasing the number of contracts. We've actually lowered our break-even point from $29 to $28.50 and increased our upside potential substantially.

- WBA – Earnings were good! If we get back to $45, the calls will be $75,000 and the short puts worthless and currently it's net $23,600 so good for a triple from here.

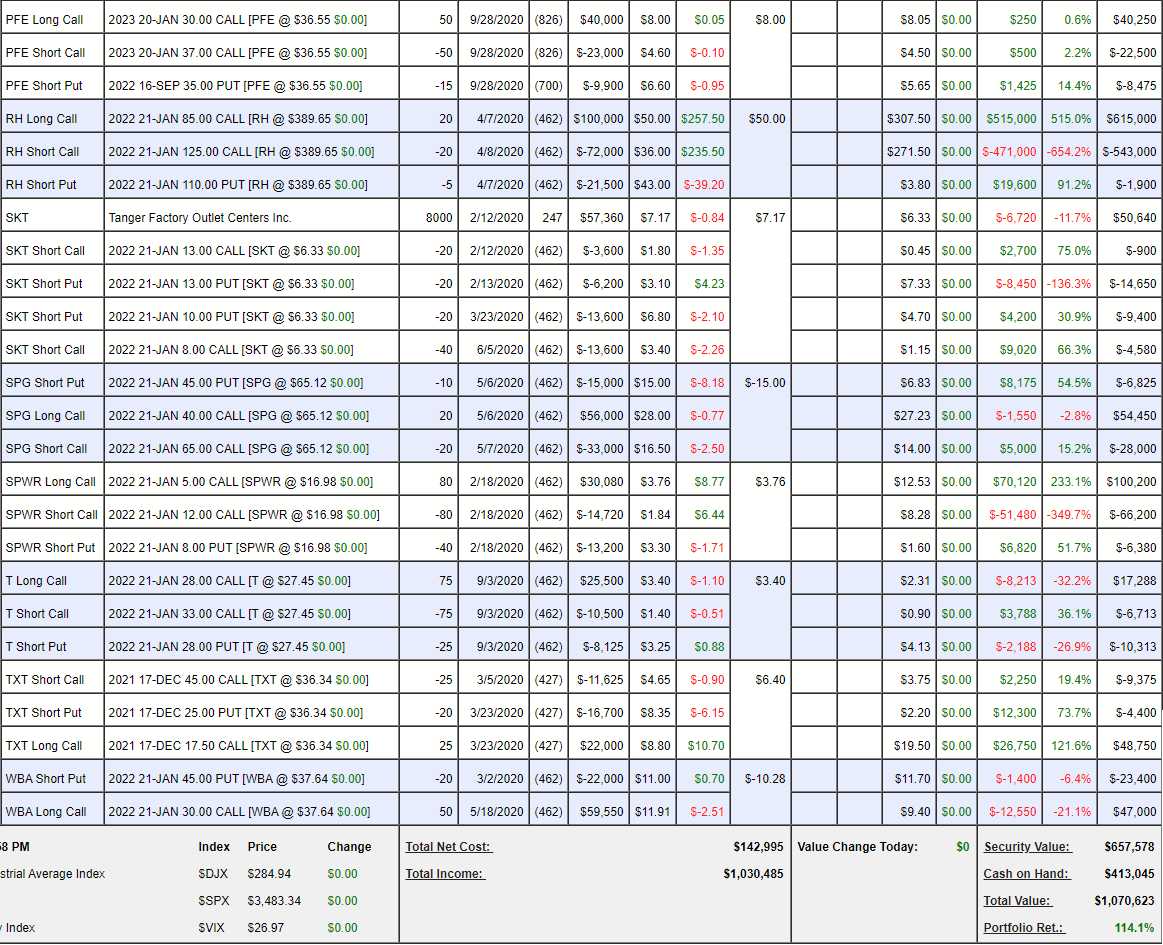

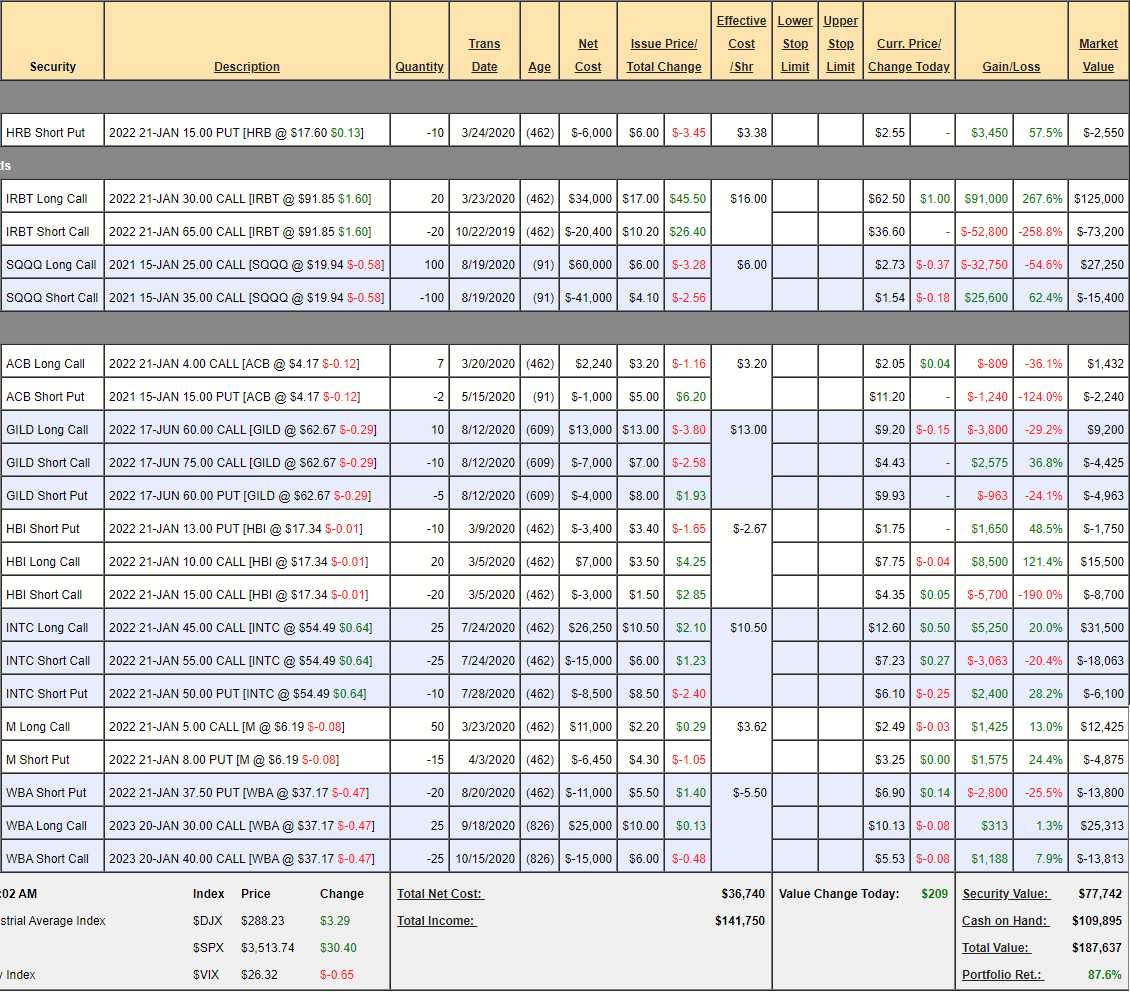

Earnings Portfolio Review: $187,637 is up 87.6% for the year but down $4,000 since our last review. We have lots of buying power so we should keep our eyes open for some earnings plays this month.

- HRB – Left over put leg from the trade we took off the table. Certainly not worried about owning 1,000 shares at net $9 so no reason not to leave it there.

- IRBT – We're netting $51,800 out of a potential $70,000 but that's still $18,200 (35%) to go for the year – nothing to sneeze at.

- SQQQ – Our hedge but not very effective so we need to roll the Jan $25 calls at $2.73 (that we paid net $2.10 for) to the 2022 $15 ($9.50)/$30 ($6.75) bull call spread at $2.75 and, when the $35 calls expire worthless, we'll sell some more short calls.

- ACB – They never really got it together but it's a small play so let's give them some time. It won't take much of a positive spin from ACB to get them back to $15. To early to DD though – I'd rather see earnings first.

- GILD – Nice, recent trade we added and still a good entry.

- HBI – Our co-stock of the year in 2018 (with LB) is now a solid performer we're happy to own.

- INTC – Another summer addition to the portfolio and back on track.

- M – This is a tough call during a crisis. We have such a good entry and I consider it to be such a great value. I can't pull the plug on this one nor can I see covering it so it stays.

- WBA – From the last earnings cycle and they just had good earnings so I'm excited to see where it goes. Still good for a new trade at a net $2,300 credit on the potential $25,000 spread. Once again – money is simply being given away….

People complain that we don't trade that much in some portfolios but that's like complaining we aren't planting seeds where the trees are already starting to grow. You have to find good positions and then LET THEM MATURE – constantly trading for the sake of trading does not make you more money – many long-term studies have proven this…

WBA will make $27,300 in 15 months if WBA is up 10%. That will add 27.3% to our $100,000 base portfolio. For normal portfolios – that's considered a very good year – and that's just one of our trades! We are planting forests here – the goal is to plant some strong trees and let them take root and grow and then we move on to look for new opportunities.

