Higher and higher we go.

Higher and higher we go.

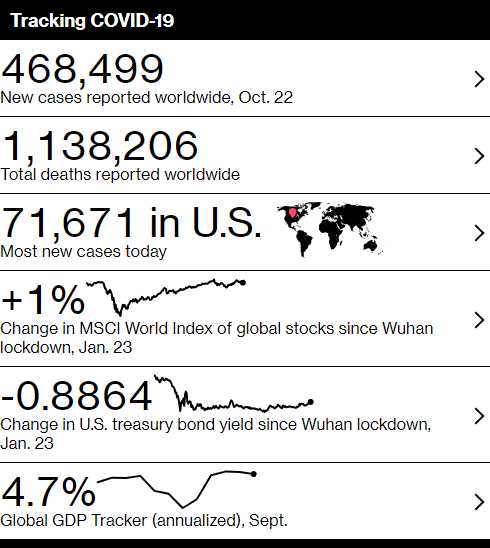

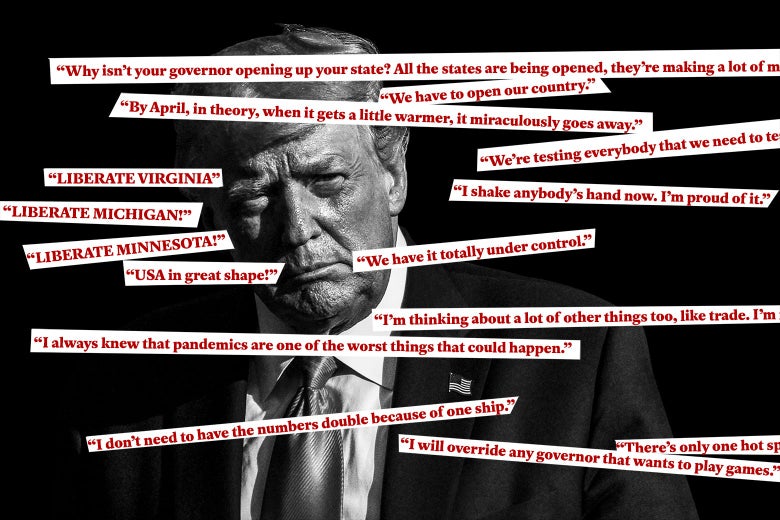

994 Americans died from Covid-19 yesterday, 1 per minute during the debate where Trump denied it was a problem, leading Joe Biden to give him a WTF?!? look. As Trump falsely stated that we are "rounding the corner" on the virus (we are not) and that a vaccine was ready (it is not), Biden pointed out that projections indicate that over 300,000 people (50% more) will be dead by Christmas – though he didn't say it that harshly.

In reality (a place we're no longer familiar with) Pfizer and Moderna have both said they could apply for Emergency Use Authorization from the US Food and Drug Administration in the coming weeks, but only if they have positive results from their Phase 3 clinical trials. Neither company says they know whether the results will be positive. Pfizer has said they could apply for emergency use authorization after the third week in November. Moderna has said they could apply in early December.

"99.9% of young people recover," Trump said. "99% of people recover. We have to recover. We can't close up our nation," Trump said.

So far, about 2.6% of people in the US who tested positive for Covid-19 died from it, according to Johns Hopkins University. Recovering from Covid-19 depends on someone's underlying health conditions, and many survivors experience lingering symptoms. Health experts are unclear as to why some people experience lingering symptoms and other internal damage.

"If you look at the people who were sick, but didn't require hospitalization," Dr. Fauci said, "when you look at the percentage of them — that actually recover, and recover within two to three weeks — a substantial proportion of them don't feel right." According to a CDC survey, symptoms subsided in some people in as little as five days, while others, studies show, have experienced symptoms several months later. Only 65% of 292 people surveyed in the CDC study from April 15th to June 25th said they returned to their normal health as soon as five to 12 days after they tested positive for Covid-19 – as Trump claims to have done.

Trump fails to mention that the reason for his amazing recovery from Covid-19 is he was given over $100,000 worth of experimental treatments not available to the average American and he began his treatment the moment he tested positive and was take to the hospital immediately. Like everything else in his charmed life – Trump gets preferential treatment that's not available to the average person and then he says you just need to be like him to succeed.

In the debate, Trump claimed that "2.2M people were expected to die" and therefore he's doing a good job but, in FACT, that was the number expected to die if no actions were taken (and they didn't say "by election day 2020 in 9 months"). With only 2.4% of the population infected (8M/330M), 230,000 Americans are, in fact, dead and 2.4% is 1/40th of 100 so 40x 230,000 is 9.2M potential deaths if we "stay the course" with President Trump.

In the debate, Trump claimed that "2.2M people were expected to die" and therefore he's doing a good job but, in FACT, that was the number expected to die if no actions were taken (and they didn't say "by election day 2020 in 9 months"). With only 2.4% of the population infected (8M/330M), 230,000 Americans are, in fact, dead and 2.4% is 1/40th of 100 so 40x 230,000 is 9.2M potential deaths if we "stay the course" with President Trump.

Oh, and a note to the people who feel I'm being "too political" – if Obama or Biden or Clinton were President and recklessley causing the deaths of hundreds of thousands of American citizens and endangering the lives of my children, my family, friends and neighbors – I'd be criticising the terrible job they were doing and calling for their removal from office as well. I'd even consider giving Donald Trump a try, rather than re-elect an incompetent, ecotistical, tyranical monstrosity that has brought our country to the brink of ruin. It just happens that, in this particular case, Donald Trump IS the incompetent, ecotistical, tyranical monstrosity that has brought our country to the brink of ruin…