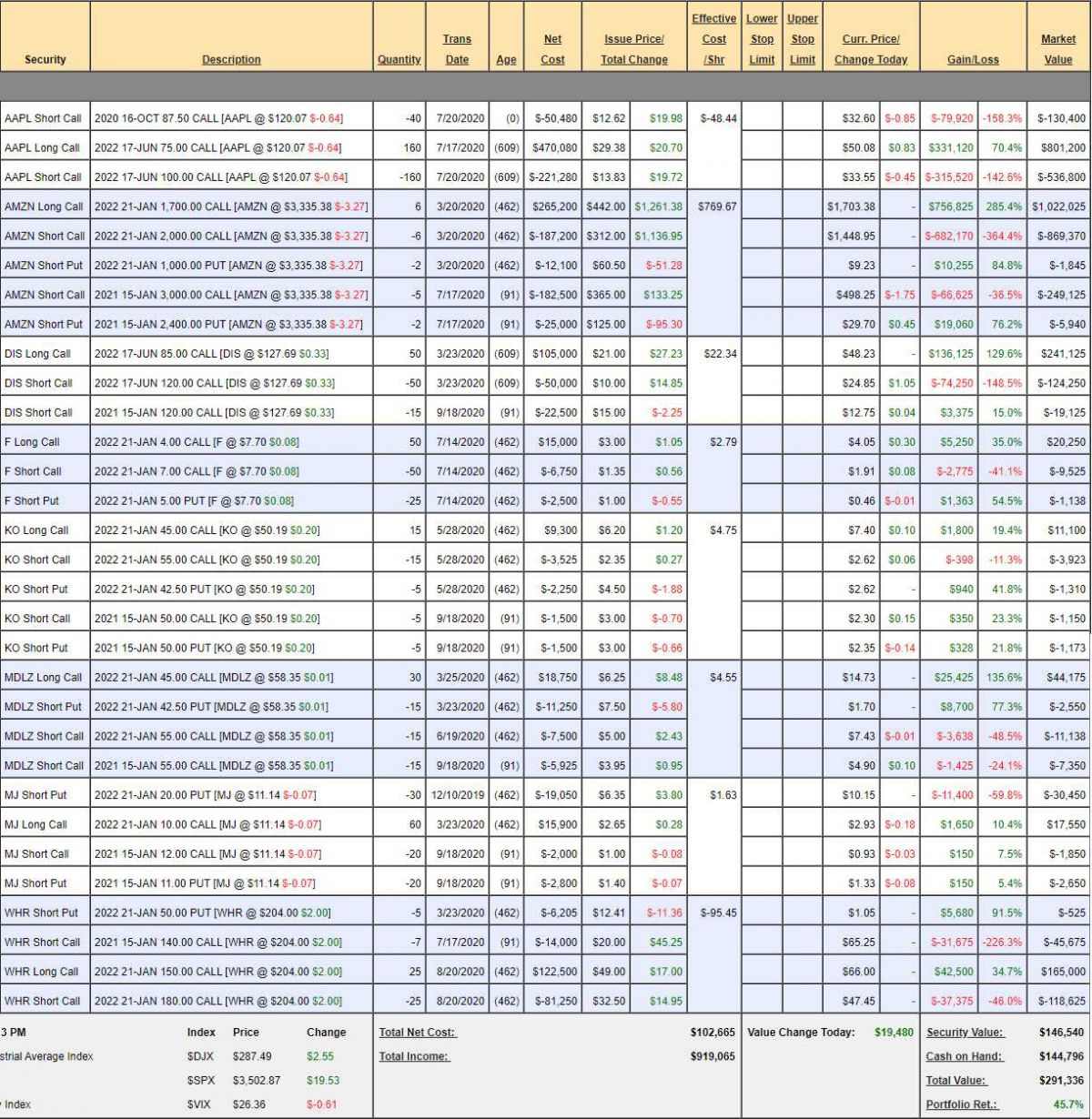

Butterfly Portfolio Review: $291,336 is up 45.7%, which is down about 40% from our last review as AAPL is crushing us on the short Oct $87.50 calls but, as I said last time, it's a $400,000 spread that's in the money but currently net $134,000 so $266,000 to gain if we can roll out of trouble on that one will be enough profit for 2 more great years – just not this month….

- AAPL – Back in September, AAPL was dipping and we left the short call alone to protect our longs but now it's come back to bite us. Still, we have tremedous upside and we'll jsut roll the short calls along but they are too deep in the money so we'll have to do it this way: Roll 40 Oct $87.50 calls at $32.60 ($130,400) to 60 Jan $105 calls at $18.75 ($112,500) and let's sell 20 Jan $105 puts for $3.65 ($7,300). We're spending net $10,600 to roll the short calls up $17.50 (15%) and we're still over-covered by 100 long spreads.

- AMZN – We're taking a hit on the short calls and the short Jan puts aren't worth keeping so we'll buy them back and see how earnings go.

- DIS – On track

- F – We should sell some short calls. Let's sell 15 Jan $7 calls for $1.13 ($1,695)

- KO – On track

- MDLZ – On track

- MJ – On track.

- WHR – Keeps going higher. Fortunately, we only sold 7 short Jan $140 calls, now $65.25 ($45,675). Let's roll those out to 12 of the March $190 calls at $28 ($33,600) and see how that plays out over earnings.

IN PROGRESS