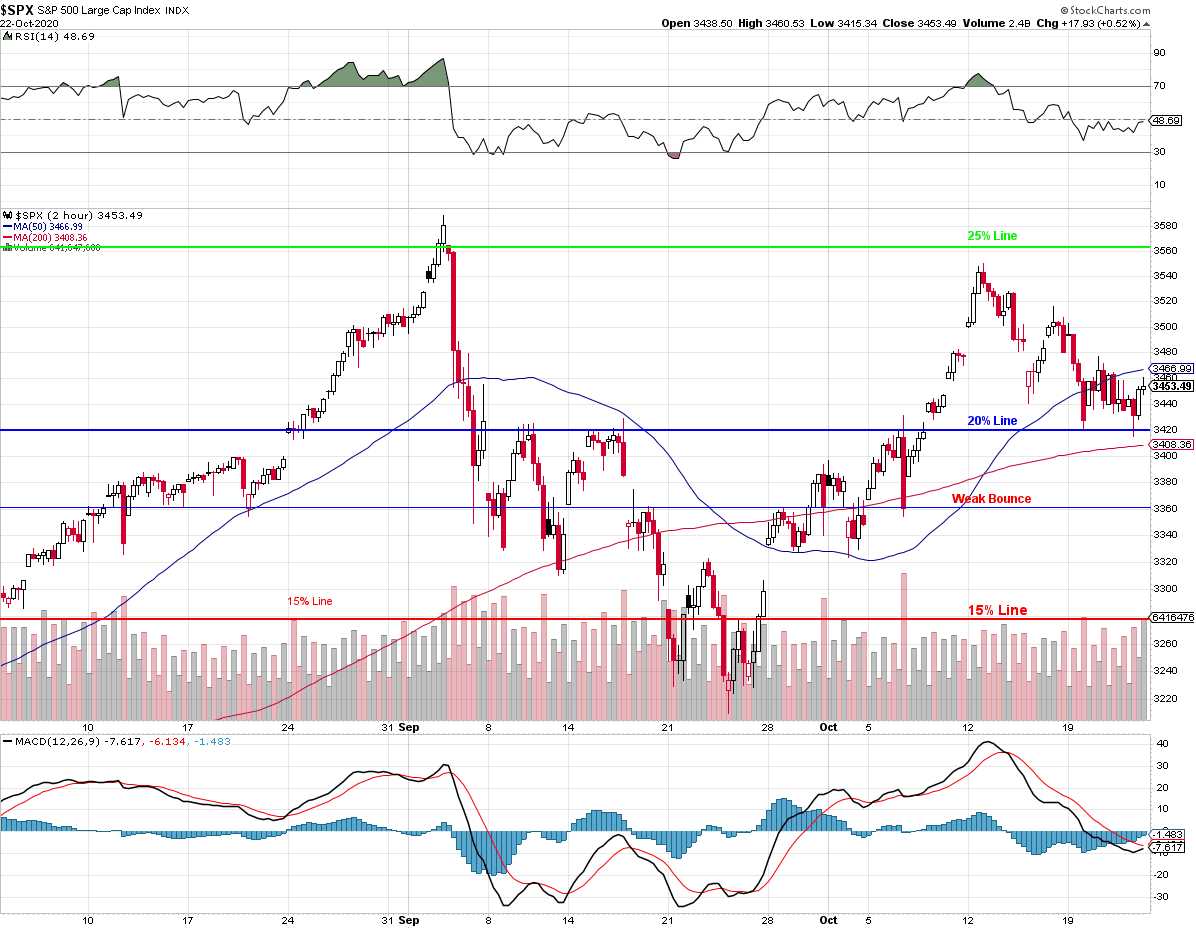

Meanwhile, the market keeps bouncing around but it's been a big downtrend for the last two weeks and, so far, it's a weak bounce off the 20% line that's keeping us from real trouble. The 25% line on the S&P 500 is 3,565 so 3,420 isdown 145 points which means a weak bounce is 29 points (20% of the drop) to 3,449 and a strong bounce is up another 29 points to 3,478 but I'd call it 3,450 and 3,480 to round things off. Finishing the week without a strong bounce makes us very vulnerable into the weekend and 3,467 is the 2-week moving average – which will be a tough nut to crack.

So that's an excellent shorting spot on the S&P 500 (/ES) Futures this morning if we get there and, of course, tight stops above that line. We're also liking the sell-off in Intel (INTC) this morning as a chance to jump in and here's how we're playing it in our Long-Term Portfolio (LTP) from our Live Member Chat Room:

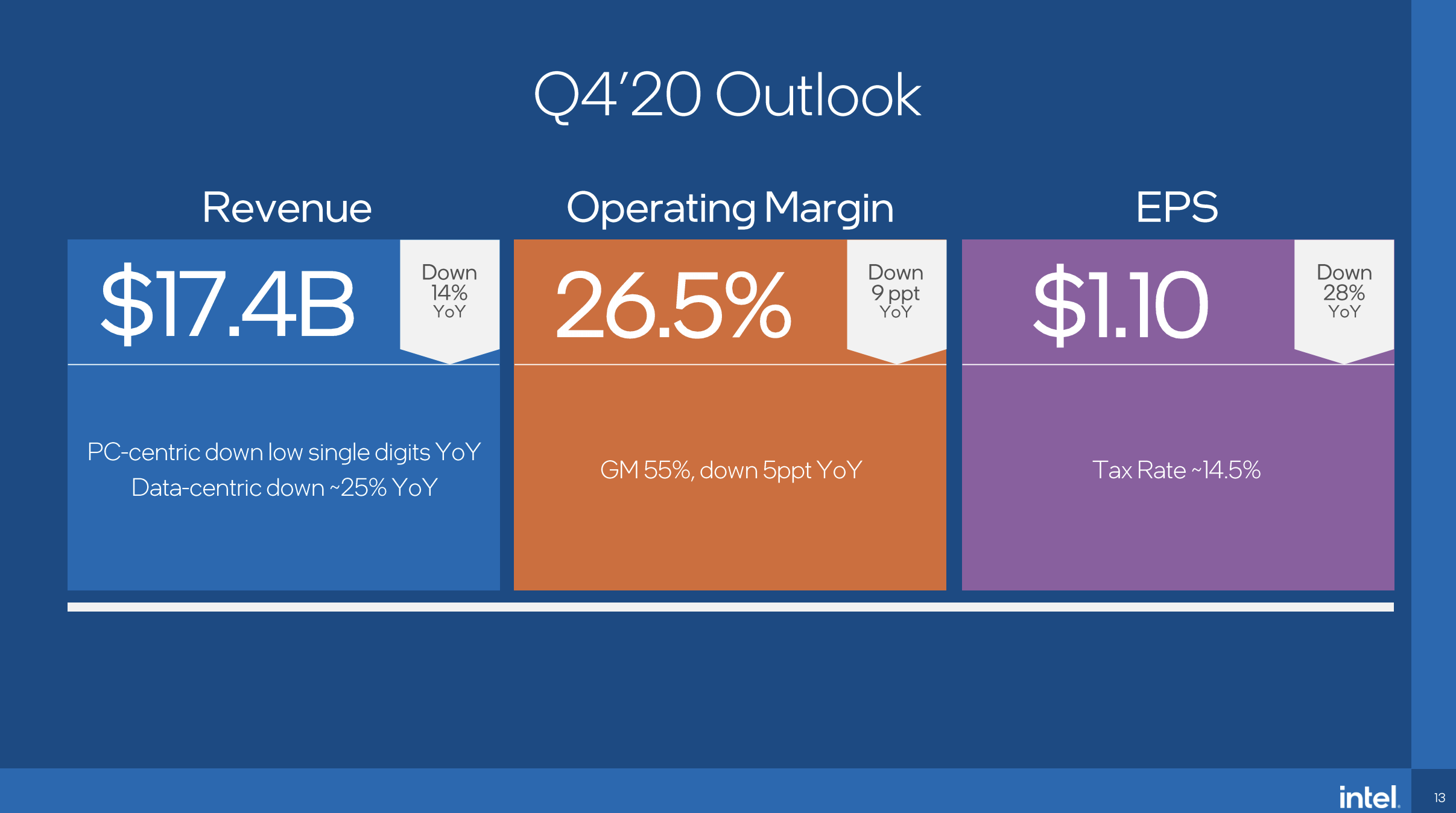

INTC – I think the worst hit for INTC was the Hynix deal is going to cost them 14% of revenue (for sure) and they weren't clear about the impact on the bottom line. I like buying INTC low as it's a true cyclical and this is a down cycle. Our entre play in INTC so far has been selling short 2022 $30 puts back in March and then, on 7/24, we bought a spread that now turns out to be too aggressive but, at a net entry of $35,000 so far, we're very early in the scale so now we have to decide if we want to own a stock at $56 (net cost) that only makes $1.10 per quarter.

INTC Short Put 2022 21-JAN 30.00 PUT [INTC @ $53.90 $0.40] -10 3/12/2020 (455) $-3,000 $3.00 $-2.07 $-3.00 $0.94 $-0.05 $2,065 68.8% $-935 INTC Short Put 2022 21-JAN 50.00 PUT [INTC @ $53.90 $0.40] -20 7/24/2020 (455) $-17,000 $8.50 $-2.25 $6.25 $-0.30 $4,500 26.5% $-12,500 INTC Long Call 2022 21-JAN 45.00 CALL [INTC @ $53.90 $0.40] 50 7/24/2020 (455) $55,000 $11.00 $1.18 $12.18 $-0.17 $5,875 10.7% $60,875 Of course, gains are not the only reason to own a stock (as we recently discussed) so we take advantage of the $5 dip to roll the 2022 $45 calls at $9.50 (guessing $47,500) to the 2023 $40 calls at $14 ($56,000) and we sell 30 of the 2023 $55 calls for $8 ($24,000) and that drops the net of the trade from $35,000 to $19,500 for 50 2022 $40s covered by 30 2023 $60s and we'll have to deal with the short puts one day, maybe.

So now we have a potential $100,000 spread that's $40,000 in the money we paid net $19,500 for and if INTC is over $50 in Jan 2022, the short puts go worthless and we get $50,000+ back on this "failed" entry. Meanwhile, I see that the Jan $55 calls should still be $1.20 so selling 20 of those puts another $2,400 in our pockets while we wait, using 84 of our 819 remaining days on this trade. 10 short sales like that is another $24,000, which would pay for the entire spread using a blue-chip stock whose revenues are down 5% in one of the worst economic crises in human history.

I think I'll stick with it….

If there were an upside catalyst for Intel, it would be in contention for our 2021 Stock of the Year but I don't know how long it will take them to turn around so it's just a simple value play on a stock we don't mind being "stuck with" for the next decade or so.

Intel should be back around $48.50 this morning, the bottom of it's uptrending range for the past 10 years. If you're not going to buy a stock when it's cheap – when will you buy it?

Have a great weekend,

– Phil